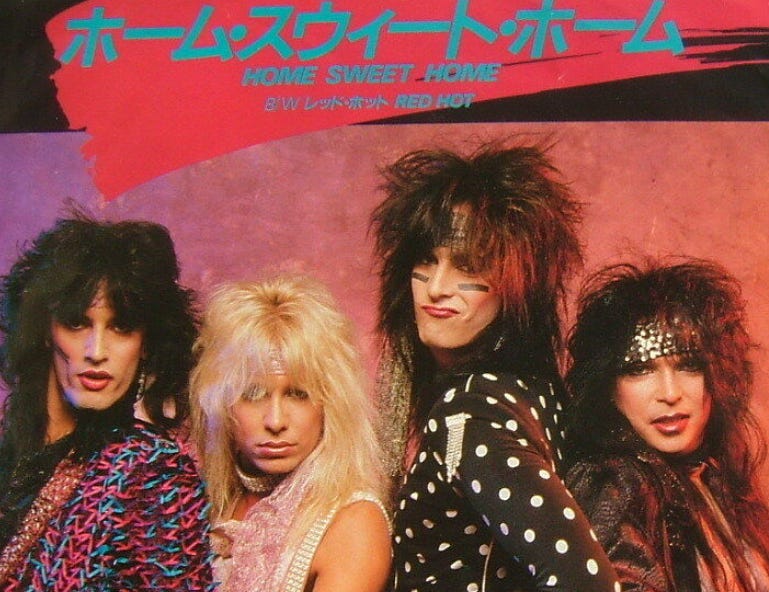

Week 29: Home Sweet Home

Flat can be a position of trading strength... Or a sign of trader weakness

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 29

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Quick update on previous trades

I have decided to square everything up. The 50in50 trades have a decidedly bearish lean, and I have been waffling on the bearish view of late as the USD looks less impulsive to the upside and things improve in the Ukraine. The CPI release gives me a chance to square up at good levels—a get out of jail free card kind of thing. I will provide a full update of all the trade results next week (Week 30). For now, the trade this week is to square everything up and get close to home.

In this piece, I’ll explain why getting close to home is a good habit for many traders, but can be a bad habit for others.

Home Sweet Home

Risk appetite in trading is a continuum that looks something like this

.

You can see from this graphic that different traders get flat for different reasons. Let’s look at the traders across this spectrum, examine how they behave, and see what we can learn from it.

Before we look at risk-averse vs. risk-seeking traders, remember that risk appetite is not constant. Many traders behave differently under different conditions. Here are three effects that influence trader risk appetite:

Zero-bound effect. Traders that are down on the year tend to trade more nervously than traders who are up. If you are up $4 million on the year and drop to $2.5 million (a loss of $1.5 million), that will feel different than going from plus $1 million to minus $500,000. You need to have the courage to take smart risk, even when you are down.

End-of-period effect. Traders tend to take less risk at the end of the year. If a trader has had a good year, they want to bank it. If they have had a bad year, they don’t want to make it worse. This effect is why most hedge funds will not pay out more than once per year. Hedge funds that institute twice-yearly payouts find that trader risk appetite drops in both June and December, instead of just in December.

House money effect. Traders that are massively profitable in a given period will tend to take on extra risk. This is known as the house money effect, a bias that shows up in both experimental and real-world settings. The house money effect is especially strong immediately after large gains, and then it dissipates over time.

.

In my book, Alpha Trader, there is a trader questionnaire and one of the attributes I ask traders to rate themselves on is risk appetite. The scores run from 1 to 10. Here is a quick discussion of different risk appetite scores, what they mean, and how to address problems related to specific ranges. Before reading this: What would you rate yourself from 1 to 10 on the risk-averse to risk-seeking spectrum?

Risk appetite score: 1-4 — Risk averse trader

More traders than you would expect fall into the 1-4 range. That’s OK! You can still succeed in trading if you are risk averse. But don’t be in denial. Be self-aware and be honest about your score. A score between 1 and 4 signals you are a risk-averse trader. Even if your risk appetite score is higher than four, please read this section.

The risk-averse trader:

Is afraid to lose money. It is impossible to trade successfully if you are afraid of losing money. You will always be weak. If your fear comes from within, you need to work on it. If your fear comes from inadequate capitalization, the irony is this: your fear of losing money means you are going to lose all your money. Wait until you are adequately capitalized and find another source of income until then. Traders with too little capital end up gambling. The biggest risk in trading is that you will lose money. You need to understand and accept this risk before you can have any chance of success as a professional.

Has trouble pulling the trigger.

