Hi.

Welcome to Fifty Trades in Fifty Weeks!

This is Trade 6: Options vs. cash

Thank you for signing up!

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

Or… Open in browser

Listen to this as a podcast on Spotify here.

Listen to this as a podcast on Apple here.

Update: Open Trades

It has been one hell of a start for this Substack. While it’s tempting to attribute the bad start to bad luck, that’s not the correct explanation. The main reason the trades have not worked out is that I tend to fade geopolitical events and that has not been a good strategy in 2022.

I have been too blasé about the financial market implications of the Russian invasion of Ukraine. I don’t particularly hate myself for this; fading geopolitical moves has been the right strategy most of the time throughout my career and so it was a logical process that I followed despite the suboptimal outcomes.

The gold and oil trades were directly blown up by Russia and the DOCS trade was stopped out in a wave of countertrend optimism before the sanctions hit. The double down in bitcoin is now stopped out too, so I am oh-for-four so far. Even if I’m oh-for-49… I’m going to do all 50 trades. Come hell or high water.

Worst case scenario here is: you learn some stuff and I learn my only edge is in FX.

With the DOCS trade, my target level hit soon after the stop loss triggered, and so in hindsight, it was a perfect trade for options, but not for cash. That brings us to this week’s topic: Trade structuring… When should I use options? I have given myself a most difficult task this week, not because the question is complicated (it is) but because I could literally write an entire book on this topic and today I’m gonna try to do it for you in under 3000 words. Let’s go!

When should I use options?

While investing generally involves mostly a one-dimensional decision of “what to buy?”… Trading sits at the other end of the decision complexity spectrum. The trader’s decision process has many dimensions:

Long or short?

At what price?

Where to stop loss and take profit?

How long do I hold?

How to structure it: Cash, futures, or options?

Trade structuring has many dimensions, and I have covered some of them already in prior posts. For example: position sizing, stop losses, entry tactics, and so on. Today, inspired by a missed opportunity in DOCS, I am going to look at a larger and more complicated question: When to use vanilla options instead of cash or spot.

