Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 33

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

The USDNOK short from last week is working well so far as my bullish risky asset view has been accurate to this point. Next week’s Fed meeting is going to be particularly interesting and while I haven’t finalized my view on the FOMC yet, it is prudent to take off the USDNOK short before that meeting. Therefore, I will cover this position at 9am on November 2 (assuming it doesn’t get stopped out first).

Write it down

I am a fanatical believer in the importance of writing things down. Good traders are prepared to trade before they start trading. They have a process and a plan before they hit any buy or sell keys.

I have a daily sheet that I complete each morning before things get busy. This sheet helps me gauge where I am at emotionally and also puts numerical brackets around my day as I set a profit target and a stop loss number. This helps enforce discipline so that I know at what point I will stop myself out (how much money can I lose today?) and when I should be taking some profit (what P&L would make this a successful day? A great day?).

Thoughts are abstract and fuzzy. Writing is solid and concrete. If you think, “I’m going to cut my AAPL short at $285”, that is completely different from writing CUT AAPL 285 on a piece of paper and having those words stare up at you as the stock rallies from $282.50 to $284.75.

The same goes for any plans or ideas you have. There is so much noise in your head, so many competing voices vying for airtime. Don’t assume you can formulate a plan in there and then execute it successfully without writing anything down. Again, this doesn’t have to mean anything more than scratching a few notes down on a piece of paper or recording some thoughts in a spreadsheet.

Research shows that when you write down a goal, you are more likely to achieve it.

When you write something down, it solidifies. It transforms from abstract into concrete. All the sludge falls away and only the important information is left. When you write something down, you have made a choice to select that particular information, goal, or action as more important than all the others. This highlights it for your brain. When you write something down, you signal to your brain “THIS IS IMPORTANT”. Your brain records it as such.

The pathways and connections developed in your brain are different when you write something down because the encoding process is different. The encoding is stronger, more robust, and information is recalled more easily. If you want something to happen, write it down.

Another benefit of writing down stop losses, take profits, ideas and goals is that it is harder to wiggle out of them when they are staring right at you. You can’t convince yourself that you never really were going to stop out at $285 absolutely for sure if you have a huge note on your desk that says CUT AAPL @ 285!!! It is your past self sending a message to your future self. Unambiguously. In black Sharpie.

The importance of a trading journal

A trading journal is the best way to keep track of your progress, especially early in your career. It can be a detailed record of every single trade you do, or it can be a few paragraphs you write at the end of the day. A trading journal can take whatever form you like. Record a few thoughts each day, or record the specifics of each trade you do. Either way, a journal will enhance your ability to analyze performance, and improve your process. You will start to notice repeated mistakes. You will identify bias in your views. "Hmmm, I’m always short bonds and never long. That’s probably not good. I need to be more flexible."

Your journal entries should focus on your decision-making and process. What triggered the idea? How strongly did you feel about it? Was it all logic, or partly gut? Describe the specifics of the process and the route you took to develop, execute, and exit the trade.

To enforce the habit of journaling, when I worked at a bank, I sent an email to one of my peers on the desk at the end of each day. I called it 12-12, meaning: 12 hours back and 12 hours forward. The 12 back part was a quick summary of how my day went, whether I stuck to the plan, whether I overtraded and so on. The 12 forward part was my overnight and next-day trading plan including stop losses, dollars at risk, and maximum position size.

Good traders have a plan

They may not always stick to the plan but they always have one.

I encourage every trader to create at least a brief written plan before they start trading. It can be one or two paragraphs, written to yourself or sent to others. But I cannot emphasize this enough: Have a written plan every day. It can be incredibly simple. Write it on a Post-It Note if you want. But do it. This simple daily practice will make you a better trader.

Every trader, regardless of experience level, should keep a trading journal. A journal helps track the evolution of your trading and captures emotions, themes and thoughts throughout the process. Many people think of a trading journal as something just for noob traders. It is not. You should use it as a professional trade strategy planning and assessment tool. There are many ways that a journal can help you.

Above all, a trading journal provides an opportunity for you to be honest with yourself. It’s one thing to think and think and think about your trading but things become more concrete when you write them down. By writing down each trade along with a rationale and thought process, you can pick up on recurring errors, themes, and leaks in your trading.

A trading journal also helps you identify bias. Are you always the same way in a specific currency? Do you tend to short commodity currencies? Long the USD? You can also look at your time horizons and study whether you make more money on certain time horizons or on specific types of trades. The more you write down, the more you can go back later and investigate various hypotheses and answer questions about your trading.

A trading journal also helps you stick to your plan. If you write your plan in your journal before you do a trade (or immediately thereafter), you are much (MUCH!) more likely to stick to that plan. Bad discipline often comes from having no plan whatsoever and just hitting the buy and sell keys in response to random market stimuli. A plan written down has 100 times the value of a plan loosely formulated in your head.

I write a daily newsletter called am/FX in which I outline my trading plan for the day and discuss the themes in focus. When I moved from an interbank trading job to a hedge fund for a few years, I stopped writing. I found that this had a major negative impact on my trading. I would walk in some mornings and just start hitting the buy and sell buttons, reacting to price action and headlines instead of trading logically according to a plan.