Always looks for the perfect trade.

Needs many things to align before trading.

Often feels much more comfortable having the same position as manager or peers. Rarely takes the opposite position.

Looks for an excuse to take off a trade as soon as she puts it on. She will say things like “It should have gone up by now”, “It’s not trading well”, “I don’t like the price action” or “This idea isn’t working” even when the security has barely moved. She will take a tiny loss or tiny profit using any possible excuse because fundamentally she is risk-averse and her subconscious would prefer not to have the position (or any position)! There is a difference between taking risk and putting on positions. If you are always on edge the second you put on a position, you need to think about how to develop staying power.

.

A basketball player who always waits for the perfect shot might shoot 100% from the field and score 4 points per game. That is not good! As a coach, you want that player to take 15 shots and miss 5 (and thus score ~20 points). Traders who are risk averse do not take enough shots.

If you are a risk-averse trader, see Chapter 7 of Alpha Trader for a series of tips on how to overcome your risk aversion. You can succeed as a risk-averse trader, you just need the right tools and tactics.

Risk appetite score: 5-7 — Moderate risk trader

If you gave yourself a 5, 6 or 7 on the continuum of risk averse to risk seeking, you can probably up your game. Your risk aversion is not a weakness, but you might be able to stretch yourself a bit and avoid an early career plateau.

In the early 2000s, I worked for a bank that was generally risk averse. They ran a business model that is surprisingly common in banks: “take risk, but don’t lose money”. This is the optimal business model for a manager that wants to protect the bank but also allow for a bit of upside if trading conditions are optimal. This same business model is employed by many pod-based hedge funds. If you have 100 traders all working with very tight stops but some of those traders are still able to generate 20% returns in a year, the overall returns and Sharpe ratio of the hedge fund will be outstanding.

Some traders detest this business model because it makes them nervous. Taking risk without losing money sounds like an oxymoron. It really isn’t. It just means that you need to behave like a call option. Take as much risk as you want when you are profitable, but play extremely tight when you are not.

The moderate risk taker thrives in that sort of model because they deliver exactly what management wants: decent upside with limited downside. I have generally been fairly flexible in my approach but I definitely have concluded that this is the optimal strategy for most traders. Increase your risk when you have a strong P&L base and decrease your risk when you are near or below zero. This substantially reduces risk of ruin, maintains the right tail of the P&L distribution, and offers you the best chance at long-term success.

The trader with risk appetite in the 5-7 range may struggle to hit the right tail of the distribution because they will more likely be satisfied once they hit their budget or goal. This is the kind of trader I was, when I worked at the generally risk-averse bank I mentioned. If my budget was $5 million and I got there eight months into the year, I was encouraged to “bank it” or “ring the register” or “take it easy into year end.”

This makes sense on some level but greatly reduces your ability to see what kind of trader you can be, because despite the risks of the house money effect, most traders are at their best when they have a big base of P&L to work with but can remain patient and on the lookout for great opportunities worthy of a big bet.

Given the incentives and guidance from management, at that bank I acted like a trader with risk appetite of 5-7 even though my true risk appetite is much higher. High enough that it tends to be a weakness when I’m not at my best.

When I went to Lehman Brothers in 2006, I had a great start to the year. My budget was $6 million and I was up more than that by March. I went to my boss at the time and asked him how he felt I should proceed. I gave him the explanation of how things went at my last job and how they would tell me to “take it easy” once I hit my budget.

Steam came out of his ears.

“No way, dude! This is your chance to see what kind of trader you are! You have six million dollars in the bank! Set a stop loss at three million and go turn that six into ten.”

I sat there thinking for a bit and he waved me out of his office.

“Go! Go make money!”

That year I made $50 million dollars and I am forever thankful to that manager for teaching me that lesson. The lesson was not: "You have money in the bank so go gamble it." The lesson was: "When you are in a strong capital position with chunky P&L, increase your risk in a methodical way and try to blow through the ceiling. The time to go for it is not January 1; the time to go for it is when you have money in the bank and markets are full of opportunity."

When you take this approach, it is crucial that you remain aware of downside and drawdown. Set a point at which you will go back to a more defensive approach. In the case outlined above, I was up $6 million and set my “go back to defensive” level at +$3m. This gives you ammo to push hard when you’re doing well but also defines your downside so you don’t just blow through all the money you’ve made.

This idea of pushing hard when you are in a strong position is 100% contingent on the opportunity set. You don’t push just because you’re doing well. You push because you’re doing well and there are great opportunities.

