This is Week 42

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

Week 37: XOM put spread is quiet but losing as China reflation helps oil.

Week 38: Sell vol in MSTR has been good so far.

Week 39: Sell 2-month USDJPY and buy 6-month USDJPY. This has been a good idea so far. USDJPY is unchanged.

Week 40 and 41: Long TSLA has been a good trade despite a wild ride. The newsflow has been poor as deliveries drop and price cuts continue, but the overall macro environment has been excellent as favorite short plays get squeezed. Last week, the play was to add at 115.06 and the low was 115.63 on the price cut news. Damn.

As discussed last week, this is the issue with limit orders; you might not get filled on the idea. We could have sent a market order with TSLA at $117.06 and got filled, but we didn’t. We could have bought the break of 125.00, but we didn’t. There is no perfect execution strategy and in this case the patience to wait for the dip to strong support was a decent idea, but did not work out.

I am going to square this idea up here now at $141.50 because TSLA earnings come out this week and I have no strong view on how the stock will respond to the release. The numbers could show a dire outlook or Musk could announce he found a CEO for Twitter and the stock explodes higher. Hard to say. The long TSLA trade was founded on the historic fall in RSI, but now, almost a month later, with TSLA up here, I don’t like the coin toss aspect of holding through earnings.

TSLA stock, 5-minute chart (12DEC to the close on January 20)

Obvious trades are not always bad

Markets are extremely efficient, most of the time, and there is no edge in putting on an obvious trade that is fully understood and priced in by the market. On the other hand, the market is not an instantaneous discounting mechanism. There are a few reasons why markets don’t immediately discount all new information.

Confirmation bias. Old narratives die hard. Traders and investors that have made money on a prior narrative tend to be slow to abandon that narrative as new information arrives.

Financial market prices are mostly continuous. When news comes out, price doesn’t just jump to a new, correct level and sit there. It flies all over the place as market players with different views and incentives disagree on the importance of the new information. What’s obvious to you might not be obvious to everyone else. This period as price moves from one equilibrium to the next can be lucrative for early movers with strong conviction. Being the first through the door comes with its own risks, but it’s often the best way to capture the biggest returns or avoid the biggest pain.

Many market participants are slow moving. A pension fund with a secular bull view on automakers might need to convene an investment committee meeting before it changes that view. This process could involve an analyst processing news, writing a report, and then presenting it to the investment committee. Then, the investment committee makes its decision to reduce the allocation to automakers and communicates this to the execution team. Then, the execution team needs to sell the stocks. If the position is large, this selling could last days or even weeks.

Price makes news. No matter how bad the news is, if the price hasn’t moved yet, some will just assume that the security “trades well” or the news doesn’t matter. Many market participants believe that price is the ultimate information signal and they will not cut a winning position until price forces them to do so.

.

Here are two “obvious” trades that worked out incredibly well.

