Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 36

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

The CIBC stock idea has been stopped out. The move in the USD (CM is denominated in CAD) and the bounce in SPX was its ruin. Many people pointed out in the comments that the large Canadian banks are extremely diversified and the mortgages they hold are mostly insured so this is partly a result of me not knowing what I’m doing in this particular area. Mortgage servicers and brokers are probably a better long-term way to short the Canadian housing problem. HRED (TSX) is a good candidate for the trade if you’re still interested. It is an inverse Canadian REIT ETF that trades in Toronto. Thanks to people in the comments and on Twitter.

EWZ is sucking wind as a long, and MSTR is doing OK, lower as the crypto utopia follows the dystopian trajectory of prior utopian dreams. Will crypto tech ever deliver on its ambitious promises to change the world? I'm agnostic, though getting more skeptical. Here's a powerful essay that argues a hard "NO".

Gaps and Single Prints

The way things generally work in liquid markets is that prices move up and down to adjust for new information along with supply and demand. Investors focus on fundamental information in the hopes that a stock price will eventually converge on their estimate of “fair value” but in the short run, supply and demand determine asset prices, not fundamentals. As Benjamin Graham said:

In the short-run, the market is a voting machine, but in the long-run, the market is a weighing machine.

This is a nuanced but important distinction. Fundamentals influence supply and demand, but price is a reflection of buyers and sellers in an ongoing auction and can deviate substantially from what you or I think the fundamentals say. That’s why stocks can rally on bad news and currencies can sell off on good news. The flows run the show.

While markets tend to be a continuous series of prices going up and down, sometimes there are discontinuous moves where new information takes price from a discrete location to some other discrete location without any trades in between. These gaps can be useful to identify when trading and they can also be devastating for risk management if you always assume continuous prices and prices jump.

Stocks are most dangerous when it comes to gaps, because they are closed half the time. Currencies are least susceptible to this problem, but can still gap significantly on weekends (and less so) on news.

In 2000 there was a particularly egregious example of gap danger as a press release came out saying Emulex earnings were going to miss by a huge margin. At the time, I worked in a day trading office and many of the guys around me sold the stock on the news. It was around $50 before the news broke, they sold at $30 or so and it was soon trading at $25.

Two guys were fully margined short (i.e., they had $100,000 in their account and were short $200,000 worth of stock) Then, disaster. The stock was halted. Nobody knew why for about 2 hours then the NASDAQ announced that the press release was fake. The stock reopened at $62 and both traders got margin called by the office and lost their entire accounts.

One, this is why gaps are dangerous. Two, careful with leverage, especially leveraged shorts.

The wiki page for the hoax is here.

Emulex stock, daily August to October 2000

Trading gaps

Gaps are a simple way of seeing that a market was in equilibrium and then moved instantaneously to a new equilibrium. There’s a lot of information there. The main thing I use gaps for is as support and resistance. There are clichés like “gaps always get filled” but they are empirically untrue. Sometimes gaps get filled; sometimes they don’t. Trading on the expectation that every gap will get filled is a recipe for losing many a finger to falling knives and many a trading account to exploding rocket ships.

I don’t think there is a systematic way to trade gaps all the time. Simply use either side of a gap as support and resistance to enter trades ideas you already like.

Let’s say I’m bearish Carvana, because I always am. I think they are going bankrupt but I have come to this view at some arbitrary moment in the last few months. The first thing I would do is look for retracements in the downtrend that test the bottom of a prior gap.

Here is the chart:

Carvana hourly chart back to September

Colorful! Each pair of colored lines marks a gap lower in Carvana’s price. Note that many of those gaps saw price rally back to, but not through the gap. The red lines are the best example, where the gap was filled perfectly, but the black lines saw a rally to the bottom of the gap and the blue lines got super close before failing. The simple strategy is identify the gap, the enter trades as price approaches the gap, with a stop on the other side.

Here’s a simpler diagram to explain it clearly:

The stock gapped from 19 to 15 and is now trading at 7. I don’t like the risk reward of going short here, because if I do: Where the heck am I gonna stop out? $22? Risking 15 to make 7 is not good. So instead, I will wait for the stock to bounce up towards the gap. I will go short at $14 with a stop at $21. Sell as price approaches the gap, with a stop loss on the other side. Same story, but reversed in an up trend.

The attractiveness of these trades is that you are participating in the primary trend while playing reactions against that trend to avoid selling the hole or buying the highs.

What exactly happens around gaps?

