Week 18: Fun with Quadrants

Simple frameworks can help us understand complex systems (part 1)

Hi.

Welcome back to Fifty Trades in Fifty Weeks!

This is Week 18: Fun with Quadrants

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

The bitcoin long was stopped as risky assets continue to crumble under the weight of high inflation (and the presumed Fed reaction function). ARKK is nosediving.

The LLY short is 8 bucks in the money and --CVNA/++RBLX (the RV trade), and short ETHBTC are doing well. Those last two trades show the beauty of market-neutral positions vs. trades where the returns are derived mostly from the overall direction of the market.

Only shorts and RV trades are making money right now and there is no particular reason to think the risky asset pain ends anytime soon. BTW, every 10 weeks, I post the full results spreadsheet with all the gory details.

Fun with Quadrants

When studying extremely complex systems, we look for heuristics or shortcuts that can help us strip out complexity and see only the most important underlying dynamics. A popular way to do this in finance is through the use of quadrants. Very often, we can slurp out the two most important variables in a system, put them on an x/y axis, and use the four quadrants produced by the matrix to better understand where we are and where we’re going.

If this sounds overly simplistic, it’s not. If it is good enough for Ray Dalio and some of the best macro analysts in the world… It’s good enough for me!

Bridgewater

The OG quadrant guy was Ray Dalio, who developed a simple matrix to better understand the economic machine. Most of what Ray Dalio writes and says resonates with me on some level. When I started in the 1990s, getting your hands on good quality macro research was difficult and mostly we just got Bridgewater’s “Daily Observations,” The Gartman Letter, and Bob Savage’s daily note. Two out of three of those were excellent!

The four-box framework that Dalio developed in the early days of Bridgewater is outlined in this excellent essay:

https://www.bridgewater.com/research-and-insights/the-all-weather-story

It looks like this:

If you can identify where your economy (or the world economy) sits in these four boxes… You’re 60% or 70% of the way to getting the macro story right. It’s not as simple as solving this framework because once you do, you still have to figure out what it means for various asset classes. But most macro traders, analysts, and strategists start with a framework like this, whether they do so explicitly or implicitly.

By weird coincidence, I was halfway through writing this note when I received an email from Bridgewater updating their quadrants. This is flukey since I only get about one email per month from them. Here is their update:

Once the most basic questions are answered (i.e., is the market’s expectation of growth rising or falling? Is the market’s expectation of inflation rising or falling?), strategists will outline which assets do well in each quadrant. Most analysts use quadrants where only one of four boxes is ever lit up at one time. That’s easier to understand.

For example, here is the Gavekal Four Quadrants framework:

