Week 49: Numbers and Narratives

Wanted: Storyteller with mad quant skills - Lavish remuneration possible

This is Week 49

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

The SPY put spread is a tiny bit underwater and the Ford and TSLA shorts are in the money despite a big rally in the indexes.

The KRE trade from Week 47 is doing well while the AAPL trade from Week 48 is stopped out. Overall, the 50in50 portfolio is doing well these days considering it’s short a bunch of stocks and the SPX is near the top of the range.

Numbers and Narratives

I apologize for the delay on this episode of 50in50. I have been traveling and also I think subconsciously I don’t want it to be over and it’s pretty much done so I’ve been slow playing this thing. This week, I want to discuss something on the border between practical and philosophical advice.

There are many ways to succeed as a trader, but I think the path with the highest probability of success is one where you are strong on both the quantitative and qualitative sides. You can succeed as a pure quant, and you can succeed as a pure behavioral trader who simply uses anecdotes and gut feel. But most do not succeed this way.

The most likely path to success is to choose one market and master everything you possibly can about that market, using a combination of data / quantitative analysis and subjective analysis of narratives, positioning, anecdotes, pattern recognition, and experience. Don’t pick a methodology, because different methodologies work in different regimes. Pick a market and master it. This approach is inherently adaptable over time while mastery of a technique or strategy is much less flexible and regime-dependent.

Let me give you a few quotes about this sort of holistic thinking. This first quote block is an excerpt from Barry Ritholz’s excellent interview with Aswath Damodaran, one of the best voices you could possibly listen to as an aspiring trader or market practitioner. He’s smart, humble, and open-minded.

DAMODARAN: I am interested in numbers. I’m naturally a numbers person. But I’ve also been interested in storytelling. To me, storytelling is much more — I mean, if you think about the history of humanity, for thousands of years, the way we pass down information was with stories, not numbers. It’s only in the last century that numbers have come to the forefront.

RITHOLTZ: Is that correct, it’s just the last century? That’s fascinating.

DAMODARAN: In fact, I think the first numbers were collected by the insurance people in the 1700s, but it was very proprietary only. Now we have access to Excel and so on. It has allowed for this acceleration of number crunching. So, to me, you know what attracts me to valuation, it’s a bridge between stories and numbers. You tell stories about companies that you convert into numbers, and those numbers eventually become valuations, and I find that attractive. I’m not a natural accountant or an actuary. I’m not a natural strategist who can tell the stories. I like to connect stories and numbers, and valuation is the place to go to do that.

RITHOLTZ: So is it safe to say narratives drive value?

DAMODARAN: Narratives drive value. Absolutely.

RITHOLTZ: Now, sometimes narratives drive value to towns and cities they really shouldn’t go.

DAMODARAN: Sometimes narratives can become very dense, and that’s why you need numbers to keep your discipline. In fact, when I start my valuation class, I have 350 MBAs who take my class and it’s in an amphitheater. I start with the question, how many of you are more naturally number crunchers? And about 200 put up their hands; ex-bankers, recovering accountants, auditors, actuary, scientists, mathematicians. And the other 150 are natural storytellers, liberal arts majors because MBA programs have become incredibly diverse.

And I tell them what my endgame for the class is, I said, by the end of this class, and I turned to my number crunchers, I said, look, I hope you have enough belief in your own imagination that you’re willing to let go because they’ve spent a lifetime being told that being subjective is a weakness, making judgments about something is a weakness. And then I turn to my storytellers, I said, by the end of this class, I hope you have enough confidence with numbers so you’d become a disciplined storyteller.

To me, what makes for good valuation is you’re either a disciplined storyteller or an imaginative number cruncher. And I think that combination is getting increasingly hard to find because we’re categorized very early in life. I see this with my wife who teaches fifth grade, and already people are being slotted as natural number crunchers. They’re going to take number crunching classes. We can go for a number crunching degree, have a number crunching job. There are no Renaissance people left on Wall Street, and investing people who can talk about drama and talk about numbers at the same time. And I think that’s a loss.

RITHOLTZ: There are a handful, but they certainly are few and far between.

I agree with Barry’s conclusion and this was my biggest beef when recruiting students into trading jobs when I worked for big banks. The pipeline of people that come through the top analyst programs is glaringly homogeneous, with an emphasis on quantitative book smarts and less emphasis on creativity or street smarts. This is a broad generalization! There were certainly excellent, well-rounded graduates coming through every year.

