Week 37: Common Traits of Top Traders

Trader survey results and a yawning jaws correlation breakdown trade

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 37

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

Week 36: +TGT vs. -WMT is doing OK.

Week 35: Short MSTR small in the money, not moving much.

Week 34: EWZ call spread sucking major wind.

Full update with the detailed spreadsheet in Week 40.

Common Traits of Top Traders

A few weeks ago, I sent out a survey to see if successful traders have different personality traits than beginners. Surveys are generally boring and annoying, so I try not to send them out too often. Feedback on this particular survey was unusually strong and positive. Most of my surveys get around 250 responses and this one got ~600.

The cool thing to me is that many of the traders I know well and have a deep respect for pinged me after to tell me they completed the survey. The results show that many experienced traders completed the questionnaire, along with many other traders of various skill levels.

Before I show you the traits that differentiate successful traders from inexperienced and not-yet-successful traders, let me provide a couple of excerpts from Alpha Trader for context. The survey I constructed was based on analysis from the early chapters of Alpha Trader where I attempted to dissect what makes a successful trader. Today’s piece is meant to complement my findings in the book, and hopefully add new insights.

In my book, I study success outside trading (in fields like academics, sports, and life outcomes) and I study research on success in trading to come up with this equation for trading success:

Rational + intelligent + skilled + conscientious + calibrated confidence

I then offer the following clarification (excerpted from Alpha Trader):

Note my equation for trading success excludes some traits that are important but not critical to trading success. I did not include risk appetite, for example. People at each end of the risk-taking continuum (extremely risk averse or highly risk seeking) might underperform those in the middle, but risk appetite is not an important character trait in the literature on trading performance.

Furthermore, risk tolerance can be dialed up or down fairly easily with a simple set of rules. I have seen traders at every point on the risk-taking spectrum succeed.

Before the year 2000 or so, IQ was less important in trading because trading was more skill-based and less quantitative. Now, a higher level of quantitative intelligence is required although I would argue that Wall Street currently overvalues IQ and academics, and does not focus enough on grit, street smarts and fire in the belly.

My equation leaves out many positive attributes that most certainly make for better traders. It does not include positive attitude or ability to handle stress, for example. These are useful but not critical attributes when it comes to trading success. There are plenty of grumpy, stressed-out traders that still make money. Sure, that’s not ideal (and certainly does not meet my personal definition of success), but only the indispensable traits are in the equation. Many other attributes will help you succeed in trading but the formula I laid out is the mashed potatoes—everything else is gravy.

On at least one of those viewpoints, the survey results show I was wrong. But I’ll get to that in a bit. First, here’s the basic info on the traders that completed the survey. Total sample was 589. The first three questions were used to bucket traders into groups by success/experience. Here are the results:

Impressive number of traders with 20+ years of experience on my distro! I thought that was cool.

Again, decent representation from professional traders. And a lot of new traders, of course. Next, profitability:

And I always enjoy throwing in this last question as a study in overconfidence bias (see next chart). Almost everyone thinks they are average, or better than average, as usual! Fun. This overconfidence bias also appears in the main data as there are very few low rankings on the scales and many, many more 7’s than you would expect in a normal distribution. The data is somewhat normally distributed, but around a mean of 7, not 5.

