Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 28: Buy the rumor / sell the fact

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Quick update on previous trades

The short SPY trade is full-on Lazarus, way back from the dead and now well in the money. SPX peaked right into mega resistance at the trendline and 200-day MA at 4300/4330 in SPX.

The TSLA short view is working, though the time of day effect has been marginal.

Now let’s talk about "buy the rumor / sell the fact.”

Buy the rumor / sell the fact

Part of today’s 50in50 is excerpted from my latest crypto note: MacroTactical Crypto #32: Stiff Competition and Hard Truths.

The reason “buy the rumor / sell the fact” works as a general pattern in financial markets, especially in markets populated mostly with inexperienced traders, is that everyone wants to be long when the good stuff is about to happen, but once the anticipated good stuff transpires… There is no reason to be long anymore. After the expected catalyst or event happens, everyone tries to sell at the same time post-event… And whoosh.

Buy the rumor / sell the fact has been a pattern since the dawn of markets and it always involves early buyers selling to later buyers. The later buyers then look to cash out but find… No bids. So the price falls.

This is often known as a buyer’s strike. Why would anyone buy AFTER a big event, when they know about it before? They wouldn’t. That’s why buy the rumor / sell the fact works.

Almost all highly-anticipated events in crypto have been textbook buy the rumor / sell the fact trades.

The futures launch

Elon on SNL

The futures ETF launch

El Salvador adopts bitcoin day (07SEP21) also saw a textbook, though less epic version of the pattern.

El Salvador adopts BTC as legal tender!

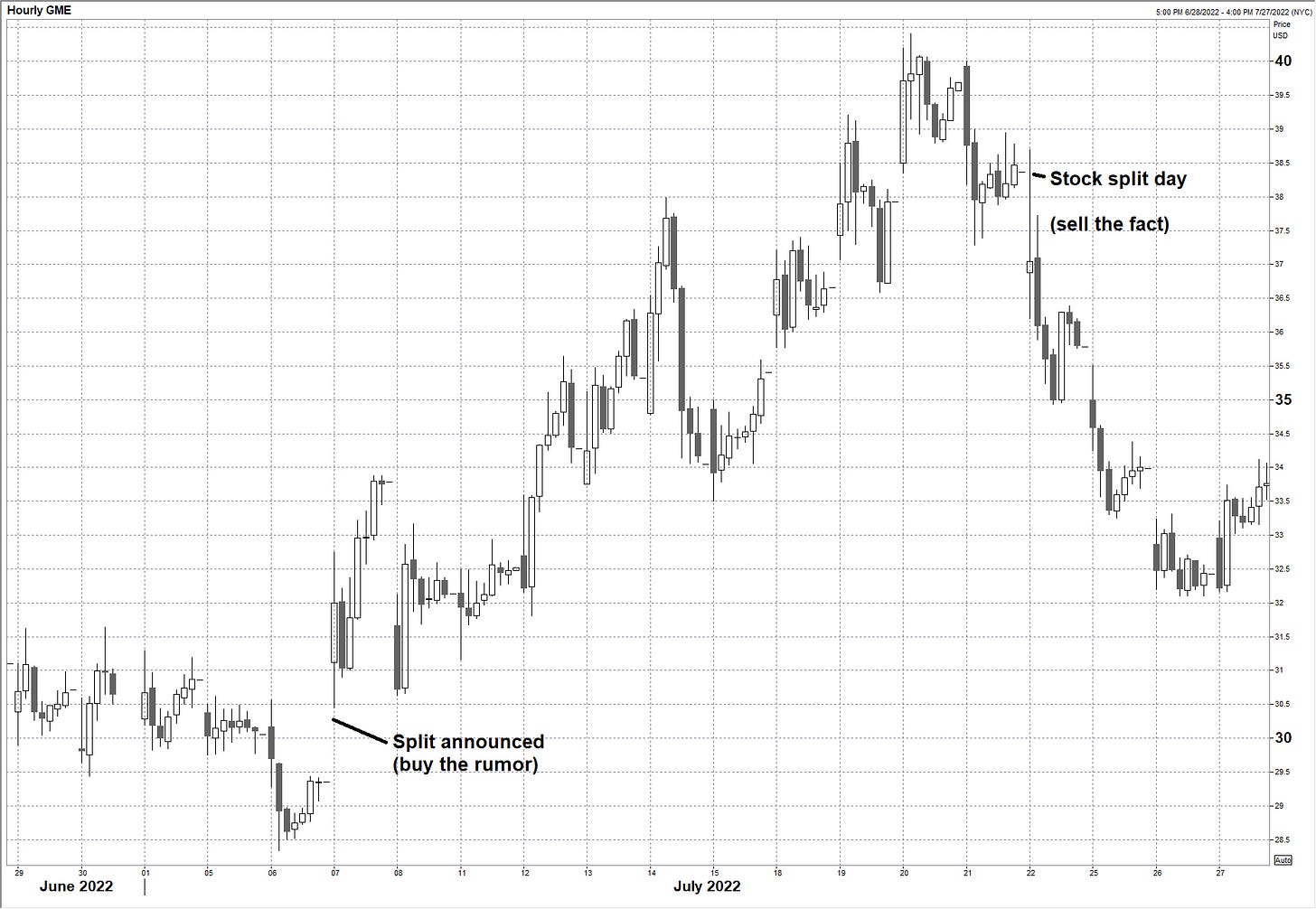

And you see similar silliness after stock splits. Traders buy stocks when they announce a split because they know they will find a greater fool to sell to as the split date nears. Once the split date arrives, the catalyst is passed and priced in and the stock goes down. Here’s buy the rumor / sell the fact on the GameStop split:

You can’t, you won’t, and you don’t stop

This is a list of recent cryptomemetic examples but buy rumor / sell fact is a thing in TradFi too. Markets are forward-looking and price things in before those things happen. Once the thing happens, there’s nothing to look forward to anymore so traders liquidate and move on to the next shiny object.

