This is Week 46

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

Week 38: The MSTR sell vol idea broke on the final day. MSTR went from 235 to 275 on expiry day and wiped out all the profit on the trade. In real life, we would probably not leave a multi-month trade to the whims of the final day’s action. But this is an educational Substack.

Week 39: Sell 2-month USDJPY and buy 6-month USDJPY. This has been a good idea so far. The 2-month USDJPY put expired worthless (good news) and now we have a June 125.00 USDJPY put. We paid much less than we would have paid otherwise.

Week 42: The Ford short is in the money now.

Week 43 and 44: Short TSLA doing better but not great.

Week 45: The IEF trade worked pretty much instantly and hit the take profit already.

Friday Speedrun!

We have a new, 5-minute per week Substack coming out! It’s called “Friday Speedrun” and it starts Friday, April 7.

.

Are you…

A business student?

Studying economics or finance?

A junior analyst in sales, trading, or banking?

Curious about financial markets and want to learn more?

.

If you answered “yes” to any of the above, Friday Speedrun is for you.

Get a clear explanation of what happened in global markets each week from a 25+ year Wall Street trader and global macro expert (me) and contributing editor Justin Ross.

It’s free, easy, and quick.

Five high-yield minutes each week.

SIGN UP HERE (it’s free)

… and even if you aren't interested in finance, we're going to share links to interesting articles, blogs, etc. every week so you can read what we've been reading. Get smarter, learn more.

The Evolution of Edge

Edge is fickle and ever-changing. You think you have a trading edge today and then it disappears, almost overnight. AI systems and human intelligence are scouring the data for any edge and whatever you have discovered will not stay in the dark for long.

The best defense against efficient markets is to keep learning, stay curious, and remain humble. Assume your current edge is not permanent and continue to look for other methodologies that will deliver alpha over time.

What is trading edge and where can I find me some?

Markets are incredibly efficient and therefore you need to assume that finding an edge that will deliver alpha in excess of trading costs is close to, but not impossible. When you backtest a system and the returns graph shows a perfect 45-degree angle from the lower left to the upper right… Be skeptical.

On the other hand, thousands of traders make money every year. It is possible, just difficult. The clearer your edge, the more likely that edge is real and sustainable. Here are three examples of edge on the smaller fractals.

This guy figured out exactly how FTX was rebalancing their perps and was able to trade the predicted rebalancing for a large profit for a long time. This sort of microstructure edge is hard to scale and can be enormously profitable for small traders. Small traders have a huge advantage over large traders because they don’t need huge P&L to move the needle. No way a large portfolio manager could do these trades because the P&L would not be big enough and the capacity of the market (liquidity) is not substantial enough.

Another example of microstructure edge like this is when you are highly-skilled at reading order flow (e.g., NASDAQ Level 2). CanteringClark is known for his microstructure skills in crypto and Michigandolf stands out on the equity side and I recommend them as great follows if you are interested in this sort of edge. They do other stuff worth learning about, too.

Predicting FX movements around month end is a source of edge. While the month-end patterns in FX have long been studied (I started trading the basic month-end model in 2005), the patterns change and the strategies fail just enough that month-end is never quite free money. This is another fairly micro source of edge. It is also a good example of how the more people know about an edge, the less it works.

.

Whether you trade at the biggest asset management firm in Midtown Manhattan or out of a spare room in your parent’s house in Wichita, Kansas… Trading is an impossibly complex game of imperfect information played by many thousands of technologically-sophisticated and highly-motivated opponents. What is your edge?

Successful traders can clearly and confidently explain their edge.

Do you have enough edge to outperform the market and exceed transaction costs? This is the most important question in trading, especially if you do not work at a bank. Banks have some built-in edge (better information, market-making revenue, best access to liquidity) but if you work at home or at a hedge fund or at an asset management firm… What is your edge? Don’t lie to yourself. Think about it and be honest.

