Hi. Welcome back to Fifty Trades in Fifty Weeks

This is Week 40

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

It’s time for the decaweekly update! The P&L performance remains somewhat random, which is mildly disappointing, but not unexpected. The trades I’m choosing are often in products like single name equities, where I have no edge. I continue to publish the results for transparency and for discussion purposes… And to be honest, even in my am/FX trades, where years of evidence shows I am probably displaying some edge in global macro … I just had my first negative quarter since 2019. So I am hot as a cucumber.

Here is the big spreadsheet.

Takeaways:

It’s worth noting that risking $2,000 per week on a single trade does not create much P&L volatility in a $100,000 account. I would not recommend this risk management style to anyone; I just wanted to keep things simple for 50in50 and I wanted to err on the small side in case anyone was confused into thinking I was suggesting a specific risk management methodology. Risking 2% of your capital each day, as a day trader, is plenty volatile, but risking 2% of your capital on one trade, once per week is nonsensical. The idea was simplicity for explanation purposes. For a full discussion of position sizing and proper risk management, please read Chapter 11 of Alpha Trader.

A couple of tactical errors crushed the P&L over the last period. One, I forgot to leave a take profit in the Substack on the USDJPY long (Week 30). The trade was good but subsequently crashed and shows up as a loss. This kind of thing happens in real life, too. You leave a TP and a stop loss overnight. Your TP gets hit before bedtime. You go to be happy then and come in the next day. You open up your P&L and see a big red number instead of a green one. Then you realize you forgot to input your order. Trading is such a game of inches that tiny screw-ups can be the difference between a W and an L.

The CM trade had the right idea but the wrong stop loss. We were short at 45 with a stop just above 47 and a take profit at 40.55. The stock went to 49 then 40. Again, good strategy isn’t enough. You need good tactics, too. The comments and feedback from this trade also revealed to me that CM was a bad expression of a Canadian housing short. There were better ways to do the trade. Then again, one of the alternative suggestions was to short Home Capital Group (HCG, the Canadian mortgage company). Somewhat hard to believe, but that company was trading at $27 when I went short CM and got bought out at $44 shortly thereafter. So could have been worse, I suppose. A good example of terrifying gap risk and bad luck for people that were levered short HCG.

The MSTR short was OK but utilized very little leverage. It’s hard to make a lot of money shorting extremely volatile stocks because you can’t take a big position.

.

Over-oversold

RSI is a simple indicator that gives you a snapshot of oversold or overbought conditions in a particular security, index, or market. The standard way to use RSI is that when it breaks below 30, you wait for it to come back above, and buy. And the opposite for breaks above 70. As someone who hates being late to a party, I have a different approach. I like to look for moments when the RSI breaks under 20 or above 80 and jump in right away.

I would not do this solely based on the RSI; I would need some sort of thesis to go along with the technical signal. Here’s a recent example of one that worked in FX.

AUDNZD with 14-day RSI

I set the parameters for the blue band on the bottom to 20 and 80 so that you can see the breaches. There are very few. Most of them coincide with overshoot and reversal, though the execution of the fade can take a few years off your life and there is nothing guaranteeing that this works every time. I have not backtested it, though that is a project I will start today. I’ll report back to you with my findings.

I’m not giving investment advice here, but the reason I have RSI on my mind today is that TSLA just hit its all-time low on the 14-day RSI.

TSLA with 14-day RSI

The stock still trades at 4.6X sales, which is -ahem- a tad higher than, say, Mercedes-Benz at 0.5X sales. But the ratio is now more in line with TSLA history before it was embraced by the “any valuation is OK when the story is fun enough” crowd as part of the meme stock bubble.

TSLA price-to-sales, 2011 to now

Note that a price/sales ratio of 25X is defensible when you are a $4B company like TSLA was in 2011. It is completely indefensible when you are one of the largest companies in the world, by market cap. Trees do not grow to the sky.

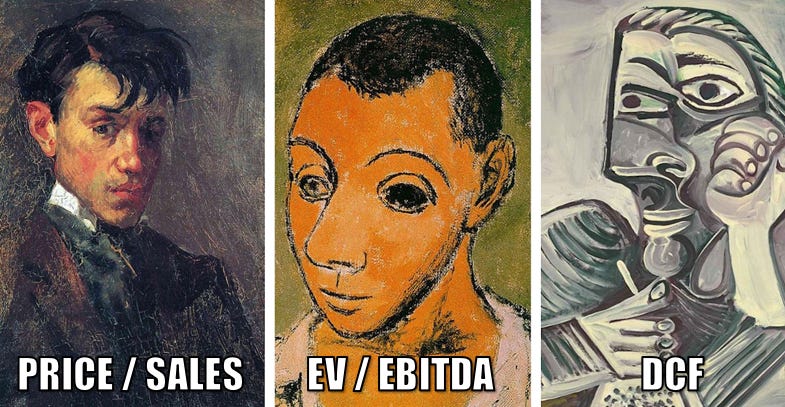

Anyway, I’m not a CFA, but I have traded through two huge tech bubbles now. Price-to-sales is a simple and logical way to cut through the community-adjusted GAAP noise and see one, easy-to-understand valuation metric. Like I said, price/sales is less meaningful for tiny companies but matters for big ones. Here’s a modern way of looking at it.

