Week 22: Time, the Forgotten Dimension

Being right or wrong, right away, lowers opportunity cost and preserves mental capital

.

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 22: Time, the Forgotten Dimension

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

Last week’s XME idea is small ITM. The TSLA short is stopped out. CVNA vs. RBLX is still good. ARKK is boring.

I am cutting the short ETH vs. BTC trade because it makes no sense anymore. The crypto crash is over and ETH Merge excitement is building into 19SEP22 (this is fully explained in my latest MacroTactical Crypto piece). GBTC still doing well.

That’s it. Let’s talk about time.

Time, the Forgotten Dimension

In my travels on Twitter and the internet, I read many write-ups about trading every day. Naturally, after 25 years of doing this, and writing two books about it, I run into fewer “wow that’s a great piece!” pieces. I do still find cool new stuff though. Always learning.

Today’s 50in50 is mostly a guest post from a FinTwit Lord who goes by the handle “Horselover Fat”. That is a reference to a Philip K. Dick novel, which made me like him right away. He’s @Michigandolf and his tag line is “Joking about life, serious about trading” which captures the vibe of his videos and Twitter. He trades a lot of ES and a bit of NQ and other stuff, and he likes talking and writing about trading much as I do.

Here is a video we did together.

Horse runs traderade.com. This is not a paid placement or endorsement, I have no financial or other relationship with Horse or Traderade. I just think the site is good and I like interacting with Horse. He’s a smart guy, he’s fun to talk to, and he knows what he’s talking about.

Instead of me trying to explain Traderade, here is their landing page:

Horse wrote a piece a while ago that resonated with me because it addresses a third dimension of risk management that I have always found prickly: Time. How long do you leave a trade on if it’s not getting stopped out but it’s also not moving much into the green? This is an issue in FX when you trade pairs like AUDNZD and NOKSEK, as they can often sit there and do nothing for ages while you wait. Generally, my view is that you just wait for the plan to work, or not, but Fat provides some compelling logic in his piece for why that is not always optimal.

Many of these things come down to personal style and preference, but it’s great to ingest as many viewpoints and approaches as possible and then digest what helps improve your process and discard what does not. Without further ado, I bring you (with permission) “Riffing on Risk” from the tradefat.com blog. I hope you like the piece! FYI, there are a few bad words in here. All typos are intentional.

Riffing on Risk

(by Horselover Fat)

.

Since I started sharing with people how I trade, I've learned something that kind of surprised me:

Risk management is a difficult topic to discuss.

Probably because it means so many different things to different people. I often find myself feeling bad because I struggle to answer the most basic of questions people ask me, like “How many points should I risk on each trade?” or “How many contracts should I trade?”

I find myself thinking “Dude…I don’t know!” I’m not you, I have no idea how you trade, what your goals are, what your experience is, etc. etc. etc. This is the conundrum with risk management: It’s arguably the most important part of trading yet so universally difficult to teach because no two people trade exactly alike and there’s no standard definition of what risk management means.

To help establish a baseline for this blog post, I’ll define risk management in the most basic sense as the process by which a trader attempts to avoid losing more than they make.

If we can all agree on that basic definition, I’d like to share with you how I think about risk as a trader. As in, how I view risk management as a whole, not in regards to specific trades. As some of you know, I primarily trade futures intraday, but I also swing stocks and buy/sell options premium occasionally. So this blog post is about how I approach risk management in the long-term, which might help explain why I trade the way I do.

Ok, introduction over…let’s get into it.

Let’s start with 2 very basic factors in determining positional risk:

Likelihood that I am correct in my thesis

My position size

.

