Week 21: Overshoots and pullbacks

Use mean reversion to improve entries and exits

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 21: Overshoots and pullbacks

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

RBLX massively outperforming CVNA (good!—see chart). GBTC ripping ($16.60 TP target looks possible soonish).

50in50 is on a good run.

CVNA short vs. RBLX long: A visual update

ARKK vs. TSLA not doing much. Let’s talk mean reversion.

Overshoots and pullbacks

Excellent traders toggle successfully between trend following and mean reversion strategies. It is not always a good time to play breakouts and it’s not always a good time to follow the trend. The ability to detect and switch between regimes is one of the hallmarks of a great trader.

Today, I’ll focus on mean reversion. While some markets mean revert more than others, all markets display some combination of trend and mean reversion over time. Prices do not move in a straight line—even in a raging up trend, price will frequently revert back towards a rising trend or moving average.

For your info, there are generally two ways people think about mean reversion. One: price goes up or down, and then pulls back. Two: when two assets with similar underlying drivers diverge and then mean revert back towards each other. The first one is what we are talking about today (price mean reversion), the second one (reversion to “fair value”) is more in the realm of correlation, intermarket, and lead/lag trading. That’s a topic I write about quite often, but not today.

Snooping and mining for mean revision

There’s a ton of research out there on mean reversion and there are systems that trade it, but one major challenge in testing and trading mean reversion systems is that they are highly regime sensitive. That is, you can easily find and backtest highly profitable mean reversion strategies but that does not mean they will work in the future, out of sample. Trading systematic mean reversion can be like picking up pennies in front of a steam roller (synthetic short carry or synthetic short options, essentially) or it can be fooled by randomness.

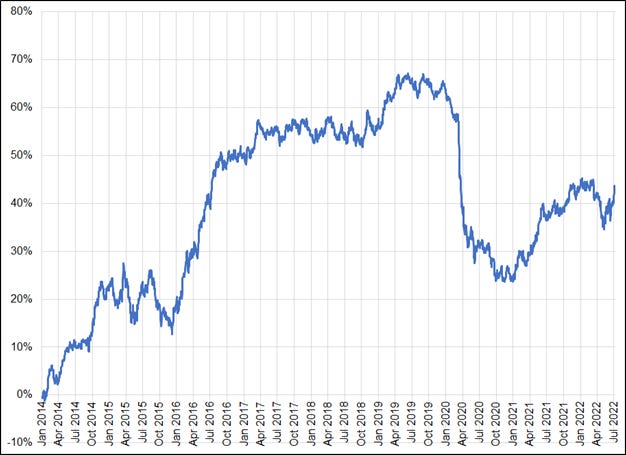

To give you a sense of what I mean, take a look at the P&L of the simplest possible mean reversion strategy which is long or short 1 unit as follows: (if market is down today, go long tomorrow / if market is up today, go short tomorrow). This simple UP / DOWN strategy could be traded in real life with minimal slippage in many markets. Here’s the cumulative P&L of the strategy in AUDUSD:

UP/DOWN strategy in AUDUSD

From 2016 to 2019, it looked pretty good but then when COVID happened, not so much. The COVID regime shift erased three years of returns in three months.

In contrast, a good human trader would not be in mean reversion mode in March 2020, even if they were mostly trading mean reversion in AUD in prior years. The game had changed and that was obvious. This P&L path for AUD mean reversion is a good example of how low and falling volatility regimes favor mean reversion. AUDUSD volatility fell steadily from 2016 to 2019 then exploded through COVID.

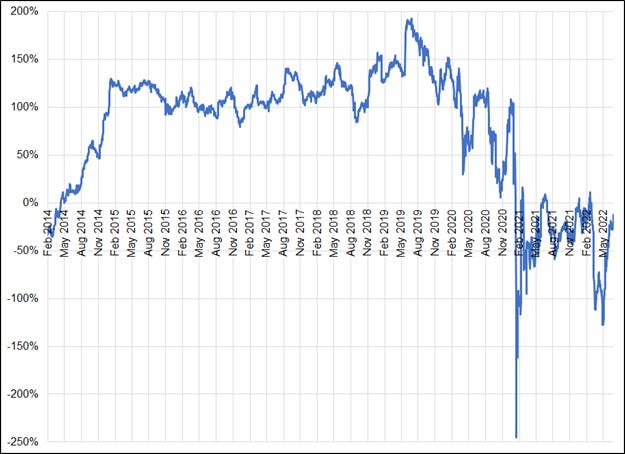

Here’s the P&L of the same strat in GME common stock:

UP/DOWN strategy in GME

Mean reversion is not a good strategy during tail events! My point here is to show that you want to focus on mean reversion strategies more when volatility is low and there isn’t some crazy thing happening in the world.