And just for fun, here’s CSCO price/sales.

CSCO price-to-sales, 1990 to now

Anyway, if you are interested in owning an automaker that trades at 4.6X sales, this might be your moment.

Tax loss selling and window dressing are probably playing a big part in the selloff in TSLA as its owner has temporarily left the building to pursue a $44B hobby that has aggressive political overtones. Fund managers who don’t believe in the Musk message, or whose investors or managers don’t believe in the message, are probably cutting TSLA holdings before year-end holdings are published.

The stock is down almost 50% this month, the RSI is at an all-time low, and the deadline for tax loss selling is Friday. As far as countertrend punts go, you could do worse. A bounce back to 150/165 would be in the realm of possibility for TSLA in JAN/FEB.

Did I mention this is not investment advice?

What is RSI, anyway?

RSI looks back at the last 14 days of price action and examines where the price finished, relative to its normal up and down moves. A figure below 20 or above 80 is difficult to achieve given the math. You need a crazy streak of large down days to get below 20.

If you would like to build the calculation into a spreadsheet, this website shows you how, step by step. It works; I used it.

https://smallbusiness.chron.com/make-rsi-excel-51528.html

It’s worth noting when using indicators like RSI, MACD, etc., that the math behind the indicators tends to be highly similar. Momentum is momentum, no matter how you measure it. Don’t overcomplicate your process or clutter up your charts by adding five momentum indicators and oscillators. One or two max will do just fine. For example, here’s TSLA with the RSI and MACD.

TSLA stock, RSI (blue) and MACD (red and green)

Do you think the MACD is adding incremental value on top of the information already provided by the RSI? Probably not. Pick one or the other. In trading, your goal is to develop robust, but simple ways of looking at the market so you can filter the noise and extract the signal. More indicators = more noise (generally).

Another way to use RSI

When the price of a security or market you are trading diverges from indicators or other markets that should be confirming, that’s a red flag. For example, if price is trending up, and RSI is making lower highs, that’s called bearish divergence. Here is an example from the first major bitcoin top in 2021.

Bitcoin with RSI and divergence marked with red lines

.

Good trends are confirmed by indicators and other markets. Tired trends are not.

You can also compare two securities this way to look for divergence. For example, in FX, it’s popular to look for agreement or disagreement between the DXY (dollar index, which is mostly EUR-driven) and EURUSD. If the dollar is making new highs against the EUR (i.e., EURUSD is at the lows) but the DXY is not confirming, that can be a sign that the dollar is tired. Here is an example of that. I remember this one specifically because many traders caught the divergence in real time and saw it as a sign that USD strength was over after the Global Financial Crisis.

Dollar Index (DXY, blue line) and EURUSD (black bars)

Bearish divergence for the USD in Q2 2009

You can use this methodology for any two markets you watch. AUDUSD making new highs but copper isn’t? Be careful with your AUDUSD longs. MSTR making new lows, but bitcoin isn’t? Maybe it’s time to get long MSTR. And so on.

This week’s trade

As you might have guessed, this week’s trade is long TSLA. Stop loss at 88.50 and take profit at 159.00. People love to love Elon Musk or they love to hate him. I don’t care. I just want to find trades that will make money. While most of 2021 was a great time to be short TSLA as it became a wildly-overvalued meme stock… Now is probably a reasonable time to stick a toe in the water long.

Please do your own research. Many of the trades in 50in50 are examples that I am using to explain a specific concept and have no embedded edge. I do truly like this idea, but it’s risky and TSLA is a falling knife. The turn of the year and the end of window dressing and tax loss selling make a good case for timing the trade here and the lowest-ever RSI is waving at me like a bullfighter’s flapping red muleta.

So I’m charging. Let’s see. Be extremely cautious around TSLA earnings on January 25.

Conclusion

There are different ways to use RSI. I like to use it at the super mega extremes as an idea trigger and if there are other reasons to get on board, I will do so. You can also use RSI as a confirmation or divergence indicator when analyzing trends. This is a useful way to measure the strength of trend using some basic mathematics.

RSI rarely gets below 20 or above 80. When it does; pay attention.

This concludes Week 40. Thank you for reading.

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

And don’t forget to buy your 2023 Trader Handbook and Almanac.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

Just closed some put spreads on TSLA because the RSI was getting so crazy. Hopefully great minds think alike in this case.