If you go into a trading day or into a specific trade without a written plan, it is a recipe for poor trading. If you have a written plan for every day and every trade, you will find your trading is tighter and your risk management is better. The process of writing down your plan also filters out some bad trades in advance as you realize as you write out the plan that the idea is not solid enough to deserve an allocation of risk capital.

ADVERTISEMENT

For my global macro thoughts, live trade ideas, and some random silliness in your inbox every day… Subscribe to am/FX right here. If you are passionate about markets, learn from an experienced professional. It’s a good investment. Even better if you USE COUPON CODE: HALLOWEEN for $100 off (expires 01NOV22).

Collect data

If you collect trade-by-trade data, once trades are closed you record the information about the trade and after a while, you will have enough numerical and qualitative data to go back and assess your performance. Wait until you have a few months of trades in your journal before you assess anything because otherwise, you will run into sample size issues.

As you progress you can ask yourself subjective questions such as:

Is there a mistake you make repeatedly? One of the best predictors of failure is the trader that keeps making the same mistakes over and over.

Do you stick to your plan? Or do you always take profit too early? Do you stop out at worse levels than you planned?

Do you always lose money in a specific currency? Are some times of day or days of the week or times of the month better or worse for you?

Are your high-conviction trades more profitable than your low-conviction trades? If yes, why? Are you sizing the different trades appropriately?

.

And so on. This type of analysis can really improve your game and reduce errors. Be creative when slicing and dicing the information and try to make an honest assessment of your performance. Always think about what is working and what is not. Do more of what works and less of what does not.

You should always work hard to understand and analyze your trading performance. This will lead to greater self-understanding and improve your chances of long-term success. Be thoughtful about your trading and about your strengths, weaknesses, and leaks. This will lead to greater self-understanding and more profits.

A specific example of how collecting data helped my trading

When I worked at a hedge fund, I was curious whether there was any particular pattern to my P&L over the course of the day. A logical thesis would be that you make your money in the morning as an FX trader in the United States because that is the most volatile and most liquid part of the day. But I didn’t know whether or not that was true for me.

I manually recorded my P&L in a spreadsheet every 30 minutes. After collecting intraday data for a while, I noticed that my P&L very consistently rose from 7:00 AM and peaked around 11:00 AM. It then came off gradually until the end of the day. The chart looked something like this:

Approximate P&L by time of day when I traded at a hedge fund

It makes sense! But instead of a theory that I may or may not have acted on, the data gave me a concrete snapshot of how much money I was pissing away every afternoon.

Armed with the information from this chart, I started to square up much, much earlier each day. Instead of taking my risk down in the afternoon, I tried my best to reduce risk around 11:00 AM. This helped me lock in more P&L and it reduced my overall stress level because once I knew that all my trading after 12 noon was net negative, I could reduce my risk and use the afternoons for research, exercise, and other more useful endeavors. An added benefit of squaring up earlier is that liquidity is much better at 11 AM NY than it is at 4 PM NY.

This is a good example of how data collection and P&L analysis can make you a better trader. Use data to investigate sensible hypotheses and ideas.

Be thoughtful about what data you collect so that you do not waste time dealing with a firehose of useless information. Do you think you might trade best on Mondays and worst on Fridays? Investigate it. What about the start of the month vs. the end of the month? Whenever you think about your trading and performance, go back and look at your P&L data to better understand your strengths, weaknesses, and leaks.

Two sources of edge, each necessary but neither sufficient

People usually think about trading edge as a toolbox of strategies and tactics that reliably beat the market. That is correct; a methodology that generates alpha is a necessary condition for success in trading. Necessary, but not sufficient. The other necessary source of edge in trading is process.

If you have amazing tactics and strategy with an 80% hit rate and an average payout of 2:1 on each trade, but terrible process, bad discipline, low conscientiousness, and sloppy risk management… You will lose. Generating alpha is hard. Setting up and using a rigorous trading process is hard, but less hard. It is 100% within your control. Work on continuously improving your process. Automate, create rules, record data, etc.

Not coincidental timing

I am writing this piece about trading process, planning, and journaling because those topics have been on my mind of late. JR and I just published The 2023 Spectra Markets Trader Handbook and Almanac. The book is a product of my strong view on the importance of planning, preparation, and writing things down.

As I mentioned earlier: each trading day, I print out a daily sheet and write down my plan, thoughts, ideas, and results. I realized this would be much more efficient if I had a book preloaded with each day.

That way, I could also have all the important events like seasonality, economic events, option expiry, and holidays, along with coaching and inspiration sprinkled throughout. Then, I thought maybe other people would value such a book as well. So, JR and I made it!

You can check out The Trader Handbook and Almanac here.

The book takes everything I have written about in this piece and puts all right in front of you every day of 2023. The book will make your process better and help you make more money.

How writing leads to trade ideas

I write a lot about markets. Much more than any normal trader would or should. Generally, I’m writing about currencies and global macro, but sometimes when I start with top-down ideas, I end up with something more micro.

