Week 24: Do Good Traders Vary Bet Size?

The relationship between forecast confidence and forecast accuracy is uncertain.

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 24: Do Good Traders Vary Bet Size?

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

Here are some updates on past 50in50 trades:

The short SPY trade got spanked by CPI but it’s a 3-month view so let’s see.

Roblox got smoked on earnings then ripped, but Carvana is ripping too.

The XME long is more than 15% in the money.

Take profit on the ARKK long. It makes me physically ill to be long that thing as the company’s public messaging and high fees make it highly questionable IMO. I regretted using it as an example trade from the second I hit send lol. :|

:

That’s it! Full spreadsheet with all the results in Week 30.

Now, let’s talk about bet sizing.

Today’s 50in50 is a joint effort co-written by Justin Ross, my colleague here at Spectra Markets. Please check out his Substack: Square Man, Round World where he picks apart life’s questions and struggles.

Do Good Traders Vary Bet Size?

In Alpha Trader and The Art of Currency Trading, there is detailed discussion of how to vary bet size according to market volatility, and according to conviction level. Varying bet size according to volatility is not controversial. If the S&P is moving 5%/day, you need to trade smaller than when it’s trading 1%/day. And it also stands to reason that if you are extremely confident on a trade, you should invest more in that idea than a trade where your confidence is just 6 out of 10.

But maybe that’s wrong!

The reason that could be wrong is that the idea is only sensible if there is a known, positive relationship between confidence and accuracy. If your highest conviction trades have the same hit ratio as your “I’m not totally sure on this one!” trades… There is no reason to vary your bet size.

The Bet Sizing Problem

Bet sizing is one of the most important topics in trading. Not only because it ties in with risk management, and not only because it allows you to leverage your best ideas… but also because there is not one clear correct answer or best methodology. While most everyone will agree that you need to vary your bet size based on volatility, the issue of whether to vary bet size according to confidence level is up for debate.

If you’ve read any trading books, or you spend time around experienced traders, you’ve probably heard somebody say: “good traders vary bet size.” And by “varying bet size,” they mean “bet bigger on better ideas, and smaller on lower-quality ideas.” This is considered timeless wisdom in many trading circles – like “never revenge trade” and “always use a stop loss.”

There are plenty of reasons why this makes perfect sense, especially for veteran traders who are good with probabilities and know their edge. However, there are also plenty of reasons that this advice just doesn’t click with other traders. Perhaps 80% of traders believe you should vary bet size with conviction, but there are plenty of experienced vets who think otherwise.

Let’s take a look at some arguments for and against varying bet size according to confidence level.

Are confidence and accuracy correlated?

Unfortunately, there is no monolithic answer to this question. Some think the answer is obvious. “Of course, higher confidence leads to higher accuracy!” But if you study the literature on this, it’s not obvious. At all. Various accuracy/confidence scatter plots offer wildly different conclusions.

For example, one study asked participants to monitor their heart rate in reaction to various stimuli and then report on changes in their cardio state over time. They were also asked how confident they were in their assessment. Here is the scatter plot of confidence vs. accuracy:

Noisy! Here’s a second chart, this time from a study of confidence vs. accuracy in the realm of avalanche prediction:

Again, there’s a weak positive relationship there, but if it wasn’t for that 45-degree line they drew, it would be hard to see. By the way, there is a confidence/accuracy scatter plot for the 50in50 trades at the end of today’s note.

Confidence and accuracy are also much studied in the arena of eyewitness testimony because such testimony is often unreliable and highly problematic. Therefore, any way of increasing the reliability of eyewitness testimony through ex-ante confidence estimates would be useful for investigators and prosecutors and might help avoid wrongful convictions.

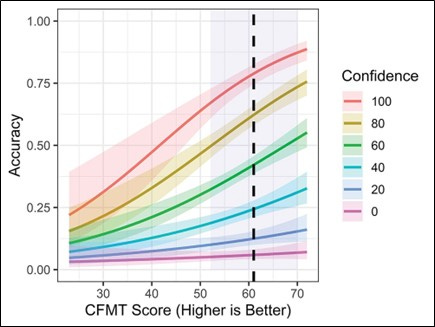

Here is the confidence vs. accuracy relationship from a Duke University article about eyewitness testimony:

This time, there appears to be a strong positive relationship, but you can see that depending on the field you study, a correlation between confidence and accuracy is not guaranteed. It depends on the subject matter, task difficulty, expertise of the individual estimating, and the calibration level of the estimator. If the person estimating is wildly overconfident, that’s going to impact the relationship between confidence and accuracy.