If Russia invades Ukraine, don’t sell oil just because it’s overbought. If a biotech’s drug passes Phase 3 and it’s a big surprise, don’t short the stock just because it’s overbought. In tail and high volatility moments, overbought and oversold mean nothing. While you can combine trend with mean reversion (as I’ll show later)… Remember that a market trending upward, and a market dislocating higher on a major news event are two completely different kettles of fish.

Three ways to trade mean reversion

Now, let’s look at three ways to profit from mean reversion. Most implementations of mean reversion involve some form of technical analysis and as I have explained in my books and in this Substack, I use techs for tactics and risk management, not for strategy. I never get a trade idea from a chart.

My ideas will come from macro, positioning, behavioral factors, events, and other inputs, and then I will use techs (like mean reversion signals) to fine-tune my tactics and maximize my leverage. Entering a trade at some random time just because you decided you’re bullish mid-range is often not optimal. Deciding you're bullish, doing nothing for a while, then buying the highs after a 2% rally because of FOMO and you “knew this was going to happen!” is definitely not optimal.

Instead, when you have a market view, you should mentally fly up out of the trees, and into the clear sky above… To take a long, calm look at the forest below. What are the best tactics you can use to implement your 5-star strategy? That’s where technical analysis can help you.

Remember that when you put on a trade, there is often a tension between “tightest possible stop loss for maximum leverage” and “risk of getting stopped out due to noise.” Getting to the right answer takes some work.

Here are three mean reversion strategies you can use to better fine-tune your entry and exit tactics.

1: Pullback to a moving average

You are bullish XYZ but it just made a double top and seems to be losing momentum. You generally like going with the trend, not against it, but you hate the current entry point. A simple approach is to find one or two moving averages, drop them on a chart, and wait for XYZ to pull back to that moving average (MA).

Avoid false precision with moving averages. Whatever moving average fit in the past will probably not fit perfectly in the future, so don’t waste time optimizing whether the 241-day MA or the 266-day MA is better. Find a moving average that defines the trend pretty well, and use it.

Another approach is to use two moving averages and scale into 1/2 your position at each. This helps with the false precision problem, and also avoids the all-or-nothing problem where the moving average is at (say) 146.10 and you bid there for your whole position and the low is 146.16.

Here is an example. It’s June 2, 2022, and you are bullish oil because of the war in Ukraine and Russia’s squeeze on the European energy markets. But the chart looks like this:

NYMEX crude, Q4 2020 to early June 2022

Oil is getting back toward the highs but not breaking through them and this just seems like a really bad entry point. As long as there is no peace treaty in Ukraine, you want to buy a dip.

Looking at the chart, you can see there is a slow trend in 2021, which was pretty smooth, followed by a steeper trend and a rip in 2022. You draw two moving averages on the chart, one that captures the lows of the first trend and one that catches the bottoms on the second, faster trend. Now the chart looks like this:

NYMEX crude, Q4 2020 to early June 2022 (with MAs)

You could also use trendlines in the exact way I am using MA’s here, they tend to accomplish the same thing. I’m fitting my MA to the trend, so that’s obviously conceptually similar to a trendline. Now, I have my “buy the dip” zone. I’ll buy half at the purple line and half at the blue line. Fast forward, and this is how the chart looks now.

NYMEX crude, Q4 2020 to now

Normally in educational things like this, someone would find an example where the price pulled back perfectly to the trendline and you would say “wow, what a great indicator” but in real life that might happen, or this might happen: Limit order at $94.40. Intraday low $95.50. Current price $103.50. Dang it! Sometimes you are going to miss your levels by a few ticks. That’s life. This type of double moving average approach gives you a window or range to buy. In this case it’s $87.80/$94.40.