Risk appetite score: 8-9 — Strong risk appetite

A trader with a risk appetite score of 8 or 9 has the most upside but also requires more supervision and has more downside risk than a trader with a lower score. I would say the sweet spot for risk appetite is somewhere in the 7 to 8 area, though traders with very high scores, when harnessed, can deliver blockbuster returns. Then again, they can be scary to watch.

A trader with strong risk appetite needs rules. If you are in this category, develop specific but simple rules to regulate your desire to take risk.

All of the following limits should be clearly defined and deemed to be unbreakable:

Maximum daily, monthly, and yearly loss. This can be a formula based on total capital and current P&L. Depending on trading style, the liquidity of products traded, and time horizon, daily stops are not appropriate for all traders. There is a full discussion of risk management in Chapter 11 of Alpha Trader.

Permitted products and strategies. Can a hedge fund PM sell volatility with unlimited downside, for example? Can a home day trader short low-priced stocks? Can an FX trader take a position in a pegged or managed Asian currency?

Depending on where you trade, this question may not be relevant. It is an esoteric question that does not come up all that often, but can be the difference between blowing up and not blowing up.

Many of the blowups that I have witnessed first-hand have been the result of trades where the trader never should have been trading that product in the first place. Hedge fund managers risking 24 basis points to make 1 on Bank of Canada day. Retail day traders going short a thinly-traded biopharma stock. Option traders selling topside USDCNH volatility. Retail FX punters going long EURCHF at 1.2010. These are all blowups caused by traders dealing in products that they never should have touched.

If you are day trading from home, what stocks are fair game? The way you answer this question might be the difference between long-term success and instant, nuclear devastation of your trading account. See GameStop shorts, for example.

Maximum position size by product.

Value at risk (VAR) or stress-test P&L. These are higher-level frameworks used at banks and hedge funds, but both methods have many issues when applied in real life. If you trade from home, don’t worry about VAR, it’s a tool used by institutions. Some issues with VAR and stress testing: a) VAR often depends on historical volatility which is not always a good predictor of future volatility. b) Stress tests can overweight rare events and ignore the fact that stop losses are effective loss control mechanisms in liquid markets. c) VAR and stress testing often rely on historical correlation which is backward-looking and unstable.

Cooling off levels. If a trader draws down X from high water or over-earns by Y, she should enter a two or three-day cooling off period. During cooling off periods, all risk is cut in half. This helps stabilize P&L after weak periods and avoids winner’s tilt after strong periods. If a trader has enough experience, P&L history, and self-awareness to know she does not suffer from winner’s tilt or overconfidence after very strong periods, the topside cooling off levels can be excluded. Cooling off levels are different from stop losses on the downside as they relate more to bad streaks and drawdown from peak, not absolute levels of P&L.

Risk appetite score: 10 — Too much risk appetite

If you gave yourself a score of 10 on risk appetite, you need to be careful. You are probably in the sensation-seeking, trading-for-excitement, or gambling category. Trading can be a lot like gambling (if you want it to be) and it has similar dopamine payoffs if you have an addictive personality. Along with the rules I listed above, traders with a risk appetite score of 10 need to honestly analyze their motivation for trading and be self-aware enough to know whether they are acting more like finance professionals or gambling addicts.

Traders on the extreme end of the risk-taking spectrum use trading as another method of sensation seeking. This is not good.

Trading can be incredibly fun. That’s good. But that is also a problem! Enjoyment should always be a side benefit of trading and not the primary objective. The first objective must always be profit. Very often, traders will get involved in the market out of boredom or out of a need for stimulation. This gets them into trades that have weak (or no) logic and low or negative expected value. Remember: tight / aggressive. Look for juicy, low-hanging fruit and pluck it. Don’t climb up into the treetops and risk a big fall. Be patient.

How powerful is trading as a stimulant? Very. This is from a 2001 study:

The psychological processes underlying the anticipation and experience of monetary prospects and outcomes would appear to play an important role in gambling and in other behaviors that entail decision making under uncertainty. In this regard, it is striking that the activations seen in the NAc, SLEA, VT, and GOb in response to monetary prospects and outcomes overlap those observed in response to cocaine infusions in subjects addicted to cocaine.

NAc (nucleus accumbens), SLEA, VT, and GOb are four reward-related brain regions.

And the following is from Andrew Lo’s testimony to Congress on Hedge Funds, Systemic Risk, and the Crisis of 2007-2008:

... the same neural circuitry that responds to cocaine, food, and sex—the mesolimbic dopamine reward system that releases dopamine in the nucleus accumbens—has been shown to be activated by monetary gain as well.