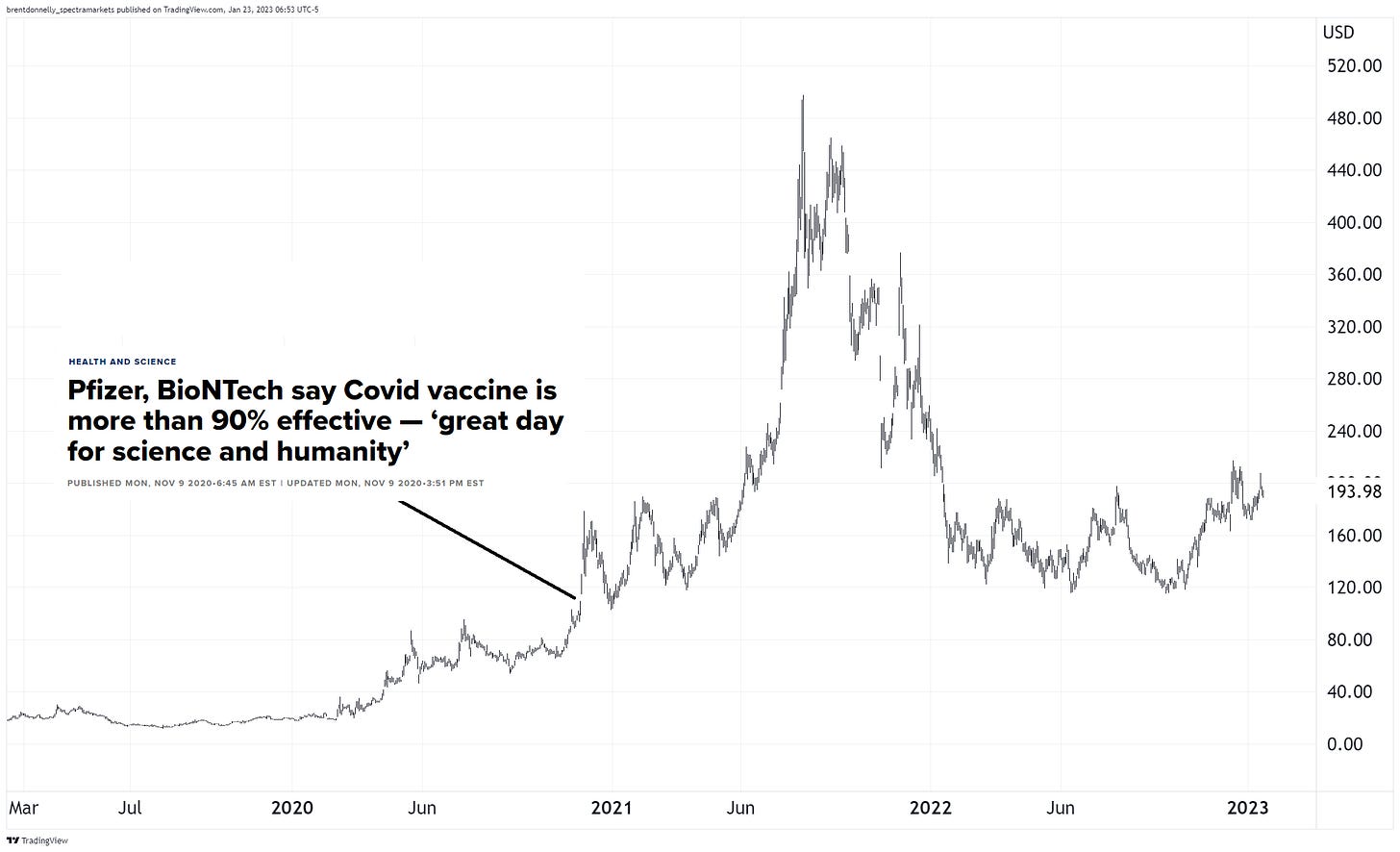

Buy Moderna on vaccine efficacy news

Sell crypto on Fed hawkish pivot

I put “obvious” in quotes because the word is subjective. But let’s just say my brother, who is a musician and never trades stocks, bought vaccine stocks in November 2020. And I was writing about the obvious bearish implications of a tighter Fed for crypto in November 2021. So this isn’t just hindsight. The Abenomics trade in 2012/2013 was probably one of the greatest macro trades of all time. And it was obvious.

Many trades around Fed and monetary policy cycles can be obvious, though there is usually a ton of volatility when the Fed turns and it’s not usually as binary and clean as it was in November 2021.

If every person who wanted to be a trader had the courage to act immediately on his own ideas, a lot more people would be good traders. Very few people have the courage to act on what’s obvious to them, until it’s too late. And then they end up buying NIO at $56.

Peter Lynch, the Captain Obvious of fundamentals

One of the greatest investors of all time is Peter Lynch. From 1977 until 1990, he ran Fidelity’s Magellan Fund, and it averaged a 29.2% annual return. As of 2003, Peter Lynch’s Magellan Fund had the best 20-year return of any mutual fund, ever.

Barry Ritholz, who probably knows more about investment management than 99.9999% of humans on earth, called him the greatest stock picker of all time, ahead of Warren Buffett.

Here’s a chart Barry featured:

Fidelity Magellan vs. S&P 500. 1977 to 1990

Sidenote: Here is a fascinating Spencer Jakab tidbit that shows that despite Lynch’s amazing returns, his investors did much worse because retail investors underperform due to horrendous timing.

During his tenure Lynch trounced the market overall and beat it in most years, racking up a 29 percent annualized return. But Lynch himself pointed out a fly in the ointment. He calculated that the average investor in his fund made only around 7 percent during the same period. When he would have a setback, for example, the money would flow out of the fund through redemptions. Then when he got back on track it would flow back in, having missed the recovery.