Sources of edge

To give you some sense of where the edge has come from over the years, let me go through a quick historical list. The list is meant to get you thinking about your own edge. The point is not to go through the list and pick one. It’s a starting point for thinking about and understanding trading edge.

There is a cliché that if you are at a poker table and you don’t know who the sucker is… You are the sucker. Similarly, if you are a trader and you do not know what your edge is, you probably don’t have an edge. I will focus on sources of edge for human traders and the date ranges I provide are my best estimate of when that source of edge was most prevalent.

Most of these sources of edge still exist, but are greatly diminished from peak. This chronological section on edge is excerpted from Alpha Trader.

Trend Following

1984 to 2003

Trend-following systems were the go-to source for human (and computer) alpha in the 1980s and 1990s. Many large trend-following commodity trading advisors (CTAs) extracted meaningful abnormal returns for more than two decades. Returns from trend-following systems have steadily declined over the past 40 years. Many studies cover the slow decline of trend-following performance. This table from a Winton study shows the decline in trend following Sharpe ratios over time.

This does not show there are now zero profitable trend following strategies, but clearly the edge has dropped over time. This is not a surprise given the proliferation of academic literature on the topic in the 1990s and 2000s. As a strategy becomes well known, its Sharpe ratio grinds towards zero.

Asymmetrical information and lack of transparency

1980 to 1996

Before the internet, markets were opaque and it was hard for those outside financial institutions to get an accurate view of prices. Traders at banks and large investment firms had a meaningful advantage given their knowledge of accurate price levels and because of wide bid/offer spreads.

Meanwhile, relatively few macro traders had big research budgets and access to policymakers. Those who did had a massive edge over less informed and less sophisticated corporations and speculators.

Instantaneous communication speeds, near-unlimited availability of information, and rigorous compliance and monitoring of non-public information have dramatically flattened the landscape for both macro and bank traders.

Technical Analysis

1980 to 2006

The most common trading strategy on most trading desks I worked on before 2006 was technical analysis. Most techniques were fairly basic, while some of the smarter-sounding people might throw in some Elliott Wave or more esoteric systems built in Lotus 1-2-3. Most of these strategies produced what amounted to trend-following or breakout signals. Continuation patterns, breakouts, head and shoulders etc. were the favored setups and these piggy-backed on the underlying high Sharpe of trend-following strategies in that era.

As algorithmic strategies became more common in the mid-2000s and trend following Sharpes fizzled, traders using simple technical analysis lost their edge because technical strategies are easy to replicate with a computer and computers are better than humans when it comes to risk management and unbiased trade selection. Now, I believe technical analysis has been reduced to a risk management tool and does not work effectively for trade selection or forecasting.

Correlation and intermarket analysis

2004 to 2014

This was my bread and butter back in the Lehman Brothers days but after the 2008 Global Financial Crisis, everyone became acutely aware of the importance of correlation and intermarket analysis for short-term trading.

Just about every global macro trader (and blogger) in the world is highly proficient in this style of analysis now. And there are many, many computerized systems using dynamic correlation to trade every asset class. Again: Too much money chasing too little alpha.

I still use correlation as an important input for my trade ideas but I think its usefulness has declined significantly over the past 20 years.

Data and Event Trading

1990 to 2005

It’s 1997. I expect a strong nonfarm payrolls (NFP) number and USDJPY is 118.80/85. As 8:30:00 a.m. approaches, I key up a bid for 100 million USDJPY at 119.01. I stare intensely at the US economic release page on Bloomberg.

5, 4, 3, 2, 1…

If the number is significantly better than expectations, I hit send. If not, I do nothing. Often, pre-2005 or so, you could scoop all the lazy offers left by risk-averse traders and make an instant $100k or $200k profit in the seconds after any major economic release. Now, there are hundreds of algos set up with a series of commands like: (If NFP beats by 1 standard deviation + Unemployment rate drops, buy 100 USDJPY, limit X). All available liquidity is sucked up in microseconds as an army of algos wipes the battlefield clean.