Both the anticipation and receipt of monetary gains trigger the reward circuitry of the brain. Human nature is to seek activation of this circuitry both consciously and unconsciously. You must come to grips with the fact that trading often involves sitting there doing nothing, just waiting for a great opportunity. Unfortunately, the numbers moving up and down on that screen are like squirrels, and you are a dog.

Various commentators, including Jean-Paul Sartre, have commented that war is “…hours of boredom interspersed with moments of terror”. Trading can often be the same. There is a strange temporal rhythm to trading where time speeds up and slows down depending on what is going on.

I remember instances after a major economic announcement or market event where I did 5 or 6 big trades, got into a position and out of a position and made hundreds of thousands of dollars. The time elapsed felt like 15 minutes. Then, later in the day when things were quiet, I would go look at the 1-minute chart and could not see enough detail to capture what had happened. I would have to go to a 1-second chart to see the levels at which I did those 5 or 6 trades and I would realize that the entire sequence, which felt like 15 minutes, actually took more like 90 seconds.

This time dilation is a common feature in sports, military action, trading, and other fast-moving pursuits that require rapid-fire, high-stakes decision making. Of course, the stakes are much higher in the military but the mental effect where time slows down is similar.

Once you get that feeling of excitement, the in the zone moments where the P&L piles up so fast you can’t believe your eyes—you want that feeling again. Problem is, you can’t get that feeling by trading low probability set ups. Instead, those low EV trades give you that “why did I do that” feeling. You can’t trade to chase a rush. Your only goal each day should be to maximize P&L.

You need to be honest with yourself. Just like it’s OK to be risk averse, it is OK to be sensation-seeking or boredom-averse. You just need to be aware of it and institute a set of rules to control your behavior and manage your weaknesses. You also need to accept that this sensation-seeking or disinhibition is a weakness you will need to deal with throughout your career. Attitudes toward risk are highly innate and very difficult to modify even with the healthiest, most growth-oriented mindset.

Sensation-seeking and gambling often go hand in hand. To get a sense of whether you are trading to feed your desire for excitement (i.e., as a form of gambling) take a look at the following excerpt from the DSM-V. The DSM-V or DSM5 is the Diagnostic and Statistical Manual of Mental Disorders. It contains descriptions, symptoms, and other criteria for identifying mental disorders and it is the authoritative guide to mental illness throughout most of the world.

Here, I have taken the section on identifying gambling disorder (previously known as pathological gambling) and replaced the word “gambling” with “trading”. Do any of these line items sound familiar to you?

A diagnosis of gambling trading disorder requires at least four of the following during the past year:

Need to trade with increasing amount of money to achieve the desired excitement

Restless or irritable when trying to cut down or stop trading

Repeated unsuccessful efforts to control, cut back on or stop trading

Frequent thoughts about trading (such as reliving past trading experiences, planning the next trade, thinking of ways to get money to trade)

Often trading when feeling distressed

After losing money trading, often returning to get even (referred to as “chasing” one’s losses)

Lying to conceal trading activity

Jeopardizing or losing a significant relationship, job, or educational/career opportunity because of trading

Relying on others to help with money problems caused by trading

.

Many traders would recognize their own thought patterns in that list. A trader who scores himself as 10 out of 10 for risk appetite might see himself in five or six of those behaviors. Think about these criteria for gambling disorder and be honest with yourself about how trading impacts your life. It should be an enjoyable, intellectually stimulating profession, not a way to achieve a gambler’s high.

Jesse Livermore is celebrated as a trading hero but it is worth remembering that he took his own life after going bankrupt for a third time, after his second divorce. He is a trading hero and a cautionary tale wrapped into one.

The process and mechanics of trading and gambling overlap. Both involve risk management, probability, randomness, risk of ruin, emotion, bias, and irrational human beings. Bad trading can often be very much like casino gambling. It is impulsive, emotional and has a negative expected value.

If you want to gamble, go to a casino.

Excellent trading deals with incomplete information and variance of a game like blackjack, but has a positive expected value, like a professional poker player at a table of weaker opponents.

One final note here: The term “gambling” usually describes a form of entertainment where the gambler’s odds or expectation are negative. Some forms of gambling, like poker, can have a positive expectation if the player is highly skilled. I would say that when a highly-skilled and highly-disciplined poker player sits down at a table full of tourists or recreational poker players, that is not gambling.

The skilled player has a significant mathematical edge. Poker is much closer to trading than most forms of gambling because it offers a small group of highly-skilled players the ability to generate abnormal returns consistently. In other words, poker is skill, not luck. Research confirms this unequivocally.