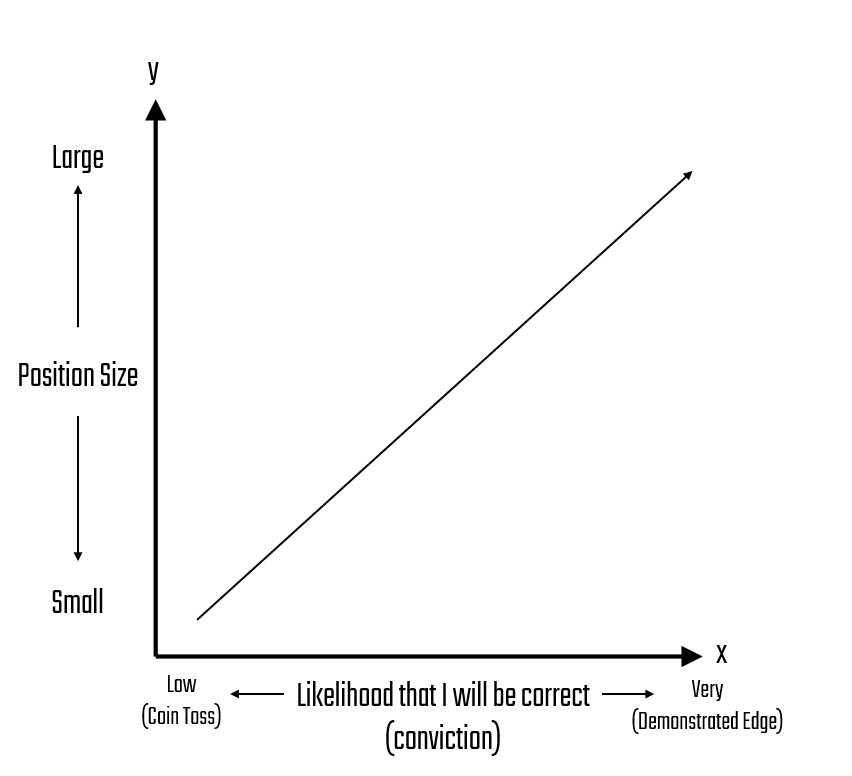

Logically, there should be a positive linear relationship between these two factors. The more likely I am to be correct when entering a trade, the larger my position size should be.

Some of you have watched the “How I Day Trade” videos I released and it should be no surprise that I approach trading like gambling. If you haven’t seen the videos, I use the analogy of poker. In poker, you start with a stack of chips (i.e. your trading capital), and good poker players wait for hands where they know they have a statistical edge based on the strength of the cards. When they receive a “strong” hand they bet accordingly (i.e. heavily).

During tournament poker, a key part of any winning strategy is the ability to fold hands that are unlikely to win. To me, it’s the same in trading. You have to be willing to cut losers and/or wait patiently for a setup that has demonstrated a high likelihood of success in the past. This core concept is what I’m referring to in Factor #1 (the likelihood that I’m correct in my thesis). If I’m entering a trade in the middle of nowhere, with no key Support/Resistance, no clear order flow information, etc., well that trade is essentially a coin toss…the market is just as likely to move against me as it is to move in my favor. To stay with the poker analogy, that’s a hand I would fold.

But let’s say the market is at a key area of confluence, and there’s a VERY good chance it’ll change direction, and I’m seeing order flow to support that thesis…well now I have a slight edge, so technically my position size should increase from whatever my minimum size currently is. We can represent this thinking with a basic graph:

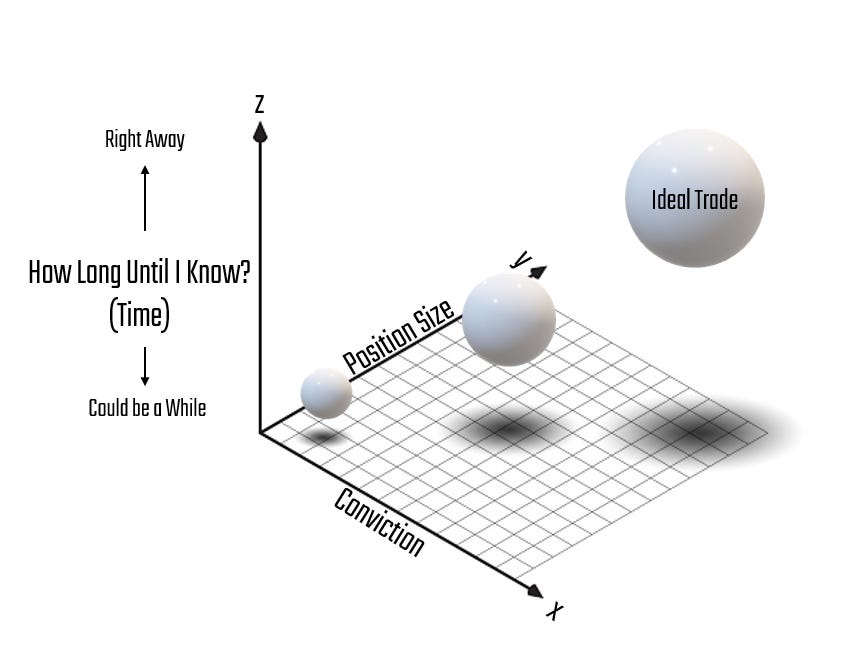

Wouldn’t it be nice if risk management was just this simple? It’s not. Now we have to introduce a third factor on our Z axis: Time.

Specifically, the time it will take me to know if I am right or wrong in my thesis.

You might be thinking, “Horse what the hell does time have to do with risk management?”

That’s a valid question. It has to do with opportunity cost.

Again, referencing our poker analogy, I have a limited stack of chips. I cannot place unlimited large bets with high conviction. I have to “manage” my chip stack, my capital. Therefore, I can’t have too much tied up for an indeterminate amount of time hoping my thesis is correct. For me, it’s sort of a “shit or get off the pot” scenario. The longer I have to wait to know if I’m correct absolutely impacts my likelihood of being correct AND my position size.

In my opinion, this is why macro investing is so difficult. You could enter a position with a very sound thesis, but over time things change and you end up being dead-ass wrong… through no fault of your own. The more time that elapses, the more opportunity for things to change that impact your initial thesis. Sometimes those unknown factors are positives, but more often than not they seem to be negatives because your initial thesis generally accounted for the positives, right?

Earlier I used the word “process” to describe risk management. I absolutely view it as an ongoing process. Things change in markets—therefore I need to be prepared to change as well in order to properly manage risk in the long term.

So back to opportunity cost. I'm a trader in this for the long haul, I need to adjust position sizes and stoplosses based on new information and time.

Here’s a couple of examples:

DWAC

One of my best equity trades this year was the DWAC SPAC (Note: Unintentional yet hilarious rhyme). Here’s how it went down and how I thought about it in my weird “mental risk model” that we’re discussing:

I developed a thesis for the trade after the markets were closed for the day. I heard the news about Trump possibly getting involved with a SPAC deal. I checked the price of DWAC after-hours and it was sitting almost at NAV (~$10), which had me scratching my head…why hadn’t this thing run? Well the answer was simple: The news JUST broke and it wasn’t priced in yet. So I decided that I’d take a very large position size pre-market the next day because I figured my likelihood of being correct (e.g. that it would pump on the news) was very high. I also factored in the time for our thesis to play out (our z axis) and determined that I’d know RIGHT away if I was right or not. The likelihood of it falling below NAV was extremely low, so it was “all systems go” for me and time to make an aggressive trade. The rest, as they say, is history.

GOLD

Another example that better showcases adjusting my risk management approach using the 3 factors we’ve discussed is a recent gold swing trade I took. In the final days of September, I started a large swing trade in gold micro futures (more on why I like the micros for gold some other time). The inflation narrative was picking back up, and even though gold is a bona fide piece of shit for an inflation hedge, my thesis was that the general public is too dumb to know that, plus gold had recently been beaten to a pulp and I figured it was oversold and there was an opportunity to BTFD.

I also figured portfolios would be getting rebalanced Sept 30-Oct 1 and IF gold was to run it would likely happen FAST due to EOM rebalancing. Additionally, the technicals looked good to me as well…so all of the factors I was looking for were there: A reasonable bull thesis based on the incompetence of Average Joe investors, likely bounce area from a technical perspective, and I’d know quickly if I was right or wrong due to EOM (plus some key FedTalks and inflation data drops were on the horizon).