Confidence and Overconfidence

There is an enormous body of literature on biases and failures in human decision-making. There is a handful of essential books in the genres of decision theory and behavioral finance, including “Thinking, Fast and Slow” by Daniel Kahneman and Amos Tversky and “Psychology of Intelligence Analysis” by Richards J. Heuer.

As these books (and countless other books and studies) detail, people are overconfident in almost all measurable aspects of human behavior. People think they’re better at forecasting than they actually are. Clinicians think they’re better at diagnosing than they actually are. Academic economists are still in demand.

So, the average trader might look at an opportunity and think he has a 70% chance of being right. But most traders actually realize closer to a 50-55% win rate, so it sounds like this trader might be a bit optimistic. But he might not be. The only way to truly know the answer is to gather data.

I often advocate for collecting as much data as you can at as granular a level as possible, but I am sad to say that I have not collected data on my conviction level on trades or trading days over the years. While I know my daily win rate is close to 50% most years back to 2006, I have no idea if that win rate correlates with ex-ante confidence.

So the first lesson is: Record your conviction level on each trade in your journal to create a database of information that will show you the relationship between your confidence and your accuracy. Then, you will have a systematic way of determining the answer to the question: “Should I vary bet size based on conviction?” If you don’t have data, you are guessing.

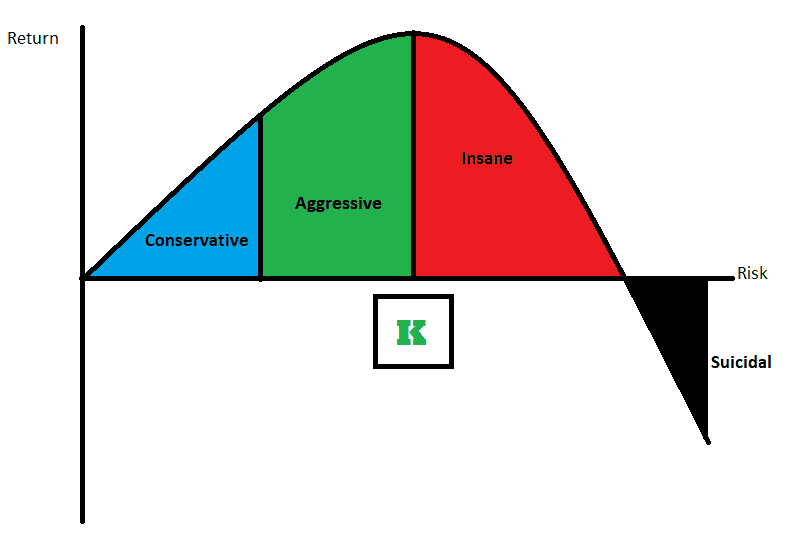

Kelly is Key

A critical concept in any optimal bet size discussion is the Kelly criterion, a formula in probability theory that maximizes gambling returns over time. It defines your edge, your payoff, and your available capital, and prescribes optimal bet size in any situation. It finds the mathematically ideal bet size that offers the best tradeoff between maximum return and least risk of ruin.

If you are not familiar with the Kelly criterion concept, it’s worth taking some time to read about it. “Fortune’s Formula by William Poundstone” is a fun read that explains the history and use of Kelly and the book has strong application to both trading and gambling.

Here is a graphic from the Wikipedia page for Kelly criterion:

Here’s a less mathy way of looking at it:

But there’s an important caveat: the Kelly criterion maximizes returns when the probability of the outcome is known. In other words, it works for coin tosses – where, until the end of time, you will have exactly a 50% probability of winning. It works for card games, where despite the immense difficulty of calculating the odds, there are defined odds. Poker players can use the Kelly criterion. Even in sports gambling, Kelly is useful because there is a huge database of historical information that can be used to objectively and accurately estimate future odds before the event.

Can traders use the Kelly criterion? The answer again, is not at all obvious. The market isn’t a static or stable thing – it doesn’t offer us repeating opportunities, strictly speaking. Every single tick, every second, every regime, is different from every other one that has ever happened before. Context is always different. Just because you had a 55% hit rate last month does not mean you will have the same hit rate this month.

So the question is: can traders realistically assess the ex-ante win probability of a trade? Maybe not new traders. But what about experienced traders with years of experience? Good traders get better at thinking probabilistically over time. And the skill associated with any endeavor goes up and to the right over time, as a rule. Also, those who know more are (at least slightly) better at knowing what they don’t know.