I have written in the past about how I like technical setups that have an underlying logic based on market structure and participant psychology. You can read more about that concept here. The gist is that super-complicated stuff like Gann fans tend to rely more on mathematics or pattern recognition while simple stuff like horizontal lines simply reflect the underlying supply and demand, and order book dynamics in a market.

If you’ve ever been a market maker, for example, you know that support and resistance are often simply the byproduct of huge customer orders in the market. If EURUSD keeps bouncing off 1.0250, it might be as simple as “China is bidding for 4 billion euros at 1.0250.”

Gaps also reflect a particular psychology in the market because they leave traders trapped. Human nature is to anchor on prior price points, even though that is totally irrational. If you got in at $50 and it goes to $45, you will often be happy to escape unscathed by selling at $50 on the bounce.

Similarly, when a stock or asset gaps, wrong-way bets are trapped and are simply praying for the thing to get back to where it was before the gap. If you’re long Nike stock and it closed at $99 yesterday, and then it gaps open to $93 on the open because of whatever… Irrational traders (i.e., the majority) will look to get out of longs as price approaches $99. That is, even though they were bullish before, they are psychologically anchored on their entry point of $99 and hate the pain they feel as the stock goes to $93. Thus they become sellers now at $99 because that’s where they feel the relief of breaking even.

Fading or going with the initial gap

Another valid strategy around gaps is to fade them almost right away, or go with them with a tight stop. The implicit idea here is that the invisible hand has not found the right price instantaneously, and it will either mean revert, or rip much farther. This often requires you to have some view of the underlying story or fundamentals, but not always.

Sunday gaps in FX (especially ones related to risk aversion or scary weekend stories) are notorious for mean reversion. Here is the P&L of fading every Sunday gap of 0.5% or more in USDJPY:

P&L of fading every Sunday gap in USDJPY since 2003

This is typical for most Sunday gaps in FX, but not always typical of gaps in stocks. Sometimes gaps will trade like this one after Nike’s earnings warning:

You could have gone long at the open $83.19 with a $1 stop loss and made 9 bucks in a couple of weeks. On the other hand, when INTC warned in June 2022, the stock did this:

You need to have a view on the importance of the news, and whether or not the market is pricing it correctly, before you trade immediately on a gap.

These can be absolutely mega trades when they work and the beauty is that a tight stop loss is the correct play on these so you can get strong leverage. Be careful fading or going with gaps pre- or post-market because it’s very difficult to risk manage. Better to wait until the open, do the trade, and automate your stop loss right away. Otherwise, that trade where you were risking $2 to make $7 becomes a trade where you lose $9.

If you would like to read more about trading equity open gaps, here’s a piece I wrote on the topic: https://www.spectramarkets.com/am-fx-gap-and-trap/

Double gapper weirdness

Over the course of the last two days, Walmart and Target released earnings. While Walmart is 6.5X larger than Target from a revenue standpoint, and the two companies cater to different clienteles, they are both downmarket, price-oriented mass retailers. If WMT is doing well, one might expect TGT to be doing OK, in general.

Before we get to the trade idea, I must share this analyst preview of the two retail giants’ earnings releases courtesy of Barron’s:

This is funny if you know what happened. I don’t post this to slag the analyst at Cowen. I am wrong plenty of times too. I just post it as a reminder that experts are wrong all the time and you should not blindly follow them (including me).

Trading your own ideas and risk managing them so that you have positive EV on your trades is so important. When you trade your own view, you are strong and will do all the right things. When you trade someone else’s view, you will risk manage it poorly, take profit too early, and never know when the situation has changed unless you have an open line to the person whose view you are trading. Always. Trade. Your. Own. View.

Anyway, here’s what happened. The chart is straight out of a Tufte nightmare, so let me explain it. The red line is Walmart, selling off into earnings on worries. The light blue line shows the selloff then WHOOSH. Massive gap higher.

The black line is Target, rallying into earnings on bullish excitement. The purple line shows the rally then KABOOM. Massive gap lower.

WMT (red) and TGT (black) rip opposite directions on earnings (intraday back to 03NOV22)

For context, here’s how the two stocks move in the bigger picture:

WMT (red) and TGT (black) rip opposite directions on earnings (daily back to 01MAR21)

You can see the ebbs and flows are similar but WMT has exploded relative to TGT. I explained three ways to use gaps:

Use gap tops and bottoms as support and resistance zones

Go with the gap using a tight stop

Fade the gap with a tight stop

So those are simple and effective ways to trade around gaps.