There are some second derivative ways to make money trading the economic data now, but 95% of the alpha is now owned by algorithms. This creates a form of singularity where price finds its new equilibrium point almost instantly after economic data hits the market. Instead of flailing all over the place as it tries to find the right price, USDJPY just ratchets to the new “correct” price in a few minutes as similarly-tuned programs react at faster than human speed.

Pattern Recognition

1980 to ???

There is a famous story of Paul Tudor Jones and Peter Borish using price and volume patterns to uncover an analogy between the price and volume pattern in the stock market in 1987 and price and volume in the stock market in 1929. Using this analogy, macro analysis, and his concerns about derivatives, portfolio insurance, and equity futures without price limits, Tudor predicted the Crash of ‘87 and returned 62% in October 1987!

In 2023, this type of analogy would be tweeted twenty-two times by day traders and online bloggers and would be revealed in the output of every machine learning, AI and pattern recognition machine at every hedge fund and bank in the world. Computers are significantly better than humans when it comes to unbiased pattern recognition.

I do believe, though, there is still an edge in pattern recognition. Experienced human traders can still combine complex pieces of information to form conclusions that would elude the best computers.

Leverage, carry, and selling risk premium

Forever

Borrow at 2% and buy an asset that yields 7%. Carry and roll down. Sell insurance to hedgers. Sell SPX puts. These are the tried, tested, and true ways to generate consistent returns. These strategies produce non-normal returns and lead to occasional blowups and meltdowns and are often more beta than alpha. Tactics like timing on entries and exits and superior risk management, though, can make simple levered carry and option selling strategies more like alpha than beta.

Quant / discretionary combo

2012 -

While quantitative analysis was once mostly the domain of systematic and algorithmic trading programs, human traders now use more sophisticated quantitative methods. Combining the best quantitative analysts, the best datasets, and the best discretionary traders into one business pod looks to me like the ideal model for discretionary alpha capture in the current era.

Quantitative analysis is greatly enhanced by experienced humans who can ask the right questions. Models are great for many types of trading, but are not as good at other tasks such as predicting or reacting to regime change or handling one-off events.

All these styles of trading still work, off and on. The challenge is to find a trading style that gives you an edge in the current market, and then stay clear-eyed, open-minded, and adaptable so you can transition or pivot as the market changes. Your edge this month might not be your edge next month, or next year.

Thinking about my own evolution

When you first start in trading, you want to buy something at a certain price and sell it at a higher price. Most everything you do is directional and fairly simple. This is fine! Most of what I do is still directional and simple. But over the years I have added more layers.

The natural evolution after you learn directional trading is to get into options. Trading options is fun, but you realize after a few years that buying options all the time is not always the way to go. The biggest reason for this is that owning options tends to be wrong-way risk for directional traders. Higher vol usually means higher P&L (active markets are easier to trade than dead markets) so if you buy vol all the time, you are really screwed if things quiet down. Your trading is less profitable right at the moment you are bleeding theta out your ears.

I address this issue more fully in Week 38: How to sell vol without risk of ruin. Many vol-selling trades are still directional, though. You are selling a spread in the opposite direction of where you think the market will go, etc.

So eventually, I moved from only directional bets, to buying options, to selling options, and then one day I realized… If you are selling options, it can open up a completely new framework. Instead of betting on what will happen, you can start to bet on what you think will NOT happen. While this is not useful on its own, it can be a useful tactical edge when coupled with an existing forecasting edge. That is, sometimes if you know your market very well, you might have a strong sense of what will not happen, even if you don’t know exactly what WILL happen.

Before we get into how to profit from something you think will NOT happen, I want to excerpt a short bit of the latest piece published by Traderade. Traderade is a service I follow. It’s run by Michigandolf and others. I have no financial relationship with the site or the people there; I just like the writeups.