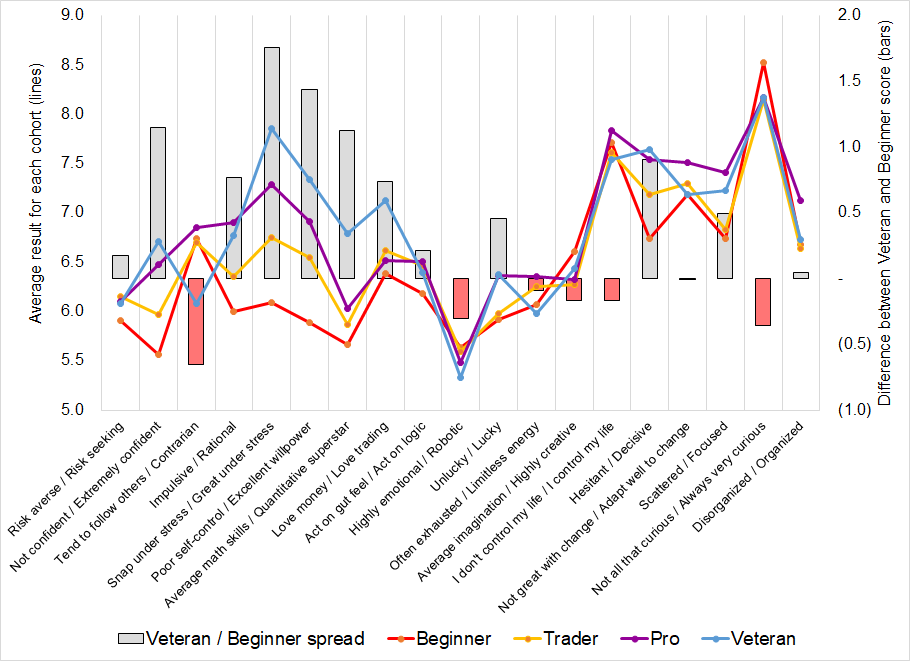

Once all the data was collected, Justin and I worked to split the respondents into four cohorts defined by experience and profitability. We called the groups: Beginner, Trader, Pro, and Veteran (ascending order of combined experience and profitability). The output I was most excited to see was the traits where there are large differences between the cohorts. The absolute responses were going to be mostly meaningless to me; I figured the relative traits comparing noobs to pros would offer the most interesting takeaways.

Some results were as expected, and there were some surprises. I am going to show the results in a graph first, then the data is provided in a table afterward, so you can see it more clearly and specifically.

Survey results

Takeaways

Focus on the gray bars in the chart, which show the difference between the blue and red lines:

Number one divergent trait is: Ability to handle stress. I find that interesting as it contradicts what I wrote in Alpha Trader. I suppose if I think about it, handling stress is one of my greatest strengths. I like stress.

Willpower, quantitative skills, confidence, rationality, and decisiveness are the five other areas where Veterans greatly exceed Beginners.

Risk appetite is about the same for traders of all levels. This is consistent with what I wrote in Alpha Trader. You can succeed in trading with any level of risk appetite. You just have to manage yourself differently and develop systems and processes to regulate or increase your risk. And know yourself.

New traders tend to be more contrarian than experienced traders. This is a lesson I learned early on. I always wanted to be contrarian when I started because my ego loved it when I made money while everyone else was losing. I wanted to be right when everyone else was wrong. Now, I just want to make money. Reflexive contrarians are not good traders because they miss every trend. Traders who focus too much on market sentiment are bearish all the way up and bullish all the way down. Good traders can fade or go with trends.

You can be either emotional or robotic and still succeed in trading. It doesn’t matter, as long as you are aware of your emotions and make sure they don’t make you irrational.

The direction of travel of the data from cohort to cohort was consistent, which gives me confidence these are meaningful results. That is: “beginners” score lower than “traders” who score lower than “pros” who score lower than “veterans” on the important traits. That is, the lines in the graph don’t criss-cross very much. That consistency is a feature of good data and meaningful research results.

.

Overall, the results of the survey provide insight into the traits and characteristics that separate professional traders from beginners. I hope you found it useful and informative. Here is all the data in table form.

To wrap things up… If you have read Alpha Trader, you might remember the questionnaire from Chapter 1. Here is the profile of the least and most successful traders in my survey, structured the same way as it’s displayed in the book:

Average traits of least and most successful traders

(least successful in yellow, most successful in green .. if both the same, box is green)

The last question I asked was: “Who is the one person on Twitter you find most useful? (please provide Twitter handle if you can)”. am/FX readers skew towards nice, so many put my Twitter handle in there. Other than me, here are the handles that came up at least five times:

Most useful Twitter handles, according to survey respondents

Thanks to all those who completed the survey and thank you for reading the results.

This week’s trade

The survey results have taken a good bit of your time, so let me quickly talk about a theme that is capturing the market’s attention right now and a way to play it.