Another more complicated way you can use gaps is as targets and strikes to help structure trades you put on with options. Here, I’m going to do an RV trade going short WMT and long TGT for convergence. If you have no idea how relative value trading works, I suggest you read Week 15: RV Trading is Hard before you read the end of this piece.

The trade: Short WMT, long TGT via options using gaps to define targets

I’m not an expert in US retail stocks. I’m using this setup as an example of how you can use gaps in your trading. Let’s say I don’t think it’s sustainable to have WMT and TGT gapping in opposite directions on earnings. Their businesses are too correlated and I expect the prices to converge. If I’m right, I would expect one or both of the stocks to close the gaps.

Here are the gaps, before we continue:

WMT gap: 138/146

TGT gap: 150/179

For what it’s worth, another great tool for looking at gaps, along with the equilibrium zones that preceded them, is Market Profile. I have written about this at length in various posts and in my books. A complete guide is here, or you can grab “Mind Over Markets” by Dalton. That is my favorite market profile book.

The gist of the methodology is that it shows how much time a security spends at each price. The longer the asset spends around the same price, the thicker the stack of letters becomes so you get a market profile chart for TGT that looks like this:

TGT Market Profile, November 3 to now

Maybe I’ll write a full Market Profile piece for 50in50 before we’re done. It’s an excellent tool that’s easy to use. In this chart, you can see that equilibrium before the run up into earnings started was 156/164. That gives you some extra context if TGT starts to run higher. The first resistance will be the top of the old equilibrium range (164) and the next one will be the top of the gap (179).

So for this trade, I want to buy call spreads in TGT and buy put spreads in WMT. I’m going to use a 1-month time horizon because that’s the kind of trade I think this is. So what strikes do I pick? When you’re buying a call spread, you want to own a strike that is far enough away to give you leverage but close enough that you will get well through it by expiry. You want to sell a strike that you think will not be breached.

So with TGT, you can buy the old equilibrium high (164) and sell the top of the gap (179). If you want to tighten up the top strike, you can use the low on that last day before earnings, which is 176. If you stare closely at the TGT chart, you can see that last day before earnings was a little island encompassing 176/179.

With WMT, you’re doing a put spread. The equilibrium range before earnings was 138/144 (this is easy to see on the WMT chart above). The stock is 148.50 right now so you buy the 144 put (assuming we head back into the old equilibrium range) and sell the 138 put (the bottom of the gap).

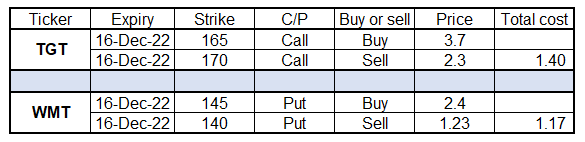

The strikes are on the $5 increments, so I see this as the complete trade structure:

If this were a simpler trade and, say, I was just buying WMT puts, the thought process would be similar. You target a closure of the gap when selecting your strikes. This trade pays $5 on a total cost of $2.51 if either stock fills the main $5 of the gap. If both stocks keep running, we lose the whole premium on both structures. If TGT is just suffering from bad management and idiosyncratic weakness, that may well happen.

And of course, there are a ton of outcomes in between. The dream scenario is that TGT rips, WMT dumps, and you make $10 minus the premium spend. Doubtful!

A nice thing about a trade like this is that you don’t care what the broader market does. You have no beta to SPX here, really. Or tiny beta as TGT vol is higher than WMT, but whatever. Another nice thing is that you are buying options after earnings, so the options are much cheaper than before (5 vols or so). You are also buying close-to-the-money options so again, vol is not pricey.

For the purposes of tracking, we spend $2,510 on this idea, doing 10 contracts of each spread. Hold to expiry.

Conclusion

Gaps are useful as they show you where price went out of equilibrium and then found its new happy place. As price travels back towards the gap (the rejected equilibrium), you will very often see it stall. There are a variety of ways to trade gaps. You can use them as support and resistance, you can go with them, you can fade them, and you can use them as targets and strikes when you structure trades using derivatives.

Use gaps to your advantage as they offer tight risk management parameters and reasonable estimates of where price may stall in the future.

That’s it! Thank you for reading. Don’t forget to buy the 2023 Trader Handbook and Almanac.

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

thanks Brent for this great newsletter and trade ideas. and great to see you are using MarketProfile, it's a fantastic tool - i've learned even before classic chart reading :)

thank you Mr. Brent, I read your work and it is informative. I am looking forward for the next post.

I just wanted to ask if maybe you can write something on commodities, how we can find trade ideas, commodity drives and fundamentals. thank you sir.