This excerpt provides an excellent example of two things. One, adapting to new regimes and new market structure. 80% of FinTwit is complaining about 0DTE options or proclaiming how they will bring down entire nations while the remaining 20% is busy trying to figure out how to profit from them. Be the 20%, not the 80%. Adaptation is about constantly having one eye on the horizon so you see new techniques, inputs, and market regimes as they appear. It’s not about whining when market structure changes.

The other reason I like the excerpt is that it’s a good example of a trader with a solid reason for thinking something will NOT happen. While they played it via a directional strategy, they could have also sold options on the other side of the Put Wall described in the piece.

One quick word on selling options. I have often written about selling options and done a video on the topic and my hard and fast rule is this: I never NEVER sell anything with unlimited downside. There are ways to do so, but it’s a completely different business model. It’s a business model I am not interested in because I value career longevity (avoiding risk of ruin) over everything else.

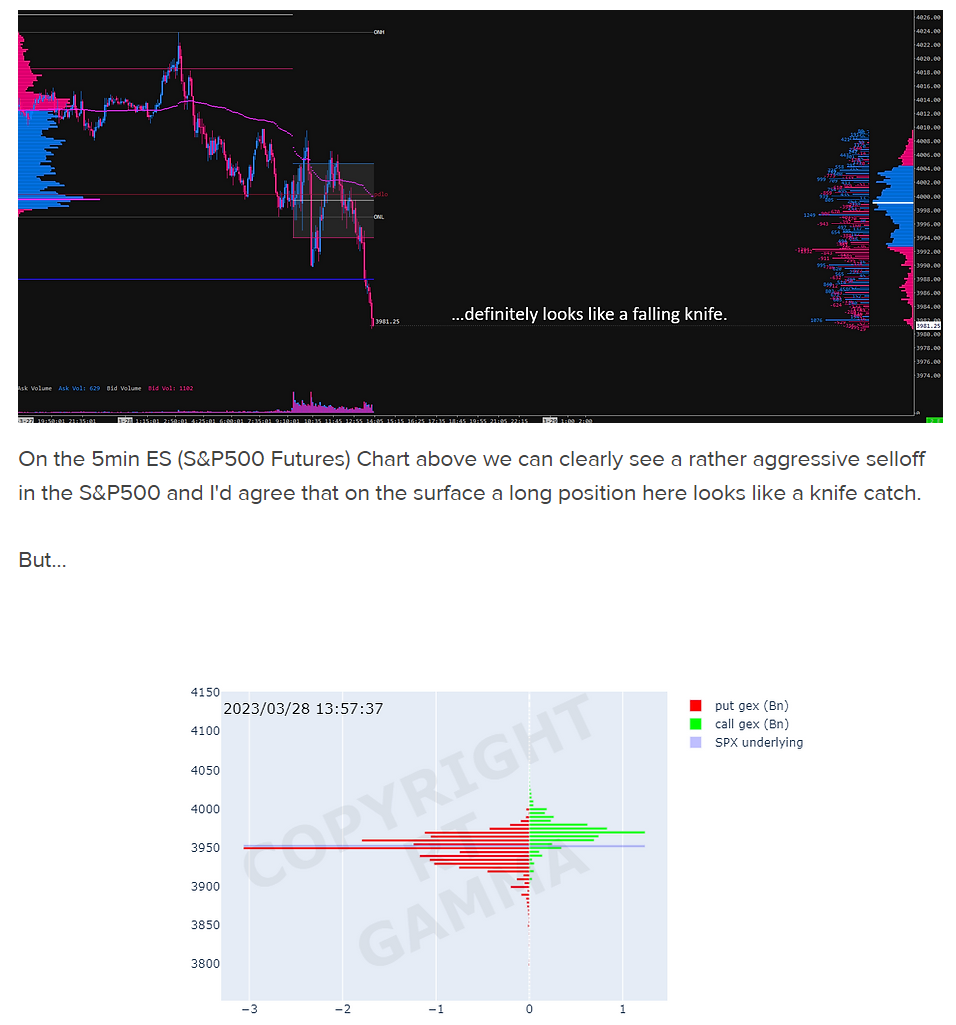

Here’s the excerpt from the Traderade piece (with permission).