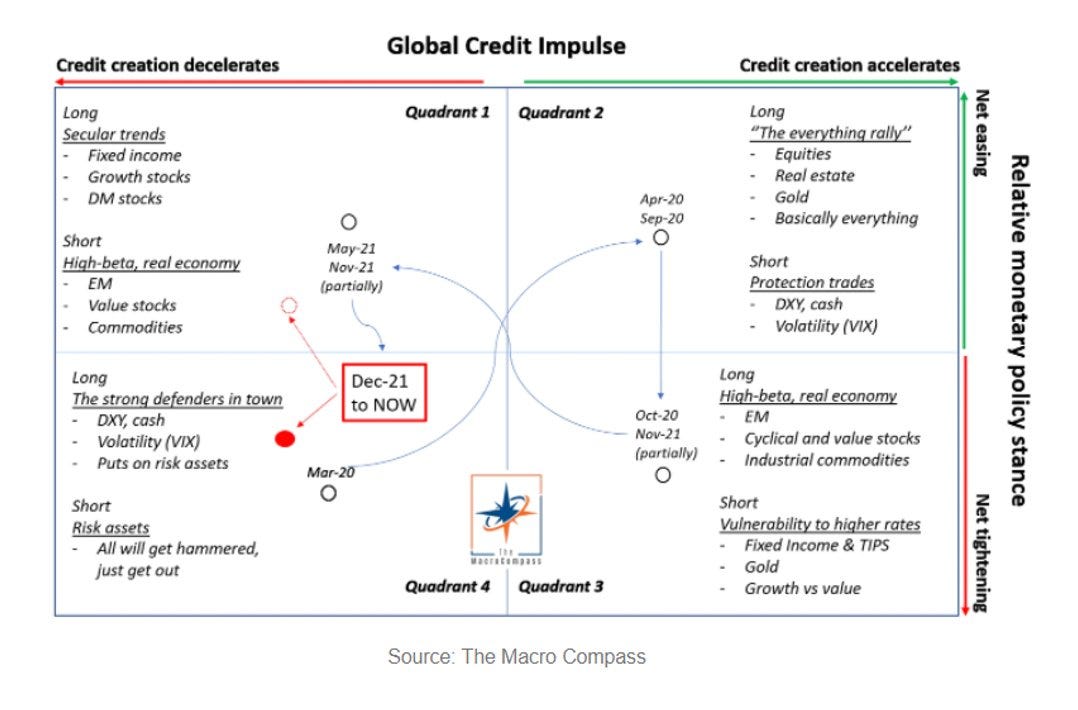

You can use empirical data and common sense logic to build a four quadrants framework of your own. Alfonso Picattielo (Macro Alf on Twitter) uses a slightly different approach with axes labeled “Global Credit Impulse” and “Relative Monetary Stance.”

This is a nuanced difference. He substitutes "monetary policy stance” for “inflation”, and “global credit impulse” for growth. This says that in his framework, the way central banks react to inflation is more important than inflation itself. And that the global credit impulse is more important than real-time growth because credit impulse leads growth. Makes sense! Here are Alf’s quadrants as of May 2022:

However you structure the quadrants, the basic principle is the same: Growth and inflation drive macro and there are four main scenarios in every economy:

Inflationary bust

Inflationary boom

Disinflationary bust

Disinflationary boom

.

We move around from quadrant to quadrant and you can mostly define recent years as follows: 1990 to 2000 - Inflationary boom 2000 to 2002 - Disinflationary bust 2003 to 2007 - Disinflationary boom 2008 - Disinflationary bust 2009 to 2020 - Disinflationary boom 2021 Inflationary boom 2022 Inflationary bust transitioning to disinflationary bust (?)

This is a nice simple macro framework. My point in this piece isn’t to teach this specific framework, but to present a super simple way of looking at the economy or markets through an easy-to-understand filter. Obviously, a lot of detail gets lost in this filtering process, but a lot of noise gets eliminated too.

Oil vs. stocks

You can use the relationship between two market variables to build useful quadrant-style matrices as well. And very often, there can be cool tie-ins between one matrix and another. Let’s look at the relationship between oil and stocks. I put the year of a strong example for each regime in purple.

There is much more complexity than a 2X2 matrix will allow, though. These matrices focus on changes because changes are always more important than levels. But levels can still matter! Falling oil is usually a signal of falling demand (bad for stocks) but low, stable oil prices can be a fat tax cut for consumers (good for stocks).

Also, velocity matters. If oil is going up four cents per day, and stocks are rallying 0.1% per day, that’s the top right quadrant, but not meaningful. If stocks and oil both rallied 10% this month, that’s turbo top right quadrant action. You can’t just split stuff into a 2X2 and ignore the underlying complexity presented by rate of change and levels.

Another example of this is that rates rising 1% off zero probably matter a lot more than rates going from 7% to 8%. So even velocity in isolation isn’t enough. Starting points, levels and velocity (rate of change) all matter, even while direction is the most important factor of all.

Remember like in high school calculus, you have: Level, change, rate of change, rate of rate of change, and so on. The biggest driver for markets is usually changes, but levels and rates of change and even rates of rates of change can also matter.

You might have noticed that my oil vs. stocks matrix mirrors the other matrices very well because oil is a good proxy for inflation and the stock market is an OK proxy for growth (not always true!!!!!) Inflationary booms are usually also periods where the stock market goes up and oil goes up.

But quadrant maps don’t always have to be about growth and inflation or related market moves. They can be useful for identifying all sorts of regimes.

Regime switcher

So far, the takeaway should be that you can create useful shorthand models for the economy and for markets in a simple way: Create a 2X2 matrix and solve for what you think each quadrant means. This is a useful way of breaking down the economy and market relationships.