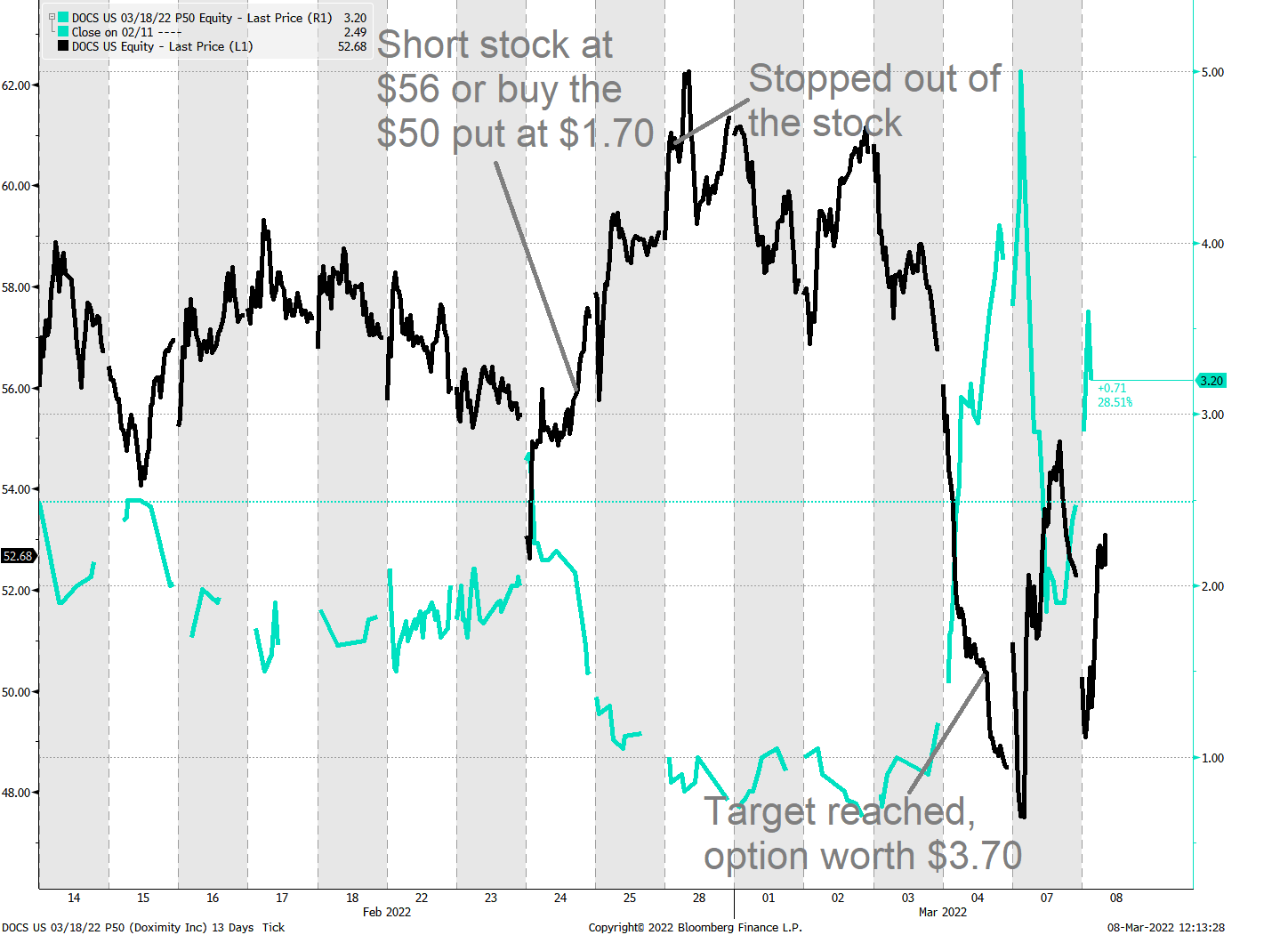

First, take a look at this summary of my DOCS trade:

DOCS: Good idea, bad structure

I went short at $56 and stopped out above $60. A few days later it dropped more than ten bucks in a straight line and hit my take profit. On March 4th, reader @svilkoni tweeted he had expressed the bearish DOCS idea via puts and done extremely well on it. Two things about that:

That’s how this is supposed to work! Readers don’t copy my ideas, they incorporate them into their own process and do what they think is best.

This is a good example of a trade where options worked better than cash. Since I trade a lot of options, this is a good time to cover that topic!

My DOCS time horizon was 2-4 weeks, so let’s see what would have happened if I had bought the 1-month put option instead of doing the cash trade. (Note: “cash” or “spot” means trading the actual thing… Not a derivative of the thing. DOCS common stock is a cash (or margin) trade and DOCS options are a derivatives trade.

I assume a working knowledge of options in this piece. If you don’t know what a put and a call are, read an introduction to options trading before you tackle this one. Vanilla just means simple puts and calls. More complex structures are useful but beyond the scope of today’s note. At some point, I will probably do a 50in50 on some other options strategies but for today we’re talking the simple stuff: Buying puts and buying calls. By the way, simple is not an insult in trading.

Simple ideas almost always work better than complicated ones.

Everything I discuss here applies to trading, not investing. I pretty much never buy options beyond a three-month time horizon, so that gives you a sense of what I’m talking about here. My normal trading time horizon is 1-10 days.

Why options can be better

Options help you accomplish specific goals in a trade. Here are situations where options can work better than cash:

To avoid getting stopped out. Once you buy an option, you are in the position until the option expires. In a cash trade, you might get stopped out right before the trade idea goes your way. That’s what happened to me in DOCS. In choppy, headline-driven markets, options can keep you in the trade.

To achieve more leverage. If you buy an option and there is a gigantic move in the market… Your option will generally make more money than a cash position would have. I will go through this in detail in the P&L comparison section coming up next.

Take very large positions more easily. If you want to be short 500 million AUDUSD, it’s tough to run a cash position with a stop loss. But you can (fairly) easily strap on a billion AUD of puts that give you a delta of 500 million. Options are good for putting on huge trades.

Avoids gap risk and offers defined risk. If you went short ZM into earnings in 2021, you are probably reading this on your phone while on break from your job at Krusty Burger because you blew up your trading account. If you bought ZM puts, they went to zero and your risk was finite. When you buy an option, you decide how much money to spend and then you either lose that much, or less. When you go long or short in cash markets, you expose yourself to gap risk on news, weekends, or when markets are closed.