A substantial portion of investor underperformance can be explained simply by the fact that investors are active when they should be doing nothing. This is proven again and again by the consistent and sizeable outperformance of index funds vs. active managers and by the poor returns in retail accounts. Most of the time you should be doing nothing!

This is a simple concept but one that is extremely difficult to put into practice in real life. In Alpha Trader, I outline specific ways to reduce the problem of overtrading.

Your default mode should always be to do nothing.

Flat is the most powerful position in trading. When you have no position, you are unbiased, ready to pounce, and unconstrained by any prior view or notions. You are not anchored on any price or level. You are most open-minded and nimble when you have no position.

Yet people often feel bad when they are flat, especially if they remain flat for many days. “I’m not putting my capital to work”, they might think. Or “My boss is gonna think I’m lazy.” Human nature equates doing nothing with laziness, and in most jobs that’s a pretty accurate assessment! An employee who sits there and does nothing over multiple days is probably not doing a great job in most roles. In trading, though, the opposite can be true. Quite often, the trader doing nothing is the wolf waiting silently in the long grass. Ready to pounce. An Alpha Trader.

Take pride and comfort in your ability to remain flat. The very nature of the tight/aggressive framework in trading is that you should be flat as often as possible and only engage when the expected value of a trade is high.

Flat is good. A trader with no position has no bias.

When you are in a position, you are not objective. You are under the influence of many forms of bias. You own something (the trade and the view that led to it) and people don’t like giving up what they own. Therefore, if you are feeling uncomfortable about a position, the best bet is to take it off. Then, once you’re flat, you can analyze with an open, unbiased mind.

Confirmation bias is strongest when we have a position. When you are flat, it is easier to honestly evaluate competing hypotheses. Only when you are totally flat can you process incoming information with zero bias. It is important to truly understand and believe that. No matter how smart you are, no matter how self-aware; everyone is subject to confirmation bias. Do not think you are exempt.

If you are confused… Get flat. As I say in “The Art of Currency Trading”:

Rule #7 of FX Trading: Flat is the strongest position. When in doubt: Get out.

If you want to level up your global macro and trading XP every day, and see how I generate actionable trade ideas in real-time, click here to subscribe to am/FX. A subscription to am/FX is the best way for you to learn about trading every day, from an experienced professional who has traded everything from a $25,000 retail account to a half yard of intraday USDJPY risk. Understand global macro and learn to trade, with am/FX.

Flat can be good or bad

Note that flat for a risk-averse trader can be the result of excessive fear and a persistent desire to avoid risk. Flat for a risk-seeking trader can be a safe harbor from overtrading and an opportunity to see the market sans bias, through clear eyes. Know yourself and know what flat means for you.

Back to flat

I am prone to overtrading. I sometimes trade for fun, or to avoid boredom. The question you have to ask is: Do you want to have fun? Or do you want to make money? When I get flat, it usually means I am trading well and doing the right thing.

The current portfolio of 50in50 trades has a strong bearish bias and I am uncomfortable with this bias right now because:

Fed is priced for 80 bps at the next FOMC meeting and it’s very hard to see the market pricing more than that.

2023 cuts from the Fed are now mostly priced out. It will take a lot to price hikes into 2023 as the Fed is getting close to neutral and hikes into restrictive territory have a higher bar than hikes from accommodative to neutral.

The energy crisis in the EU looks less bad as energy prices fall and EU and UK governments intervene.

The newsflow out of Ukraine has improved.

S&Ps just dropped 100 points in a straight line, providing a nice exit.

.

The 50in50 book hasn’t been flat in ages. It’s time to get flat, reevaluate, and achieve complete open-mindedness. Maybe next week I’ll be bearish again. Or maybe I’ll be bullish. In the meantime, I am nimble and unbiased.

I square up all the trades here, including the RBLX / CVNA relative value trade. We start fresh next week with a results update and brand-new concepts and ideas.

That's it for today. Thanks for reading! If you liked this post, please click the heart icon thingy.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily here

Subscribe to 50in50 for free right here.

I'd say this is the best one yet. It reminded me that I'm a moderate risk trader & prone to overtrading. Re-evaluating my positions now and I'm also overly bearish. The theme of this one came at a very appropriate time for me. I have some thinking to do...Thanks Brent.

Actually, I've been meaning to ask you this when the topic came up in a post: is there a book you'd recommend to deal with risk aversion specifically? Not much luck on Amazon searches.

I realize that the multitude of bibliography on psychology in trading would help, though...