Lynch wrote three books and his main principle is, "invest in what you know." Since most people are expert in particular fields, applying this basic "invest in what you know" principle helps individual investors find good undervalued stocks.

Lynch views the observation of successful companies in everyday life as a starting point for investment opportunities. He invested in Dunkin' Donuts after being impressed by their coffee as a customer, noticing their busy Boston locations, and studying the company's financial status.

Lynch believes individual investors can make similar smart choices by paying attention to business trends in their careers and hobbies. He outlines how to read and interpret company paperwork in his books. Lynch states that his undergraduate studies in philosophy and logic were more important to his career than his MBA in math and finance, as he disagrees with the academic theories of random walk hypothesis and efficient market hypothesis. He relies more on practitioners than theoreticians.

This sort of fundamental analysis has appeal, but it’s important to note that this does not mean you just say “Yummy coffee!” and go buy the stock. The coffee being delicious is simply a logical starting point for a thesis and you build on that thesis by analyzing other inputs. For a full summary of Lynch’s investment process, you can read this. But believe me; he’s not just checking out a new sandwich at Wendy’s, then buying Wendy’s stock.

The biggest mistake traders and investors make with the common sense approach is the failure to understand this critical point:

Great companies can be terrible investments.

Trading and investing are about the interaction of 1) opportunity / value and 2) price. Amazon was a great company and a terrible investment in 2001. Seemingly bad companies like GameStop can be terrible shorts. Markets are always about the interaction of price and value. It’s story + price, not just story. Always. This is the most costly error investors make: Chasing great stories at any price.

In early 2021, I was somewhat shocked to see that famous value investor Howard Marks was getting bulled up on tech and disruptors. I managed to arrange a phone call with him and we spoke for about an hour. This piece is a summary of our conversation.

I recommend you give that piece a read because there are many timeless bits of knowledge in there. I am particularly proud of that piece because even while Howard Marks, an investor I admire, was saying “this time might be different,” I stuck to my view that the rally in disruptor tech stocks was BS and likely to crash to earth under the weight of reality.

Here is the takeaway from that interview that is relevant to today’s piece:

“It’s not what you buy, it’s what you paid.”

Or for trading: It’s not how obvious the story is, it’s where you get in.

Marks said to me on the phone: “I’m going to sell you my car, do you want to buy it?” I mumbled for a second and he clarified: “The question makes no sense.” Every asset you buy is a combination of the intrinsic worth of the asset and the price you pay. Looking at one or the other in isolation is dumb. People define “value” as cheap, but they are often talking about price, not worth.

Again, buying and selling on obvious fundamental stories can lead you to bankruptcy because you might always be chasing the new shiny thing and selling when things are at their worst. What Lynch managed to do was find bullish stories and good products before the market sniffed them out. Then, he could get in, do more analysis, narrow down his picks, and ride the waves up.

And Peter Lynch is not the only investor or trader who starts with common sense observations as the backbone for a trade idea. Jeffrey Neumann (featured in Jack Schwager’s excellent book “Unknown Market Wizards”) uses the same approach.

Macro tourists often jump on big, obvious macro trades like Abenomics, ECB QE, and the 2009 China stimulus. Don’t assume that just because a thesis is obvious, it won’t work. What you want is a thesis that is common-sensical or obvious, but not yet fully priced in.