To achieve custom payout profiles. Let's say you think a stock is going to go up but it's not going to the moon. You could trade a spread that gives you very high leverage for your specific view while substantially reducing your premium outlay.

Why options can be worse

Timing is critical, especially on short-dated options. If your option expires, you are out!

If the market goes nowhere, you lose money. This is called time decay, or theta. Each day you wait, you bleed.

You can be right and lose money. If the asset moves in your direction, but not enough to cover the option premium, you lose money. The price you pay and the strike you choose are key. Note you can be right and lose money in cash too, like I was on my DOCS trade. There is no free lunch.

Bid/offer is wider in options. This can actually be a benefit though! As a person who overtrades, I like that options are harder to get in and out because once I’m in an options trade, I tend to stick with it longer. Because the cost to get out is higher, the bar to chop a trade for no reason is higher.

Events and obvious catalysts tend to be overpriced. Events and catalysts are the two setups where you most want to use options and they are the most expensive. Buying USDJPY options through nonfarm payrolls was a sucker’s game through the 2010s, even though USDJPY moved a lot on payrolls. The dream scenario for option buyers is when you have a view on an event or catalyst but that view is not priced into the options market.

For example, say there is a big speech from the deputy governor of the RBNZ tonight. People know about it, but nobody cares. You believe the central bank could be about to pivot and there is a decent chance the assistant governor may say something important. In this case, you have a divergent view on volatility.

The market thinks the speech is a nothingburger and you think it’s important. Those are the best setups for buying options. Sure, buying calls through Zoom earnings might work, but it’s not a positive expected value play. The options market knows the earnings are coming out and it’s going to price that in by charging you through the nose for the privilege of participating.

Less obvious events and catalysts can be bargains in the short-term options market. In the case of the DOCS trade, earnings had passed and options prices were relatively reasonable.

Those are the main points on options vs. cash. The key to understanding whether cash or options provide a better expression of a trade you like is to build a spreadsheet. It’s not super hard, and it forces you to truly understand what the heck you’re getting into.

It all comes down to three things:

Where do you think the market is going?

What path do you think it will take to get there?

How much do options cost?

A quick example, using DOCS

In Trade 3, I went short at $56 with a stop at $60.50 and got stopped out of DOCS. Instead, I could have bought the March 18 $50 puts for $1.70. Here is a chart of the stock (black) and the option (seafoam green) with some key moments tagged.

DOCS stock and the March 18 $50 put in DOCS

So clearly, in this case, the put was better. It saved me from getting stopped out and turned my $2,000 into $4,400 in the options market. My $2,000 turned into zero on the cash trade. If you want to understand what an option’s going to look like vs. cash… The first thing to do is make a spreadsheet that shows your P&L at each level the option could expire. For example, here’s one for this DOCS trade:

P&L at expiry of short DOCS at $56 vs. buying the 18MAR21 $50 put

The stock position and options position size are both plugged so each has $2,000 of risk. And here is the chart of that spreadsheet:

This tells you a few things:

As you move from left to right on the chart, that is the stock price going up, and you are losing money on the bearish position. If the stock goes straight up, you lose $2000 on either structure. As you go left, the P&L goes up because we’re cheering for a lower stock price.

If the stock ends around $44 at expiry, both trades have the same P&L. That’s the place where the green and the blue lines cross. Once the stock falls below there, the put (the steeper green line) makes more money (that’s when leverage kicks in). Since our take profit was $50, buying the $50 strike is pretty aggressive—you need a quick move to the target for this option to work. In this case, it worked out but the option trade was extremely risky, just in different ways. In hindsight, the option worked, but ex-ante it probably would not have looked all that amazing because my target was not ambitious.

If the stock is above $50 on expiry day, you lose the whole 2k on the option and you’re flat or positive on the cash trade (if you didn’t get stopped out). There is a huge tradeoff here!

The chart captures only the final destination (expiry), not the path. It shows what happens if you put the trade on and then you cover on the day the option expires. This ignores the path that the security follows in real life which in this case was that the stock price shot higher, stopping out the cash trade, then cratered, hitting the TP.

You can see that while in this case, the option worked out better because the cash got stopped out, the tradeoffs you had to make to get the optionality were significant. Anywhere above $44 at expiry, the cash position was better.