Some people use more than two moving averages to further deal with the false precision problem. There is even the Guppy Multiple Moving Average system which I find is a bit nuts but produces super cool looking Mobius strip kinda charts like this:

GMMA of NYMEX crude

You can read more about GMMA here. When we wait for a pullback to a moving average, we optimize our entry point based on the slope of the prior trend and avoid paying the highs or some random mid-range location. We benefit from mean reversion but stay with the direction of the trend.

2: The Deviation

If you want to play mean reversion directly and go against the trend, there are many overbought and oversold signals you can use. My favorite is called “The Deviation.” The technique is pretty simple, as usual. I take the price of the asset I’m trading and check how far it is from the 100-hour moving average. Then, I look as far back as possible and see if The Deviation tends to oscillate in a steady range or if it looks unreliable or random. For many markets, you will see that The Deviation tends to peak and trough around the same levels over and over as long as overall market volatility is fairly stable.

Here is an example using S&P minis.

TOP: S&P 500 futures with 100-hour MA in green

MIDDLE: Deviation from the 100-hour MA

BOTTOM: Buy / sell signal triggers if S&P is more than 3.5% above or below 100-hour MA

This is easy to set up on your trading system or in a spreadsheet. Use historical data to determine what the extremes are in The Deviation and then use those extremes going forward as reversal signals. In this case, I filtered for the 5% of most extreme values in the deviation and this represents a move in the S&P 500 of about 3.5%.

When using The Deviation, it is important to understand the skew of your market. Skew is the direction of the market that tends to happen faster and be more volatile. For example, stocks tend to sell off much more quickly than they rally, so you might want to use a more conservative entry point for your deviation signal on the downside or scale in gradually knowing that sell-offs can overshoot and are harder and more violent to fade. I use the Deviation regularly in my FX trading.

3: Relative strength indicator (RSI)

Every trader should have one or two indicators that tell them when their market is extremely oversold or overbought on the time horizon they trade. RSI is a standard indicator most people use, and the textbook strategy is that if it goes above 70, wait for it to fall back below 70 and then sell. I use it differently.

I take as much data as possible (using hourly data because that suits my trading time horizon) and find the extremes in the RSI going back as far as possible. I then calculate the top and bottom 5% most extreme and use these levels as “get out no matter what” levels. That is, if I’m long, and the RSI gets into the top 5% of the series, I cut. I find that at the mega RSI extremes, the risk of a reversal is too high so the risk-reward on staying in the trend is poor. If I am trying to trade against the trend, I will also use these mega extremes as an entry point.

Here's a super short excerpt from one of my dailies (December 2, 2020) where I use an extreme in the RSI to get short NZDUSD:

The textbook approach to trading RSI is to wait for it to rise above 70 and then fall back below 70 and then go short. I prefer to isolate the most extreme levels and use those as reversal points right away. While RSI is a trend indicator, generally, it can be an amazing reversal indicator at the MEGA extremes.

I sorted all the daily NZDUSD RSI data from 2010 to now and the most extreme readings occur when the RSI breaks above 75. That happened this week. With the dramatic repricing in NZ rates and the non-stop flood of good vaccine news, much goodness is in the price of NZDUSD now. The table below shows how the pair performed in the twelve instances where the RSI went above 75 (since 2010).

You can see in this short example that if you isolate the times when the RSI is historically extreme, you can find points where you have high confidence to go the other way. When the NZD RSI is above 75, future performance is raging bearish as NZD averages a drop of 2.7% over the next 60 trading days and goes up only 25% of the time.

In this case, I was already bearish risky assets (NZD is a risky asset) so this just added to my thesis and gave me a way to play it. I went short NZDUSD at 0.7040 with a stop at 0.7111 and a take profit at 0.6911. A high RSI on its own would not be enough to get me involved, but it’s a nice seed that might grow into a full trade idea.

Think about what you are doing

An important note about using overbought and oversold signals: think think think. If the Fed just announced a massive QE program and stocks rip higher to extreme overbought… That is probably not a signal that it is time to go short. Things that are overbought can become more overbought and then more overbought again. Overbought on its own is not a reason to sell an asset. It’s a warning sign that the future distribution of returns might be skewed lower and that’s all.