Even if the programs attempted to achieve some sort of diversity, the diversity tended to be related more to demographic features, not manners of thinking. When you recruit from a group of 10 or 12 universities all located in the Northeastern United States, you are going to get a lot of really smart people that grew up with rich parents and incredible test-taking skills.

Again, I’m not dissing every single recruit! There were many, many good ones. And I understand that a recruiting process that is more bespoke would be less scalable and less efficient. The takeaway, though, is that if you are a polymath/Renaissance person, you have an advantage. And you don’t have to be born a polymath, either. You can be intentionally curious and build the weaker muscles in both your left and right brain.

This quote, from a somewhat obscure book called the Tao Jones Averages, is also good. The quote is via this write-up from Sapient Capital.

“The left-brained analytic system on Wall Street has become overdeveloped. Like a tree that has grown too large for its place in the forest, it has crowded out intuition, vision, creativity, and gestalt sensing, which are the properties of the right hemisphere. As professionals of the Street continue to try to overpower darkness, opportunities will exist for those who can sense new directions.”

Many of the best traders, analysts, salespeople, and strategists on Wall Street are polymaths who are part math professor, and part humanities PhD. You can succeed as a mainstream thinker on Wall Street, but the outliers are people that can think differently.

Here’s one more quote, this time from Stan Druckenmiller:

I think the great thing about my original mentor Spiros Drelles in Pittsburgh was he made me focus on what moves the stock price. Like you can’t just say, “Okay this is a great company and the earnings are great…” So tell me how people are going to think differently in 18 or 24 months about the situation than they’re thinking now.

That would be my number one advice to young people. Do not invest in the present. The present is not what moves stock prices, change moves them, and I want you to try and envision a different world in a year and a half from now, and where these security prices would trade versus now given the world you envisioned.

That would be my number one advice to a young person getting in the business.

In other words, conventional thinkers extrapolate. Original thinkers do not.

A word of caution here because I think a lot of people would assume this means you have to be contrarian all the time to succeed on Wall Street. That is not true. In fact, being contrarian all the time leads to a reflexive countertrend stance that will mean you miss all the big trends and you are fighting every major move. You can’t just put a negative sign in front of whatever the consensus says and assume that’s the right answer.

You need to be contrarian at times, and when you are contrarian you have to be right. Being contrarian all the time is a good way to feel smarter than everyone else while you lose money. Being selectively contrarian at times because your view of the future diverges from the crowd’s view is a way to find huge opportunities and inefficiencies in the market.

In Alpha Trader, I lay out the formula for trading success as:

Alpha Trader = rational + intelligent + skilled + conscientious + calibrated confidence

I stand by that formula, but looking from another angle, I would say that success in trading also comes from a strong fusion of quantitative and creative skills. If you want a great read on how this fusion of numbers and stories works in the equity valuation game, check out this wonderfully-detailed presentation from Professor Damodoran.

ADVERTISEMENT!

50in50 is almost over…

Sign up for Friday Speedrun!

We have a new, 5-minute-per-week Substack coming out! It’s called “Friday Speedrun”. Check it out here.

Get a clear explanation of what happened in global markets each week from a 25+ year Wall Street trader and global macro expert (me) and contributing editor Justin Ross.

It’s free, easy, and quick.

Five high-yield minutes each week.

SIGN UP HERE (it’s free)

Get smarter, learn more. Faster.

END OF ADVERTISEMENT

An attempt to be contrarian and correct

I have written many times about how trading stocks successfully always comes from an understanding of the interplay between price and value. Value is what you get. Price is what you pay. People tend to overpay for stories.

The ARKK ETF is a good example of this. They were so blinded by the religion of disruption that the story became the only thing and valuation and price became irrelevant. They used ridiculous inputs to create a veneer of quantitative rigor around what was really just a preconceived view that disruption stories are so powerful there is no price too high. They focused on a story (TSLA is great!) and then reverse-engineered the data to sell it.

If you have not seen it, my interview with Howard Marks in March 2021 is here. It covers the difference between good stories and good stocks. They are sometimes the same thing, but very often they are not. Cheap stocks are usually cheap for a reason and no matter how good a company is, it’s a bad bet at the wrong price.

Buffet says it best:

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

While the focus tends to be on buying good assets for low prices, the converse is often just as valid. Selling good assets short at inflated prices can be profitable, too. While it’s hard to make money shorting a bubble, there are plenty of times when it makes sense to short a good story when you believe that story is fully subscribed and more likely to mean revert than continue. You don’t need to expect a complete reversal in the story, you just need to have a contrary view on price… And good timing.