BUT… You also see how the path matters. The quick move lower meant the $50 put option still had tons of value so instead of losing $2,000 on the trade, the option would have allowed us to take profit and make good money (sell the option at $3.70 when the stock hit our $50.21 target).

In that case, when the target hits, you sell the option for a profit and move on. In a whippy, up / down / up scenario, the option is much better and that certainly was the case here. The cash trade lost $2,000 and the option trade made $2,400. On $100,000 of capital, that’s a massive swing.

The way you structure trades can make or break your P&L.

When I say “structure trades” I mean everything from cash or option right down to your choice of entry and exit points. If my stop loss on the DOCS trade had been above the old high, I would have survived and hit my target. BUT, my position would have been half the size and my risk/reward would have been sus.

There is always tension between maximizing position size and maximizing leverage while optimizing trade structure. In this case, I did a bad job. An option, or a wider stop loss, would have allowed me to be a winner here, instead of a loser.

Trade 6: Bullish EWC

EWC is the US-traded ETF that tracks Canadian equities. Here is a brief thesis on the trade and then I’ll talk about whether or not an option makes sense to express the bullish view.

Canadian equities are showing tremendous relative strength. As global equities slump, the Toronto Stock Exchange is near the all-time highs as it’s a geopolitically stable supplier of commodities in a world caught short commodities. If global equities stabilize, Canada should outperform as oil prices remain elevated and commodities like wheat remain in short supply. By the way, one of the most famous songs by one of the most famous Canadian bands is called “Wheat Kings”. It’s a beautiful song. Listen here.

The world needs somewhere to put their money. EWC is dominated by bank stocks and oil companies… In a world of rising commodities and rising rates, it makes sense that Canadian stocks are performing well. Money is flying out of Europe and emerging markets at a crazy pace and it needs to find a new home.

To give you a sense of how money is flying out of Europe and into “other”… Check out this chart I put in am/FX today.

Distance from Kyiv in miles vs. currency performance since 25FEB

In a world of geopolitical uncertainty, Canada is a natural safe haven. Bonds are scary in inflationary times and US tech is even scarier. If things in the world improve, stocks should rally broadly and EWC should do well so this makes EWC a bit of an all-weather trade right now as it has commodity exposure and bank and risky asset exposure, all in about the right balance.

US bans Russian oil imports. It’s a token gesture but helps the US oil-exporting neighbors a bit.

It makes sense that money will continue to flow into Canada and this should support Canadian equity prices. I am not 100% sure if this is a bullish oil trade… I think there are scenarios where oil could sell off, global equities rally, and EWC still goes higher.

Should we buy the stock, or buy an option?

First, we need to choose our target and stop loss and punch all the info into the spreadsheet. The stop loss is fairly easy as the daily chart has been consolidating for ages and looks like this:

EWC daily since Q4 2019

So a stop loss below all those lows would be $35.19. The take profit is $44.80, which is simply the top of the current range ($40.00) plus the width of the current consolidation ($4.80). That is a semi-standard way of projecting breakouts from a consolidation.

To compare this to an option, we need to decide on the holding period. The nearby options expire March 18th and April 18th. This trade needs a bit of time to work; $44.80 is not a chip shot and March 18th is way too tight. So let’s look at April expiry options. Then, we pick a strike. Since the breakout level is clearly $40 on this chart, that’s a nice level to pick. One might reasonably expect price to accelerate once it breaks $40.

The April $40 EWC calls are thinly traded but trade around $0.60 with EWC at current levels ($38.00). We set the number of shares to equal a $2,000 loss at the stop loss level and we set the number of contracts to cost $2,000 so that both trades are equivalent risk. You can download the spreadsheet here.

P&L at expiry comparison to spot trade

So here we see the crossover point for the option to outperform the stock is around $41.40. EWC is moving around in a $2/$3 range so a 8.9% rally from $38 to $41.40 feels like a lot to ask. In fact, since we know April 18th is 38 days away, we can check the data and see how many times the stock has rallied more than 8.9% in 38 days. I looked back to 2018, and the answer is less than 10% of the time. And that is in a period where EWC rallied a fair bit! Based on that data and a simple eye-balling of the chart, $41.40 feels like a long way away. Here is the rolling 1-month low/high range for the ETF:

Rolling 1-month range for EWC

I don’t have any special reason to think EWC volatility is about to skyrocket. It’s a basket of a bunch of stocks and even through the Russia news, the drop in global stocks, and the rise in oil prices has created opposite pressure on EWC and kept it somewhat pinned.