But when it comes to the specifics of assessing probabilities in trading – we don’t really know. Some traders we talk to are confident their high conviction trades out-earn their low conviction trades. But they don’t have any hard data to back it up. So they might just be overconfident. Or they might be dead wrong.

This question must be answered, with data, on a trader-by-trader basis. Because everybody trades differently. Everybody looks at different criteria and senses the market in their own idiosyncratic ways. The only way to assess the outcomes of your probabilistic predictions over time is to journal about them every time you trade, before you trade.

Then, once you have a good idea of your win rate based on probability, you plug it into Kelly, adjust to a determined percentage of Kelly, and place your bet. This is the most sophisticated and difficult, but highest leverage way to size your trades.

A second, simpler option

Until you have data that tells you whether your win rate and confidence level on trades are correlated, another approach is to use your historical win/loss statistics to figure out the ideal $ at risk for each trade and stick to that. You assume your conviction is not correlated with success rate and you bet the same amount every time. This makes life easier; one less variable to juggle and one less question to ask yourself every time.

For example, if you have a 57% win rate and your winning trades make 1.5X the average loss on your losing trades over the past three years, just use those stats in conjunction with a modified Kelly calculation to determine your sizing. There is something to be said for this level of simplicity. It doesn’t allow you to increase leverage on higher confidence ideas … but it preserves mental capital by reducing complexity.

Conviction level is one less dial to fine-tune, one less thought to fret over before you put on a trade. Mental capital is just as important as financial capital and simplicity can save you from overthinking and exhaustion.

If you think you know your trading stats pretty well (either trade-by-trade or daily stats), you can plug them into this formula.

% of Capital to Risk = Win% - ((1-Win%)/(AverageWin/AverageLoss))

So let’s say it’s the first trading day of the year and you have $4,000,000 of free capital (free capital means how much you can lose… At a bank or hedge fund, that’s your stop loss, as a retail trader, that’s your account size).

You make money on 50% of your trades and your average winning trade is $370,000 and average losing trade is $300,000. You know this from collecting three years of historical P&L data. The figures here are realistic and approximately reflect real life daily trading performance data for someone generating around $10 million dollars per year of P&L at a commercial bank. Plugging these numbers into the Kelly formula we get:

% of Capital to Risk = 0.50 - ((1 - 0.50)/(370,000/300,000))

= 9.4%

So 9.4% times $4,000,000 would suggest this trader should risk $378,400 on their first trade of the year. The Kelly number tends to be very high relative to what you might expect because it represents the most aggressive allocation possible to maximize upside. Understand that the Kelly Criterion was developed for gambling scenarios where you know the exact odds beforehand and every bet is made in a series. Kelly assumes you are making one bet at a time whereas in trading you might have multiple bets on at once. There are critical reasons why the Kelly Criterion is better suited to gambling games than to trading.

In trading, you use a past probability to estimate a future probability. To compensate for the fact that you don’t know your real odds going forward (you can only estimate the future using historical odds) you should consider half-Kelly or quarter-Kelly sizing. This depends on how confident you are in your performance data and how consistent your performance has been over the years.

A third, simplest option

The simplest approach is to assume a) conviction doesn’t correlate with accuracy, and b) historical trading stats may not predict the future distribution of outcomes. Then, just bet a fixed percentage of your capital on each trade.

2% or 3% of free capital is conservative and will keep you out of trouble.

Simple Kelly, or Kelly adjusted for conviction level, is more aggressive and offers greater and more asymmetric upside than conservative, fixed bet sizing… But it’s riskier and more complicated. There are always tradeoffs.

Before we continue, a brief word from our sponsor.

If you want to level up your global macro and trading XP every day, and see how I generate actionable trade ideas in real-time, click here to subscribe to am/FX. The price for new subscribers goes from $490 to $590 at the end of August—sign up now and lock in $490/year forever. Click here to subscribe.

Systematic, Automatic

In Chapter 11 of Alpha Trader, a tiered sizing system is presented where confidence is the input and bet size is the output. In this system, a run-of-the-mill mean reversion trade merits a smaller bet than a once-a-year “perfect” macro setup with a tight stop loss. The latter trade gets the bigger bet size.

The math says that if you’re aggressive on your “best bets,” and your confidence is correlated to your accuracy, your winners will vastly outweigh your losers over time. Your P&L will grow dramatically as you capitalize more and more on your best ideas. This is why lots of veteran traders are telling you to vary bet size: because you want to leverage your best ideas.