These matrices help you identify the current regime and they should also help you identify regime switches in advance or at least in real time. Adaptive regime-switching is a trading superpower. To survive as a trader in the long run, you must be able to adapt as economic and market regimes change. If your strategy was to buy short-dated calls before disruptortech earnings announcements and you didn’t recognize that there was a regime shift around 2021, you probably made a lot of money for a while … then lost a lot of money, really fast.

One of the greatest advantages humans have over computers is our ability to make creative, non-linear, non-obvious judgments about regime shifts, especially shifts into regimes that never existed in the past. For example, any human being could probably reason that COVID lockdowns would lead to more time playing video games. It is extremely unlikely that any algorithm or machine learning or AI model would have been able to make such a prediction because there would be no data to analyze as video games did not exist the last time a major pandemic swept the world.

Trading regimes

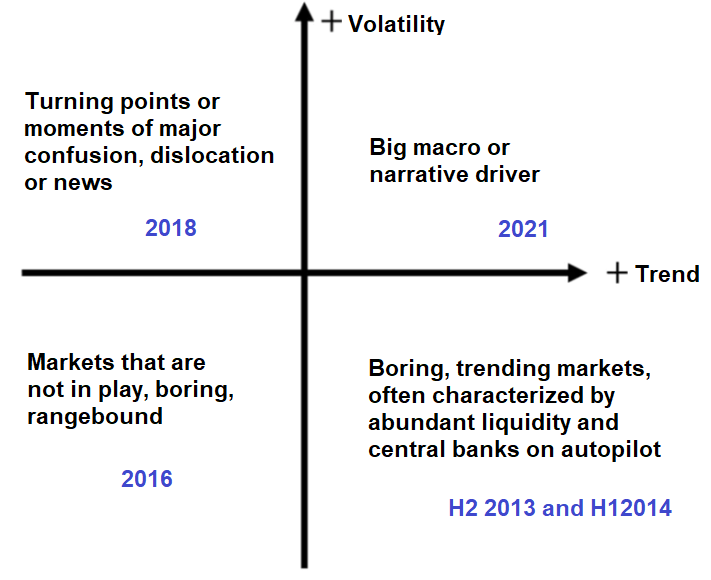

While economic regimes can be most simply boiled down to growth and inflation, trading regimes can be boiled down most simply to volatility and trend. Here’s a matrix for those two variables with examples for SPX in purple. For example, 2021 was a high-volatility trend higher in stocks as everything ripped and call buyers kept volatility supported.

If we were making a 3D cube instead of a 2X2 matrix, we would add correlation, but as a general rule, correlation and volatility move together so the volatility axis partly accounts for correlation.

As a rule, super high correlation (aka, corr) between assets is a feature of high-volatility, fear-driven markets. When things are calm, correlations are lower and individual assets can express idiosyncratic directional moves. This is a general truth but not an ironclad law of global markets. The reason corr tends to go up during periods of fear is that every asset is made up of a systemic risk/liquidity component and an idiosyncratic component. As systemic risk rises, the idiosyncratic factor is crowded out and the systemic/fear component dominates. In a risk aversion regime, fear (and relief from fear) crowds out the idiosyncratic drivers of each asset class and pushes cross-asset corr towards 1.

For example, in crypto, nobody cares about bitcoin adoption, or Solana transaction speeds, or the promise of GameFi right now. All that matters now is macro and the Fed. Here is a quick analogy from a recent MacroTactical Crypto piece I wrote:

Imagine a music festival with four separate stages. The song being played on each stage will lead to idiosyncratic styles and speeds of dancing. People watching Kendrick Lamar will dance and walk around in styles and patterns that are totally independent of the movements of people watching the trance DJ, the pop singer, or the deep house DJ on the side stages (that is: the movement of people watching each stage is idiosyncratic and uncorrelated).

If there’s light rain, you will see some people from each stage area head for cover (some correlation, but still low correlation of people movement as some portion of spectators at each stage heads for the tent).

But if there’s a massive lightning storm (i.e., risk event), all the people at all four stages will run for cover, regardless of the style of music being performed on each stage (high correlation of people movement, most of the crowd rushing for cover).

During periods of calm and optimism, asset classes dance independently. During periods of fear, all asset classes move as one. That is: fear drives cross-market correlation higher. There are various names for this such as “risk on/risk off (aka RORO)”, “The Blob” and so on.