Options don’t appear to offer much leverage here. If we were doing a more expert-level piece, we could compare implied to realized volatility and see the options look expensive using that methodology too. Implied vol is above 25% and historical is 18%.

You don’t need an advanced degree in applied math to make reasonable estimates of future volatility. I’m putting my finger in the air and into a few spreadsheets and determining that an option is unlikely to work better than cash.

The other question I need to answer (as we saw in the case of the DOCS trade) is: What is the chance I get stopped out, and then it hits my target? Again, in one month and one week, it seems highly unlikely to me that we trade down to $35.19 and then back up and through the top of the old range.

My target on the trade is not feasible by April 18th, so I looked at the June expiry options too, but again, you need a huge move before it’s worthwhile. The breakeven between spot and option on the June $41 calls is around $43.10 so yes, if EWC goes to $44.80 by June, you are better off in the option, but I strongly doubt I will want to hold this trade that long and holding an option like that severely reduces my flexibility. Especially as these are thinly-traded options with poor liquidity.

In this case, you are not purchasing an expected volatility catalyst, you are simply giving yourself staying power in a choppy market and leverage if EWC breaks out. The stop loss on a cash position is clear, the options are expensive given the ETF hasn’t been moving, and if it continues to consolidate for another month or two… You lose everything in the option and lose nothing on the cash trade.

Don’t buy the option

In this case, the answer was pretty obvious to me. The cash long is better than the option because:

I strongly doubt EWC hits both my stop and my take profit in the next 38 days. It’s just not that volatile. The stop loss is pretty easy to determine given it has been a clear range trade.

There is a meaningful chance EWC stays in this range. If I own the option, it will be worthless on April 18th. If I buy the stock and it goes nowhere, I have lost nothing.

The leverage is not impressive. For something that frequently trades monthly ranges less than 5% wide, an 8.9% directional move in 38 days is asking a lot.

Conclusion

The option is too expensive and doesn’t provide a meaningful benefit vs. cash.

Today I have presented a simple way to evaluate whether you should buy an option, or trade a cash position instead. Please understand this is a starting point for further exploration and I have approached the question in a fairly simple way. Still, simple is good! Sure you can compare historical to implied in a more rigorous way than I have done here… But your answers should converge if you have a decent sense of what you are doing.

To decide between cash or options: look at the destination the stock needs to reach for your option to pay off… And then make your best guess as to the path the stock will take on its way to that destination. If there’s zero chance you’re gonna get stopped out, and the stop is close enough to give you decent leverage… The option is not a good bet.

If you’re worried about getting stopped out, or you have a target that is aggressive in terms of both distance from market and the speed you expect it to hit… An option will be superior.

The simple way to start looking at options is to create a payoff spreadsheet like the ones I made above and then make a realistic estimate of where you think the stock might go. Don’t salivate at the huge pile of coins that might come out of the slot machine if the very unlikely tail outcome takes place. Think about the most likely scenarios and the distribution of probabilities around the other scenarios and then make your decision. And live with it.

Don’t do a bunch of woulda coulda shoulda afterward.

Write down your plan, execute it, and let the chips fall.

50in50 goes long EWC at $38.00 with a stop at $35.19 and take profit at $44.80

That’s it for today. As always, I will monitor the performance and offer detailed updates as we progress. See you next week!

Thanks for reading.

Trade at your own risk. Be smart. Have fun. Call your mom.

My global macro daily is here

My crypto substack is here

And this is my Twitter

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people that want to learn. This is an educational Substack. Trade your own view!

Thanks for the content Brent. I actually used to get your letter via Wally T who was my boss at RIM back in the day. Read it throughout the financial crash. Spot on about options. I had a bunch of Lehman puts but they expired one month too early.

Thank you for the serries. It's been consitently high quality content which I've thoroughly enjoyed. From personal experience, I'd say even if I have a strong macro conviction, choosing the right markets & instruments to express that idea is equally important as forming the thesis. Do I express my macro view in equities, FX, fixed income or commodities. Futures or options or some funky structures. In my opinion, this is part of the trading edge (together with position sizing, risk management and discipline). Thanks again for the insight.