Some of you may remember from my obnoxious Twitter bragging, but I practically bottom ticked it and gold took off on a nice ~7.5% bull run.

But I’d be lying if I said I held that position full size for the entire run. I didn’t.

I trimmed it and I’ll tell you why: My mental model for long-term risk management changed. In early November gold started to slip again, so I naturally questioned 2 of my key factors: Likelihood of being correct and time.

At this point, I had been in the position for over a month and truthfully I thought it would run harder than it did given the intensity of the inflation narrative. The index futures were looking more and more attractive in early November, as I was anticipating seasonal bullishness and continuation of recent momentum. So things began to shift on my mental risk model. Did I really want that many of my “chips” tied up in that one “hand” anymore, or would it be better deployed somewhere else? I determined it was time to trim the position considerably…of course gold ended up ripping right after that because, well, fuck gold lol. But hopefully you get the point of this example: If I deem the likelihood of continuing to be correct has decreased AND the time it will take me to know is longer than anticipated, then I will actively manage my exposure (risk) and make changes.

These are ever-changing factors. As soon as you enter a trade they begin to change. This is the main reason I prefer to trade futures intraday: I am better at it than equities/options (therefore I typically have a higher likelihood of being correct) and I know IMMEDIATELY if I am right or wrong. Since futures are a leveraged product, I am able to quickly size accordingly…and size large if the thesis is strong.

One of the reasons I decided to write this post is to help you better understand why I am not phased in the least when one of my “Quickies” (usually equity swing trades) doesn’t pan out. The position size is typically negligible compared to day trading futures because my conviction is usually much lower and the time it takes me to know if I’m right or wrong is usually much longer. It may seem weird to you, but it’s all part of a holistic way of managing risk throughout my trading journey.

I love seeing a great equity swing trade pan out over time. Absolutely love it. But I’m also very realistic about my strengths, so my risk management approach needs to align with that awareness. When I see large orders on the Limit Order Book tipping their hand at a key level of confluence, I am usually VERY certain what is about to happen in the next 5 to 10 minutes. I can’t say the same for swing trading stocks, therefore I can’t size the same.

Now, I don’t want you to read this and leave thinking there’s anything wrong with the classic “risk 1-2% of your capital per trade” approach to risk management…there isn’t. Everyone is different. I’m just simply providing a different way of approaching risk management in its entirety. Even if you’re very disciplined about only risking 1-2% per trade, things change once you take the position! All I’m suggesting is to view true risk management as a fluid process, not a stagnant one.

I’m a firm believer that to be a sustainable trader, risk needs to be viewed on a “macro” scale. For example, I mentioned in the “How I Day Trade” videos that my sizing for short trades is ALWAYS smaller than my sizing for long trades. Why? Because markets are inherently bullish due to the incredible amount of passive investing flows. Seems like a small detail, right? Maybe. But not if you plan to sustainably trade for years to come.

That’s what I want to do, and that’s what I want for you…no matter how you do it.

So I hope this post is at least thought-provoking if nothing else. I know we didn’t get into the details of stoplosses and stuff, but I think that warrants its own post. For now, I just wanted to expand on how I think about risk management from a philosophical perspective.

Thanks for reading and thanks for being here.

Horse.

I was thinking about this piece because there is a trade like that this week. A trade where every single catalyst is rammed into a small window and you can put the trade on and you’ll either be right or wrong just about right away.

Week 21: Short META

Facebook isn’t doing well lately. Sheryl Sandberg is out, SNAP and TWTR have signaled ad revenues are at risk, revenue growth could be negative for the first time when they announce earnings on 27JUL, new measures to grow the user base look desperate, and it has lost to TikTok. The stock obviously reflects many of these harsh realities as it has collapsed from 386 to 165 in a year.

If 2001 (dotcom) and 2021 (ARKK and friends) taught us anything, it’s that once-favored tech companies can drop 85% in pretty much a straight line if they want to. Selling something that’s down 57% is a hard trade, but it’s often also the right trade.