In The Art of Currency Trading, there were five levels of confidence. In Alpha Trader, there were three. Now, we are debating whether there should be any variation in bet sizing by confidence. This is a hard question and that’s why it’s worth debating.

Whether you use five, three or just one level of conviction for trade sizing, you should always consider the possibility that one day there could still be the occasional outlier that deserves a bigger bet. If you’re good, you will know it when you see it. And you’ll record the results so that over time you learn what you know, what you think you know, and what you don’t know. As the apocryphal Mark Twain quote says:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.“

So What’s The Right Answer?

There is no right answer to the varied bet size question. It depends on the trader. It depends on your experience, confidence, calibration, and risk tolerance. You have to decide what kind of bet sizing protocol is right for you. As is often the case with questions of trading styles and methodologies, the answer varies by individual. You have to decide for yourself.

If you’re the kind of person who is good at making snap judgments, and you’re great with probabilities, and you already have an extended history of trade journaling that shows a strong confidence/accuracy connection… vary your bet sizes. If you’re up 12 million dollars on the year and you seem to keep finding outstanding opportunities, then bigger bets might be for you. If you are confident, and your confidence is well-calibrated to reality, and you can afford to take some extra risk, you will benefit from varied bet sizing when you play your cards (candles) right.

But if you’re not the kind of person who wants extra risk, higher variance, increased stress, or extra mental output, that’s okay too. When extra complexity does not yield a clear and measurable benefit, take the simple route. Maybe you are self-aware enough to see you don’t have a well-defined sense of which opportunities are better or worse. You simply have a binary way of looking at trades. They’re either good enough to put on, or they’re not. That’s fine.

Conclusion

All good traders vary bet size according to volatility. But whether or not to vary bet size based on conviction is a subjective call that can be turned into an objective decision with enough data. Your goal should be to establish whether or not there is a correlation between your confidence and your accuracy in trading. Then, choose between one of three sizing methods:

Easy. Use a fixed percentage of free capital as your constant bet size on all trades. This is the simplest, lowest risk way to trade and that is not a bad thing. As you gain experience and collect data, you can experiment with other approaches.

Medium. Use historical win rates and trading stats and a modified Kelly criterion percentage to pick a bet size and stick to that every time. This is simple, it reduces the number of decisions you have to make every day, and it allows you to make quicker trading decisions by reducing complexity and making the sizing decision binary. Either you do the trade in size X, or you don’t. If you ever do stray from fixed sizing (perhaps because of a watermelon-sized opportunity you sniff out), record the outcome in an effort to create your own confidence/accuracy scatter plot.

Hard. Vary bet size according to conviction. Use rigorously collected data on win/loss percentage, size of average win and loss, and modified Kelly to determine the appropriate risk on each trade. Design and implement an objective bet sizing procedure that uses historical trading stats and does not rely on guesswork about the relationship between confidence and accuracy in your trading. Scale your bets using the linear or geometric relationship between conviction and accuracy. Keep collecting data and update your system as you gain more insight.

:

One more thing

Instead of a trade this week, we’re going to try something different and collect a bunch of data for the next few weeks. The goal is to collect accuracy vs. conviction data from as many people as possible over multiple weeks to determine whether the wisdom of the market crowd has a positive confidence/accuracy relationship. Please complete this survey; it will take you less than 2 minutes.

Thanks for reading.

Bonus chart

Here is the accuracy/confidence scatter plot for 50in50 so far

:

A few takeaways from that chart:

There is a correlation, but it’s early to tell with just 23 data points.

Trades with a conviction level of 6 or lower have a 33% hit rate.

Trades with a conviction level of 7 or higher have a 58% hit rate.

Trades with a conviction level of 10 are 100% (sample size = 2).

Why would I do a trade with a conviction level below 5? In real life, I wouldn’t. But for the Substack, sometimes it’s hard to get a solid trade and attach it to a clear concept every week. In those cases, (like the LLY, CLK2, BTC slingshot reversal, and recent TSLA trades) I find a reasonable example that kinda made sense… But that was not an actionable “many planets in line” setup that would be worthy of a real capital allocation in real life.

:

That's it for today. Thanks for reading!

Don’t forget to do the quick survey. SURVEY LINK

Trade at your own risk. Be smart. Have fun. Call your mom.

If you liked this episode, please click the LIKE button. Thanks!

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily here

Subscribe to 50in50 for free right here.

Good stuff.

I believe the argument is even stronger (that there is no relation between confidence and accuracy) in sports betting. I can't take any handicapper seriously who has different levels of 'star' wagers. It's ridiculous.

Awesome post again, Thanks!