There is normally a strong correlation between oil companies and the price of crude. This is probably the easiest correlation in finance to explain. If the price of oil goes up, companies that pump oil out of the ground get more money. And their expenses don’t change much. So oil company margins are mostly determined by:

(Market price of oil) minus (Cost of extraction / production)

This is a gross oversimplification, and there are many other variables but those dominate. Therefore, if you overlay the price of Exxon Mobil (XOM) and crude oil, you will generally see something that looks like this:

Crude oil, hourly chart (blue) vs. XOM stock (black)

November 2021 to July 2022

I am using XOM and you could use XLE (the oil and gas ETF) and get the same answer. There are divergences, but the general direction of travel is usually the same. Oil up, XOM up. Oil down, XOM down.

Here’s how it looks since then:

Crude oil, hourly chart (blue) vs. XOM stock (black)

August 2022 to now

And here is the zoomed out version so you can see both charts as one.

Crude oil, hourly chart (blue) vs. XOM stock (black)

September 2021 to now

That is one Looney Tunes / Mugatu crazy pills divergence.

If you run a correlation of the variables through various filters and lookbacks, you will see that the residual (the difference between expected XOM price and actual XOM price) has rarely if ever been larger.

There are many ways to play a divergence like this. You can buy oil and sell XOM (relative value trade), you can sell XOM if you have other reasons, or you can buy oil if you have other reasons to do so.

I like selling XOM. Here’s why:

Many, many people I talk to are bullish energy and energy producers. This was supposed to be the big trade of 2022.

Good news / bad price in oil. You have had a massive energy shock and war in Europe, ESG crippling investment, and raging bullish views from investors and speculators all year. And oil is unchanged. Unchanged on the year! It’s probably one of the most extreme cases of good news / bad price I have ever seen, in any market.

When two correlated variables diverge, I like to focus on the one with momentum. Oil has the downward momentum. XOM is just hanging there like Wile E. Coyote. And I am bearish oil, even down here.

There’s a good chance people are praying and holding their longs for January 1, 2023, so they can sell with fewer tax consequences. That’s how megatech played out at the turn of 2021/2022: People saw the writing on the wall in December 2021 as Powell dropped transitory and Waller floated QT, but they held on ‘til the first week of January then unloaded with a vengeance. Megatech went straight down from the opening bell on the first day of January 2022. Here’s the evidence.

.

NASDAQ October 2021 to now

So oil trades incredibly heavy, the market is confidently long oil producers and oil exploration stocks, and investors are praying they can make it to January without XOM dropping back to reality so they can lower their capital gains pains. My view is that this all resolves with XOM sub-100. It took two months to rally from 85 to 115, so perfect symmetry would put us back to 85 in late January. That’s an optimistic target for bears, but not an unrealistic one. Symmetry is a simple and useful way to estimate future moves and determine profit targets.

XOM hourly chart showing symmetry if it starts selling off in early December

To keep my life simple and avoid any wild price action around this weekend’s OPEC meeting and year-end shenanigans and window dressing, I’m going to buy February options.

Buy February 100 XOM puts for $3.00

Sell February 85 XOM puts for $0.80

I am buying a strike that’s easily reachable and selling the strike at the stretch target because I doubt XOM can go much lower than $85 by expiry. Spending $2,200 on 10 contracts of the put spread. Remember this is an educational Substack. These are examples of trade ideas to stimulate and educate. Trade your own view.

All prices as of 10 am 30NOV when I wrote this. For official tracking, I will mark to market when I hit send.

Conclusion

To be a good trader, you need to handle stress. You need willpower, quantitative skills, confidence, and decisiveness. You must be rational. And you need a healthy, supportive trading environment. Know yourself, plug your leaks, and level up your strengths.

See you below $100 XOM.

Thank you for reading.

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

And don’t forget to buy the 2023 Trader Handbook and Almanac.

Photo puzzle answers: George Soros, Jesse Livermore, Ed Thorp, Paul Tudor Jones, Stan Druckenmiller, Louis Bacon

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

Thanks for the summary. Always good to see how my profile compares to the best traders.