Some examples of this: shorting crypto in 2021 on the back of Fed tightening and the Bubblicious narrative, shorting Tesla when Elon was on the front cover of Time Magazine, shorting wheat when it was on the front cover of The Economist, or many lesser-known stories that captured the market’s imagination, then mean reverted like crazy… 3-D printing, the recent uranium frenzy, work-from-home stocks, etc.

Right now, we are in the midst of an AI frenzy. This can be ascertained via basic observation (it’s the only thing anyone is talking about)… But you can also see it through anecdotes:

There’s a cliché on Wall Street: “If it’s in the news, it’s in the price.” The real money is made by those who have unique views that are not obvious to everyone else in the world. Doing the obvious thing can work, but doing the obvious thing at nosebleed levels can be enormously costly. We now have AI on four magazines in less than three weeks.

Further reading on why magazine covers are often reverse indicators..

Meanwhile, here’s Google search activity for AI:

It has ramped up to all-time highs and is now starting to come off. Why would this matter? Search interest, demand for an asset, and the price of an asset often move in lockstep. More interest = more buyers. Here’s an example of how interest in crypto and the price of ETH move together:

“But dude! AI is going to change the world!”

Of course it is! That’s why everyone is so excited. World-changing technology is the stuff that price overshoots are made of. By the way, when you frequently hear the words “world-changing” with regard to a company’s technology, that is often a strong clue that the stock might be overvalued.

Zoom kinda changed the world, but it was still a terrible investment

When we think of the leaders in the AI race, we might think of NVDA or MSFT. Those stocks have gone to the moon of late, but so have many other megacap techs. When looking to short a narrative, you want pure play stocks that are faddish, not perennial behemoths like MSFT and NVDA. While I think MSFT and NVDA are wickedly overvalued and I would be underweight or flat both of them… They are tough shorts.

The data also points to another huge issue with shorting MSFT particularly. Their shares outstanding are in inexorable decline as they buy back more and more stock. If price is a function of supply and demand, you are running uphill trying to short a stock with less and less supply outstanding.