An elevated RSI reading or a sexy stochastic are not reason enough to do a trade. Incorporate overbought and oversold indicators into your process and use them to fine-tune entries and exits, but don’t be the trader who fades a move solely because “Too far, too fast, dude!” That is not a valid trading strategy. Remember we are using these technicals as guidance and tactical inputs and not as a systematic quantitative trading framework.

Long XME

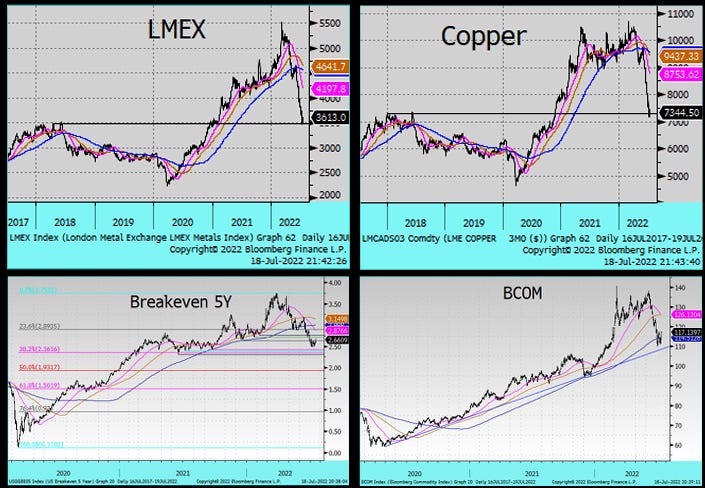

Tony Greer writes a great daily macro letter with a focus on commodities. He has been long commods for a while and highlighted in his piece today that a ton of commodities have pulled back to support as defined by previous 2021 tops.

The four tops

Let’s say I’m bullish commodities but flat right now. There’s a lot of recession talk out there and maybe, just maybe the real story is more nuanced as the jobs market remains strong, inflation is still pretty sticky, and soft sentiment data could be overstating hard economic weakness due to the way consumers feel real vs. nominal pain. China and Europe are sucking wind, but maybe that’s priced in by now?

So my thesis is bullish commodities as I think the worst of the bad economic vibes are priced in, and the mean reversion setup on XME (the metals ETF) looks especially attractive. The 504-day moving average (two years of daily data, because there are 252 trading days in a year) looks like this:

XME vs. 504-day moving average

This is a nice chart. Overshoot up to 66 then major mean reversion back to a moving average that has done an excellent job of defining the trends. I especially like how the break of the MA in Q4 2020 was an excellent straight-line breakout indicator. You also have a quadruple bottom $39/$40; that was the base for most of 2021.

Meanwhile, if we zoom in and look at The Deviation (from 100-hour MA), there is a consistent pattern where XME momentum fades when it gets more than $7 above or below the 100-hour. Here’s the chart:

XME vs. 100-hour (in blue) and deviation from 100-hour (bottom panel)

We held the oversold Deviation, and have now rallied back above the 100-hour. The dream scenario is that we would have seen this when XME was at $40, trading $7 below the 100-hour, but I still like it here given the litany of supports and other greenlights.

There’s so much to like here. In fact, if we zoom out to the daily chart again, you can see that a) we are bouncing off the old 2017 highs ($39.50—strong resistance becomes important support—see horizontal line)… And b) the deviation from the 100-day has bottomed roughly the same place it bottomed during COVID.

This is not the PERFECT entry point; we have bounced a fair bit off the 504-day MA and we are way off the $7 deviation, but we also don’t want to let perfect be the enemy of good. There are so many converging technical signals here, I’m not going to wait for another dip down to $40/$43.

Let’s just plug our nose here and buy at $44.50 with a stop loss at $34.95. That stop loss is more than $7 below the current 100-hour MA, and it’s well, well below the big support in the $39/$40 area. Note that of course, The Deviation and moving averages change over time, so the current Deviation is not the same as what it will be in a week. Take profit at $63.70.

Conclusion

Mean reversion is an important tactical tool that every trader needs to know how to use. I have suggested three specific methodologies in today’s 50 in 50. Use these, and other mean reversion tactics, to focus your entries and exits, maximize leverage, and squeeze the most possible juice from your best trade ideas.

That’s it for today. Thanks for reading!

If you liked this episode, please click the LIKE button. Thanks!

That was a good instalment, thanks so much

Thank you for sharing your experience. Very useful.