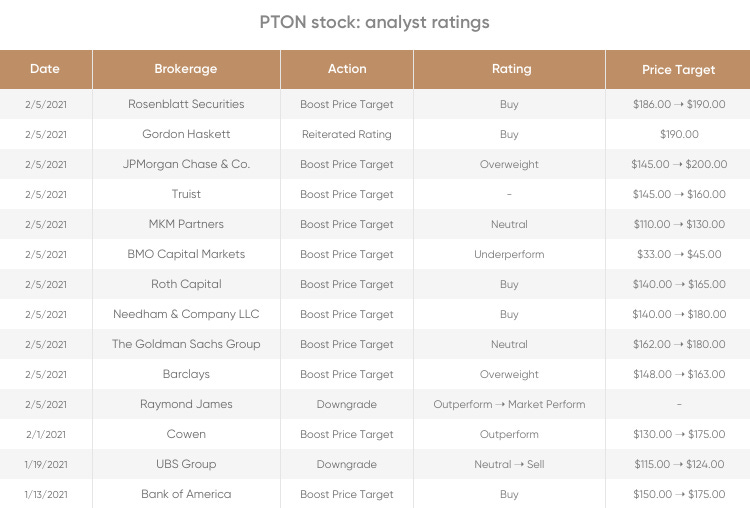

This is totally different from saying: “Peloton is a cool product and WFH FTW!—let me get some of that stock at $150!” That’s what analysts do, as evidenced here:

Tell me you don’t understand extrapolation without telling me…

But this isn’t 50 investments in 50 weeks

But this Substack isn’t about investing; it’s about trading. The reason I have given you this background information on Peter Lynch is that good trades, like good investments, can also start with a common sense observation.

Obvious, common sense trades can and sometimes do make sense. But there has to be more to the process than a single common sense observation. This is consistent with my overall philosophy that excellent trades have many inputs. Let’s look at what seems to me to be an obvious trade.

Tesla price cuts are straight out of a business school case study

In business school, we used the case method, which means you study real company stories and debate what went right and what went wrong thereafter. The recent, somewhat gigantic price cuts from TSLA provide the kind of case study you would do in biz school.

Demand is falling, so a major player decides to cut prices dramatically. What does this mean for that company, and for its competitors?

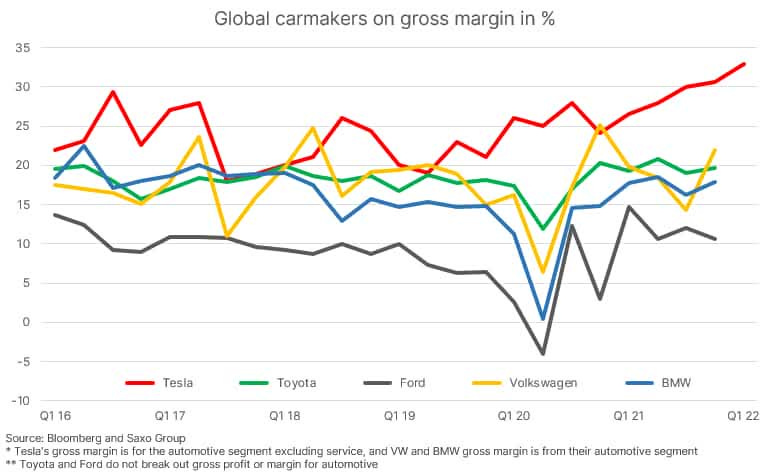

The obvious takeaway to me is that lower-margin competitors will be hurt the most by the price cuts and the company cutting prices may gain or lose, depending on shifts in demand. This story from the Verge covers it pretty well. Here’s a key quote from Dan Ives:

“We believe all together these price cuts could spur demand/deliveries by 12 percent to 15 percent globally in 2023 and shows Tesla and Musk are going on the ‘offensive’ to spur demand in a softening backdrop,” Ives said. “This is a clear shot across the bow at European automakers and U.S. stalwarts (GM and Ford) that Tesla is not going to play nice in the sandbox with an EV price war now underway.”

I am not an automotive analyst, but my first thought when I heard about these price cuts was: this is obviously really bad for Ford. Here’s why:

Ford has been winning the EV narrative game. Markets and consumers have been excited about Ford’s push into EVs. In late 2021, Ford made a massive commitment to EVs while many companies like BMW have been slower to go electric.

With finite EV credits available, and TSLA cars now eligible for more EV credits, Ford buyers will lose out.

Tesla has much higher profit margins than Ford so it can afford a price war.

.

.

Meanwhile, searches for Ford stock are in a nice downtrend after peaking during COVID. Since most investors and traders buy stocks and trade exclusively from the long side, search interest tends to be bullish.

Google search interest for Ford and Tesla stock

From a trading point of view, here’s what I see on the daily chart.

Ford daily chart back to the start of 2020

The daily chart is tracing out a series of triangles with each subsquent high weaker than the last. You can see this pattern of weakening rallies in two ways. 1) The bounces are not getting back up to the old declining trendline and 2) the RSI is making a series of lower highs. This gives us a clear exit because if F goes back above the November high (14.70), the idea is wrong.