Over the past four weeks or so, I have been writing about the coming mortgage reset calamity and residential investment collapse in Canada. I have been suggesting that the Bank of Canada will turn less hawkish as they see the same things I see: Overindebted Canadian consumers reached high in the sky for any house they could buy in 2020/2021 and financed it at super low rates. Variable rate and short-term fixed-rate mortgages such as 3-year fixed are popular in Canada and were more popular than ever in 2021. Canadians are up to their eyeballs in debt as you can see in this chart Macro Alf made.

As an FX guy, my first inclination was to think about how this might affect CAD. But if you believe that the Canadian economy is likely to be hard hit by mortgage resets, falling residential real estate investment, and a decline in spending on housing services, the trade will be in rates, not CAD. This is because CAD has been driven by risky assets and US yields, not domestic news. Hawkish BoC didn’t matter for USDCAD so it will not matter for CAD if they turn dovish, either.

I don’t really trade rates though. But I keep writing about this theme so it compelled me to find another expression of the trade.

Before I go any further here, I want to acknowledge that shorting the Canadian housing market is an evergreen doom and gloom narrative that people have been trying to make money on for years. This 2013 Maclean’s cover is a true classic.

The online version featured this pic:

The thing is… “People have tried this many times and it never worked before” is not a good reason to exclude a thesis. It is a reason to look for triggers and signals before getting involved.

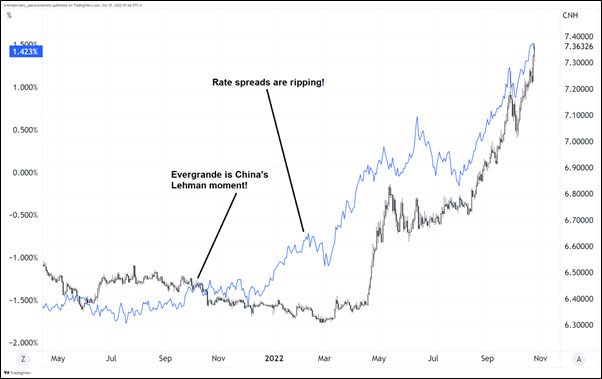

I remember from the day I started at Spectra in September 2021 and right through the start of 2022, it looked obvious that USDCNH should be going higher. Everyone was trying various approaches, but the thing would not budge. Then, months later, without warning, it finally ripped. Yes, CNH is managed, so that could explain that particular lag, but this is emblematic of how sometimes markets just don’t do what you think they should do for ages—then they do it with a vengeance.

USDCNH (black) vs. US/China 10-year rate differential (blue)

Timing is always hard.

In trading, early is a synonym for wrong.

Canada Housing Short

This piece is getting on 3000 words and that’s where I like to cap these bad boys so let me give you the super short trade thesis here.

Housing is a huge part of the Canadian economy. Here is a chart:

Residential Investment as a % of GDP in USA, Canada, Ireland and Spain, 1985 to now

US Housing has turned aggressively lower. NAHB Housing Index is collapsing. Today’s US GDP number showed a collapse in Fixed Residential Investment. Canada is highly exposed to such a collapse and the two economies are strongly correlated.

The bank most exposed to mortgage risk in Canada is CIBC. Here’s another chart:

And here’s a chart of CIBC stock (trading in the USA).

Pretty good timing here as it just rallied right up into a major gap and an old high. This trade is easy to risk manage. Short here, stop above all those lines ($47.11 to give it a bit more room). Take profit at $40.55 (down near the lows). Risking $2.00 to make $4.60. Bear in mind that since this is a Canadian stock, and you are trading the US-listed version, some of your performance is going to come from movements in USDCAD. That’s fine by me now that USDCAD is down here, but still something important to know and keep in mind if you trade this.

Also remember: This is an educational Substack. Learn from my process and trade your own views. None of this is investment advice. Some of these trades are designed primarily as a way to teach a concept. I may or may not have an edge in trading 6-month views on Canadian bank stock performance! My normal trading time horizon is one day to one month.

Conclusion

There are two types of edge in trading and you need both to succeed.

The ability to generate alpha through ideas, tactics, and strategies.

The ability to act rationally using a reliable and consistent set of processes. One critical part of good process in trading is to write things down.

.

Trading edge (alpha) and process edge are both necessary but neither is sufficient for success on its own. You need to have both engines running smoothly or you won’t succeed in trading.

The more you write down your ideas and plans, the more you will develop your process edge. And you will find that as you write out your thoughts, plans, and views other new, different trade ideas will also pop out. For me, the process of writing about the Canadian housing market, and my difficulty in finding a good expression in FX has led me to this:

Short CIBC at 45.10, stop loss 47.11, take profit at 40.55.

A joke before we go:

How do you spell: Canada?

C, eh? N, eh? D, eh?

That is a terrible joke. Sorrey, eh.

That’s it! Thank you for reading. Don’t forget to buy the Trader Handbook and Almanac.

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

Hi it's a great point .. I'm scared to short HCG given buffett's connection and the others are just very tiny and seem like they would have more idiosyncratic risk. Any particular brokerage stand out to you?

50in50 is like a summary of the the first book.. Guys get the books. You will love reading the books