The Merge™

Ethereum is about to transition from proof of work to proof of stake. The date for the event is approximately September 13. Here is a chart of ETH since the announcement of a merge date:

ETH rallies on the Merge announcement

You can see there was significant buying in the days after the announcement as some believe The Merge will unlock all sorts of value and send ETH to the moon. The market piled into the September 30th 4000 ETH calls. There is a huge debate about the importance of The Merge, but this piece isn’t really debating that one way or the other. This piece is about the idea of a known catalyst approaching from way out and landing in a week or so.

Who is going to buy ETH immediately after The Merge?

There is a 100% chance of significant selling by short-term specs in the hours and days after the Merge. They are simply (and logically) front running the event. I’m not talking about long-term buyers and inflows… Those will come when they come. Crypto hedge funds are not sitting on the sidelines waiting for the Merge to happen so they can buy ETH at 1650. They’re either long already or they might be leaving bids lower, but they are not waiting for the Merge to get out of the way so they can go to market.

IMPORTANT NOTE: Not every anticipated event leads to a historic selloff from the all-time highs. An important and notable example of this: Bitcoin halvings are known events that have resulted in prolonged bull markets before and after, not buy the rumor / sell the fact.

The big argument for post-Merge ETH longs is the digital bond hypothesis. “It will be an ESG compliant, commodity-linked digital bond!” is the most extreme bull case. I can’t get past the simple TradFi notion that ETH is way (wayyy) too volatile for any institution to care much or at all about the yield. I discuss this in detail in MTC32, but let me give you the gist here.

The reason bond yields are useful is because they are proportionate to the volatility of the underlying instrument. ETH as a 70-vol bond that yields under 7% makes little sense under any normal framework for evaluating fixed-income securities. Plus, if it’s a digital bond, it’s a security, and will thus attract interest from regulators.

When an institution looks at a carry product (a bond, currency carry basket, etc.) the standard metric they use is the carry/volatility ratio. That’s the best snapshot of how much principal risk you are taking to earn a given yield. Here is carry versus vol for some well-known yieldy instruments, along with ETH. I have very generously assumed a 7% annual yield for ETH.

Yield and volatility of various “bond-like instruments”

If this all sounds a bit Boomer/TradFi to you… Guess who runs the institutional money? TradFi Boomers.

The packaging and marketing of ETH as a digital bond rings hollow to me because it doesn’t stand a chance against other bond-like instruments. The only way ETH works as a digital bond is if volatility collapses or if you package and hedge it and repackage it and/or lend and overcollateralize it into a synthetic derivative. Synthetic on-chain hedged ETH solutions are attractive to some, but introduce a lot of complicated, hard-to-measure basis risk (and execution and risk management inconveniences).

The synthetic ETH bond is probably only going to appeal to the most diehard institutional fans of crypto. One River Digital has been talking about this kind of digital yield product for a while and it surely has appeal. But it’s niche and it existed before The Merge so I don’t envision some massive stampede into synthetic digital yield post-Merge.

My feeling is that ETH bulls expect a huge wave of institutional adoption when really ETH as a bond-like instrument is a niche product that has become less attractive in recent months as the regulatory Eye of Sauron turns towards ad-hoc enforcement and criminal complaints against various crypto entities and coins.

Given everything I have read and considered… My view is: Sell ETH on the merge announcement. It should be classic buy the rumor / sell the fact.

Strategy vs. tactics

It’s fun to look at those doge and BTC charts and dream about going short and never covering. The hard part is that you don’t know if it’s the DOGE scenario (collapse and never revisit that level), the El Salvador scenario (drop 25% in a few weeks then rip to new highs), or the BTC halving scenario (no pattern of trading other than some hard to identify bullishness before and after in the midst of a trend).

My view on buy rumor / sell fact is that it’s a fairly short-term phenomenon and the effect is trumped by new information rather quickly. So while there were some epic sell-and-HODL opportunities in the past on these buy rumor/sell fact trades, the high expected value approach is to get in and out somewhat quickly. You capitalize on the juicy, reliable part of the pattern near the event date and who cares what happens once you take profit.

The Merge Trade: Details

The Merge will occur when Ethereum Mainnet hits the Terminal Total Difficulty (TTD) value of 58750000000000000000000. That was thought to be 19SEP but the date keeps moving left. It was 15/16SEP and now looks to be as early as 13SEP. For my purposes, The Merge is priced in and therefore I would rather just sell now, not wait for the announcement. The most likely price action immediately on the headline that The Merge has succeeded is ETH flash up 100 then down 300 or so (my guess, not investment advice!)

Always trade your own view and make sure you understand the risk you are taking (including gap and margin call risk). The first rule of trading is AVOID RISK OF RUIN.

Given the timing of the news is not precisely knowable and my belief it’s fully priced in, 50in50 goes short ETH here (1650) with a stop loss 50% at 1906 and 50% at 2056. Take profit on the whole thing at 1155. Not super high leverage here, but you need to have the stop far enough away to avoid the zippy whipsaw jiggle fest vol explosion on September 13.

That's it for today. Thanks for reading! If you liked this post, please click the heart icon thingy.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily here

Subscribe to 50in50 for free right here.

see that rug pull in BTC just now 19800 to 19200 , and now 19100 , no bounce

Well done mate.

'Dirty Hammer' did you dirty with the Cheer Hedge....