In trading, it’s absolutely critical to know what volatility regime you’re in, and whether your market is rangebound or trending. I go into this stuff in great detail in my book: Alpha Trader. Let me talk a bit more here about range vs. trend markets.

Rangebound vs. Trending

Rangebound markets favor mean reversion strategies (buy low/sell high) while trending markets favor breakout or “go with” strategies (buy high/sell higher). You should always have a good sense of whether each market you trade is trending or rangebound. Identifying if you are in a range or trend regime is fairly easy, but forecasting when the regime will change is hard.

Volatility and trend are the two features you should always be able to describe with confidence for each market you trade. You should always know where volatility is relative to recent history, and whether your market is in a trend or a range. If you update your view of these two variables daily, you will adapt in real time better than most of your competitors.

One more matrix

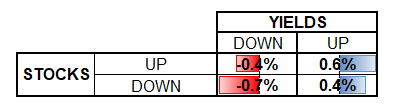

Here is a matrix I use to trade the USD:

Yields up, stocks up = America, fk yea! Buy USDJPY. Yields up, stocks down = Inflation problem or liquidity issues, sell risky currencies like AUD, NZD, EMFX etc. And so on. Once you put together a matrix like this, you can backtest it.

Let’s look at average returns for USDJPY using this breakdown, but with a bit more detail so you can see what I mean. The JPY is a low-yield currency, so we would think top right corner action (stocks up, yields up) would be best for USDJPY. I’m going to look at data since 2010 because any analysis including data pre-2010 will tend to be distorted by the monster moves in 2008 and 2009.

This simple table tells you right away that USDJPY is a yields trade, and not an equity trade. People commonly believe that the JPY is a safe haven, but it’s not. It’s only a safe haven when bonds are a safe haven (and bonds are often not a safe haven in times of high inflation, like right now). If you care about JPY and its relationship to rates and equities, read more here.

The Trade: Buy bonds

The purpose of this lesson was to get you thinking about two-variable interactions and how you can reduce complex systems into a simple matrix for better understanding. These matrixes can lead to trade ideas as you understand the current state of the world and forecast its future state.

The US economy has accelerated into the inflationary bust quadrant now as Bridgewater says in their email. That’s rates up, stocks down. It’s a good time to own cash and a terrible time to own almost all assets.

But my feeling is that we are soon going to transition out of the inflationary bust and into a disinflationary bust as the Fed accelerates its response to the CPI threat. The accelerating velocity of the Fed response is hitting stocks and will further decimate growth expectations. I envision an episode similar to May where US 10-year yields pull back 30-50bps. This is a catch the falling knife scenario in bonds, but my core view for the past 2 weeks (as described in am/FX, my daily note) has been: one last soul-crushing capitulation push up through the 3.24% double top in US 10-year yields. We just got that.

Since bond futures are at the lows, there is no obvious technical point to leave a stop loss. I’m going to take 3X daily average range of 0.5 points in 2022 and put my stop loss 1.5 points below my entry.

The Fed meeting is tomorrow so there is serious event risk. I think the best result for this trade (counterintuitively, perhaps) would be 100bp (1%) hike from the Fed. To anchor inflation expectations and bond prices, the Fed must abandon their addiction to gradualism and go Volcker.

The trade parameters are: Long TYU2 at 114 18/32. Bond futures trade in 32nds so 114 18/32 is 114.56. My stop loss is 3 days ranges away and below the round number of 113 so it will be at 112 27/32 or 112.84375. The take profit is a move back to where we were three days ago: 118.00. I am risking 1.7 points to make 3.4. Let’s go.

By the way: If you’re truly passionate about learning global macro and trading, subscribe to my daily macro note (am/FX) right here. I have been writing it since 2004 and it will help you learn to trade. It’s the best investment you can make in your own trading education.

Conclusion

A simple four-quadrant matrix can help you distill themes and reduce complexity. First, make sure you fully understand the popular macro quadrants framework developed by Bridgewater. Then, be creative and come up with your own 2X2 matrices.

Let me know if you think of any cool ones. That's it for today. Thanks for reading!

If you liked this episode, please click the LIKE button. Thanks!

My global macro daily is here

My crypto substack is here

And this is my Twitter

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

Really appreciate how well you put that together, great education thanks a bunch.

Probably your weekly 50in50 write-up that taught me the most so far. Thank you!