Short META right now either works or it doesn’t work, just about right away because we have FOMC and then META earnings on Wednesday, July 27 (I am writing this on July 25). My view is that the market is too early on looking for a Fed pivot and that despite the swoon post SNAP earnings, there is still plenty of room for META to take another dump towards the 125/137 base formed in 2018 and 2019.

Here is my reasoning on the Fed, excerpted from this morning’s am/FX.

.

Excerpt from am/FX: Trends Resume Tomorrow? (25JUL22)

I feel like the market is still locked into the old Fed framework which was: Fed turns dovish at the first whiff of trouble. I don’t think that is the right framework anymore and the Fed is likely to remain much stickier and more hawkish than people currently think. This week’s Fed meeting will reveal whether I’m right or wrong.

I don’t see any scope for the Fed to back off at this week’s meeting as the remaining scraps of their credibility are in jeopardy after a horrendous twelve months of bad forecasts (understandable, forgivable), slow pivot (still buying MBS in 2022, etc., nonsensical), and a spate of trading scandals and resignations (deplorable). For them to declare any sort of mission accomplished here with headline CPI at 9%, PPI at 18%, and Biden wishing gas prices lower on Twitter every day seems premature. Jackson Hole at the earliest.

The current market setup is:

Everything got oversold

Market got short and got squeezed

Growth is slowing faster than economists thought

QT is just starting and will double in September

The same way they bought MBS in February 2022 even though housing was blasting through the moon and towards Mars, they will be doubling QT in September even as the US economy may well be entering a third straight quarter of negative growth at that point. The implication for markets is that this year’s primary trends—lower stocks and a higher USD—should resume Tuesday or Wednesday.

***End of excerpt***

If you want to level up your global macro and trading XP every day, and see how I generate actionable trade ideas IRL, click here to subscribe to am/FX. I’m about to raise the price from $490 to $590 for new subscribers—but I will give you a coupon for $100 off the $490 rate right now, so you will get one year for $390. Coupon code 50in50 expires July 31. Click here to subscribe.

You have two big catalysts on Wednesday, and a horrible fundamental story and downtrend in META. Even if you think it’s come a long way down, it’s also 10 bucks off the June lows, so a move to 150/155 isn’t hard to imagine. A cash trade is difficult to manage because of the gap risk, so the idea is to plug your nose and buy $1,000 worth of the July 29 expiry $160 puts for $6.30 and $1000 worth of the $155 puts for $4.60. A 15% drop in META to $142 on worse-than-expected earnings is not a crazy target … but we don’t need a target because the whole trade is going to last a few days.

Instant gratification—or annihilation.

If the trade works, cover everything at 3:59 PM on July 28. The good news is, as Horse explained in the main part of the post, we know if we’re wrong almost right away and the opportunity cost of this trade (and its drain on our mental capital) will be minimal. Right or wrong, we move on.

Conclusion

This is a bit of a lotto ticket trade, and Horse’s approach is juicier when you can do the trade in cash with a reasonable expectation of enough liquidity to safely exit at your stop loss level. Trades with immediate right/wrong timing that involve chart breaks, or less obvious fundamental catalysts, are often better than this META idea because implied volatility will not be so high.

In this case, there has been a lot of bad news about META and there is bearish anticipation going into earnings. Therefore if I’m wrong, I could get my face ripped off with a short position as the stock gaps through $200 and delivers the pain. I don’t like getting my face ripped off, so the only alternative here, despite eye-watering vol, is to buy the option and hope it realizes.

That's it for today. Thanks for reading.

Trade at your own risk. Be smart. Have fun. Call your mom.

If you liked this episode, please click the LIKE button. Thanks!

Full disclosure: At the time of publication, I am short META stock at $169 with a stop just above $175. I plan to buy puts tomorrow, but I am not guaranteeing I will do so! My views and positions change all the time. This is an educational Substack, not investment advice. Trade your own view! :]

Question: what’s the benefit of buying two puts five dollars apart?