MSFT shares outstanding 2000 to now

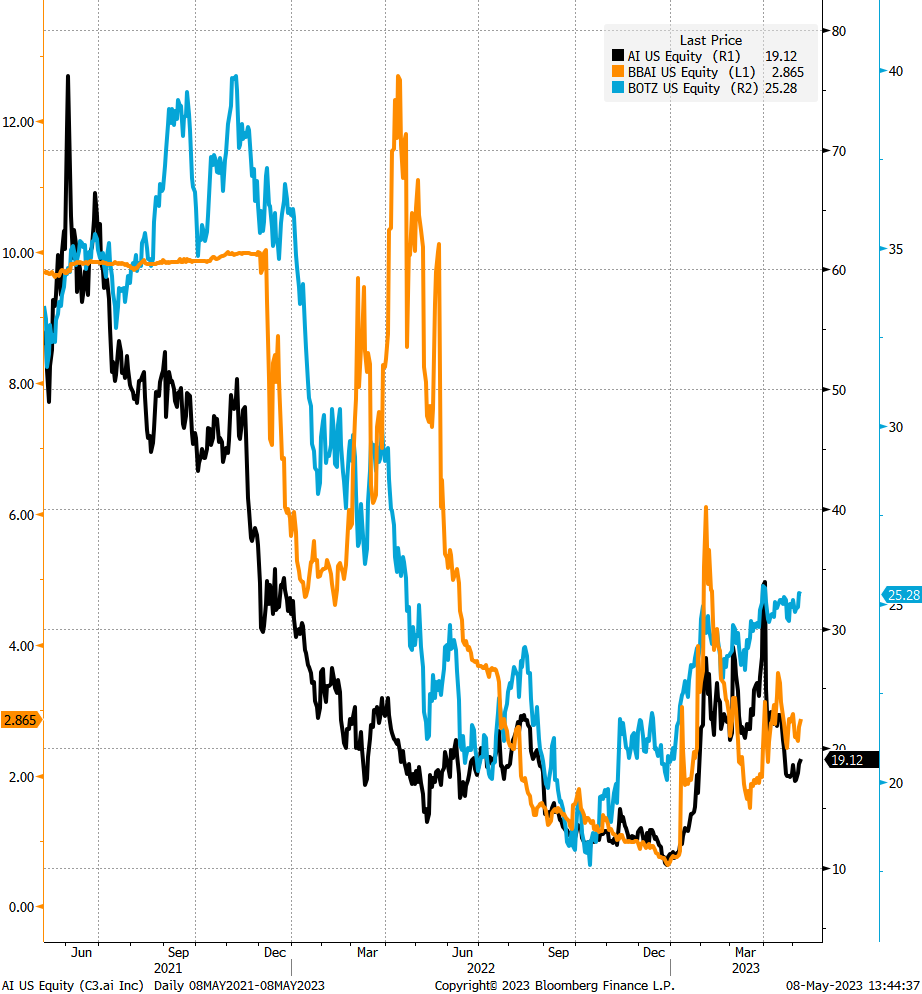

A more attractive way to short AI is to find the weakest links. For example, look at Big Bear AI, C3.AI, or BOTZ (The Robotics and AI ETF). All three are nowhere near their highs despite the (justified) hysteria over AI. I would always rather sell something like this that is already weak than try to short MSFT or NVDA as they rage like flying sky mutants up toward the mesosphere.

AI, BBAI and BOTZ (daily chart back to 2021)

So… To recap… The search data shows us AI interest has gone wild. Four magazine covers tell us it’s at the forefront of the zeitgeist. Shares outstanding data tells us MSFT is always going to be a tough short. And when we look at price charts, we can see the underperformance of the gimmicky pure plays.

Without any further information, I would consider a basket where we go short all three stocks. Digging a bit deeper, BBAI is trading at 2.68. I don’t like shorting cheap stocks because they tend to have much greater short squeeze risk. Remember you can lose infinity on a short, but you can only make 100%. Shorting low-priced stocks is a recipe for disaster, so BBAI is out.

Meanwhile, if you check short interest, 34% of AI’s outstanding shares are sold short. So there’s major squeeze risk there, too. But it’s the best expression of the trade because when we drill into the components of BOTZ, it’s really more of a robotics ETF than an AI ETF. We want to be short the maximum of the AI narrative, and that’s not going to be achieved via a robotics ETF.

C3.AI (ticker: AI) is a dangerous short, but shorting is generally always dangerous. To do it safely, you could use options, but for simplicity here I’m going to talk about shorting the stock. Don’t do this unless you know what you are doing. For a full video on how to structure bearish bets without getting your face ripped off, see my video here.

AI common stock, hourly back to March 2022

In that chart, I note that the old highs in 2022 were $23.50 and $24.50 (black horizontal lines), then we had the hyperactive AI bubble action that took us into the low 30s. After that last spike, and after we crashed back to earth, the red arrows show highs of $25.10 and $23.80. If we are back to a less bubbly regime as AI excitement peaks in the short term, we should not go back through that band of pre- and post-bubble highs ($23.50/$25.10).

Therefore, I think $26.25 is an appropriate stop loss and I will take profit back down towards the low of $11.11. This thing costs about 10% / year to borrow (estimated) so it’s expensive to short, but not prohibitively expensive.

Short AI at 19.25 with a stop loss at 26.26 and take profit at 11.11.

This is Week 49 out of 50, so I’ll call this a multi-month trade and I will check back in with a randomly-timed post sometime after Week 50.

Conclusion

Common sense observation of the narrative tells you that AI is in a super heavy hype cycle right now. Using anecdotal observations (magazine covers) and data (search frequency) we can conclude that now may be a good time to put on the contrarian hat and go the other way. We are not betting that AI will never matter—it will! We are betting that the narrative is fully subscribed and about to leak a bunch of air.

Using short interest data, technical analysis, data on ETF composition, and a common sense understanding of the asymmetry of shorting low-priced stocks, we narrow our choice to C3.AI. Note we are playing this from a pure max-narrative angle and we are not doing a DCF or anything of that sort. A comprehensive analysis of the company would add another layer of sophistication to this trade idea but that’s beyond the scope of this week’s lesson.

Bonus read… Related.

https://www.profgalloway.com/storytelling/

That’s it for this week!

Next week, I’ll offer some final thoughts on trading, a final trade idea, and comprehensive results for all the trades.

We are nearly at the end of the ride! I hope you have enjoyed the ups and downs so far.

Remember: I’m not telling you to do these trades. This is an educational Substack. The concepts are the thing, not the trade ideas. Always trade your own view.

Oh, hey… Don’t forget to sign up for Friday Speedrun.

If you liked this episode, please click the LIKE button. Thanks!

My global macro daily is here

And this is my Twitter

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

"I don’t want it to be over." We don't want it to be over either, Brent. Great work!

I came here thinking it would be like: Wk 1, bricklayer; Wk 2, plumber etc!

just for fun- good luck with your page!