If we zoom in, the chart looks like this:

Ford hourly chart back to the start of November 2023

The gap on the TSLA news gives us a nice nearby resistance at 13.40, followed by the down trend line at 13.50. In conjunction with the daily chart, we can put our stop at 15.26 and that’s well above all the resistance on both the hourly and daily charts. A much tighter stop at 14.06 is probably reasonable, too, if you want more leverage.

Looking back at the daily chart, the full round trip of the move that started in early 2021 would take us back to 8.00 and this is a good take profit area. For this trade, we’ll put the TP at 9.03 to get ahead of that noisy $8/$9 launch area where Ford made a major base in January 2021. Risking 2.77 to make 3.43 (off $12.60). Like I said, you could also put your stop at 14.06 and then you are risking 1.57 to make 3.43 but I will err on the side of more room here.

Clarifying the thesis

The idea here is that a major competitor has initiated a price war and the obvious trade is to sell competitors with low margins. As we are not professional auto analysts, we are jumping on an obvious catalyst because:

The stock hasn’t moved that much since news came out and the narrative that Ford is in trouble is not in the market. If Ford was at $10.50 and there were tons of articles about Ford margins collapsing, then we are in the bad kind of obvious trade where everyone is already involved. What you want are trades that are seemingly obvious, but not yet fully subscribed. This looks to me to be one of those.

There is a clear stop loss. We are not saying Ford is doomed and we will keep selling the stock no matter where it goes. We are saying, this looks like obvious bad news for Ford that is not fully priced in. If we are correct, Ford should not go above 15.00. If it does, the thesis is wrong and we get out. The huge triangle and gap lower on the news makes the trade easy to risk manage. If we break above the triangle and the prior highs, the idea is wrong.

The chart supports the idea. The hourly RSI was mega overbought (above 80) when the TSLA news came out and we are down just a buck. Each rally is weaker than the last as measured by the trendline and the RSI.

.

I said in the intro that I’m squaring up the TSLA long idea from Week 40. Why not keep the TSLA long trade and do the RV trade of long TSLA/short Ford? There are two main reasons:

TSLA earnings on Wednesday, January 25 are a coin toss. I don’t have a strong view on which way those results will lean. It will likely be an extremely volatile and (to me) totally random move. You don’t want to hold stuff through huge, random gaps.

It’s not obvious that price wars are bullish TSLA. The market has taken Tesla higher since the news, but much of it has been an all-out squeezefest of anything the market was short. Stocks like BBBY, CVNA, MSTR and TSLA were all much hated and have been the leaders on this rally. Falling deliveries leading to massive price cuts and a price war is not clearly bullish TSLA.

.

Conclusion

There is nothing wrong with obvious trades. You can use a common sense observation as a starting point for a trade idea and then dig deeper into other factors such as sentiment, chart patterns, and price momentum to figure out whether or not the obvious thing you’ve observed is priced in.

When the obvious thing is: “WFH is going to change the world!” and WFH stocks have already quadrupled, be careful. When the obvious thing is “Price wars are bad for Ford because it was perceived as a leader in the EV market” and Ford is down a buck since the news, it’s reasonable to think about getting short.

The biggest risk to this trade is simply a broad stock market rally, of course. But at SPX 4000 I think market risks are pretty balanced.

That concludes Week 42. Thank you for reading!

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view! I may be long or short stocks or securities mentioned in this piece, and those positions could be in the same or opposite direction to the views expressed herein. I am a short term trader and my views change all the time.

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

Great article as per usual, always learn a lot from this. Appreciate the context, insights and tactical advice.

Hey Brent, loving the substack and just finished the Alpha Trader book (great book btw). I’ve been trading for 3 years now and have finally seen some consistency in my trading. Currently I work as a software engineer, but am looking into doing a career switch into trading.

I know there are many jobs that overlap with tech and trading, but was wondering if you could give any insight on how to break into more traditional trading roles. It seems like most roles today are focused on quantitative analysis, market making or HFTs, but maybe it’s just my bias as my peers in tech work in or around these businesses. If you had to start your trading career all over again today, how would you go about it?

Keep up the great content, and wishing you a great 2023!