.

So here, Horse identified the Put Wall and bought against it. Another approach would have been to sell put spreads against that level, or identify a stock you like and sell put spreads there. Obviously, in this case the futures exploded higher and Horse’s strategy was best. But it’s an excellent example of a case where you might say: “I dunno if we’ll bounce much, but we are going to have a tough time getting through that Put Wall, so I’m not going to bet on S&P futures going up, I’m going to bet that ES futures will NOT go down.”

Betting on what won’t happen

For the sake of this week’s exercise, let’s assume I think stocks are going nowhere. I think we are trapped in a loop where stock rallies lead to a more hawkish Fed but massive shorts and underweights are always on the bid any time stocks sell off. This has been the environment for the past 9 months, basically.

SPX: Blame it on the range

I lean bearish stocks, but I think there has been so much bad news that it’s hard to imagine what it will take to break the back of the market. The thing is, if stocks rally, I doubt they will go far because the calm that might help stocks rally will allow the Fed to keep hiking gradually and as the Fed hikes, more naked swimmers will emerge. So: I don’t think stocks are necessarily going down. But I don’t think they will go above 4100, either.

I am going to use options on SPY, the S&P 500 ETF. There is some basis between SPX (the index), ES (the index futures) and SPY (the ETF) but for simplicity, let’s say I don’t think SPY is going over 410.00. We can sell the 410/412 April 21/2023 call spread and receive around $0.65 per contract. If we’re risking $2000 on the trade, that’s 10 contracts.

Now the sad part about trades like this is that you do not get leverage. If the trade works, you win $650. But there is a reason for that! It’s more likely to work, than not to work. SPY is 400 right now and you are betting it won’t be above 410 on April 21, 2023. Very often, this is the nature of selling options with limited downside. Just like buying options often gives you unlimited profit potential (leverage!) … Selling options usually does not.

It’s all about expected value. Don’t get fooled by the optics… This could be a fine trade, depending on the odds you assign to the win and lose outcomes.

Note: 410/412 is a very skinny spread. There are reasons to do wide spreads and reasons to do skinny spreads but they are beyond the scope of this note. The point of today’s note is to get you thinking about different ways you can find an edge beyond pure directional trading. A discussion of the right way to sell spreads is a whole ‘nother post.

This trade on its own will not move the needle. But as part of a larger framework, I hope it gets you thinking about different ways to look at the market and different ways to structure your bets.

Conclusion

Your edge can come from many different angles. Studying your market and finding inefficiencies is one. Observing the entire macro universe and finding dislocations is another. As shown in today’s note, finding different ways to express and structure your views can also be a source of edge.

If you are a directional punter and you think “This thing ain’t going up, but it might just be stuck here for ages trading a range,” there is nothing to do. If you have other non-linear tools in your toolbox… There just might be something profitable to do!

Don’t forget to sign up for Friday Speedrun.

If you liked this episode, please click the LIKE button. Thanks!

My global macro daily is here

And this is my Twitter

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

Thanks for the nice write-up!

Why not use SPX options instead? They are cash settled, and so one wouldn’t need to risk-manage the position on expiration day so as to avoid waking up the next day and being short 1000 SPY shares in case SPY closed at $411. One SPX option corresponds in size to 10 SPY options at roughly the same strike.

Those who want to trade smaller size could use XSP options, which are equivalent to SPX options but one tenth the size. Both SPX and XSP options trade also overnight.

Great article this week. Appreciate it .

Hoping you will spend one of your four remaining weeks talking about spreads, narrow versus wide. And wondering if there’s a difference on the call or put side. Either way thanks for the 50 trades and 50 weeks.