Hi.

Welcome to Fifty Trades in Fifty Weeks!

This is Trade 10: The Metagame

Thank you for signing up!

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

Listen to this as a podcast on the web

… or Spotify

… or Apple.

Update: Open and recently closed trades

Short NQM2 is in the money and halfway to the take profit as risky assets slump and Fed fears mount. Move the stop loss to 15301 now (above the 100-day, 200-day, and late March tops)

EWC long at 37.85 is doing OK currently trading at 39.65, which isn’t bad considering broad equity market weakness. Take profit on EWC here as oil is slumping, global financials are not trading well, and the Bank of Canada meeting this week could hurt CAD. The thesis was that Canadian stocks are heavily weighted to financials and oil and thus should do well. As bank stocks fail to benefit from rising rates and oil slumps to $94 after touching $130 on the Russia panic… The thesis feels stale. Take the money and run.

Twitter long is stopped out. Another doge-like failed Elon pump, in the end.

The May $60 XPO puts are worth about $4.10 (cost was $2.60). Plenty of time left on the clock. XPO has come way off the highs and trades pretty soft. No change to the plan.

Update complete!

Today, I am going to talk about understanding the metagame, especially as it relates to messages from policymakers.

The Metagame

Good traders understand the game and they don’t play some other fictional game that only exists in their heads. This is similar to sports where weak competitors will complain about a new rule while others will find ways to adapt to it and capitalize on it. Or in school where high-performing students predict what will be on the test and low-performance students complain that the teacher is bad.

In markets: you can complain about central bank intervention and the death of free markets and crazy dovish policies and so on… Or you can attempt to understand them and trade profitably. It doesn’t matter what the Fed “should do”; it matters what the Fed will do. It doesn’t matter what is right or wrong. It only matters what is.

One classic example of this is in 2010 when the market was still gripped by post-GFC permabearishness. To give you a sense of how bearish the world was, there were two celebrity forecaster economists with the nickname “Dr. Doom” on TV. All the time. LOL.

Every headline was like:

Everyone was focused on the old game (economic performance, future growth, earnings estimates…) Meanwhile, up there on CNBC, hedge fund manager David Tepper and famed strategist David Zervos were bullish. All they cared about was liquidity. Obviously, Tepper and Zervos had the right framework while the majority of traders and investors did not.

Here’s Tepper with the best read on the market at the time. His framework was: Economy up: Good for stocks. Economy down: More QE, good for stocks. He was right! Almost everyone else was wrong. What did Tepper understand that nobody else did? The Fed put was the only game in town. He had no idea where the economy was going but he understood that forecasting the economy was not important.

While many in the market stuck with bearish outlooks on stocks for years after that, Tepper correctly identified that liquidity was the only thing that mattered and he performed incredibly well.

In the 2012-2015 period, there was constant shouting at the TV from rates traders who were paid rates and criticizing the Fed because “they should be hiking!” Same story in 2021. Too many traders were positioned for a move they thought the Fed should make, instead of trying to predict the move the Fed would make. The important thing is to understand that it’s fine to debate what the Fed should be doing, but to make money, you must predict what the Fed will do. Not what it should do.

Intervention

There is a long and rich history of central banks putting a floor under domestic equity markets. Japan conducted “price-keeping operations” (PKOs) from August 1992 to November 1993.

Japan Nikkei, 1990 to 1995

The most famous is when Hong Kong enacted price-keeping operations, buying HK equities directly in 1998. This operation was no secret. Joseph Yam explained it in a WSJ editorial on August 20, 1998. The editorial is interesting and informative. You can read it here.

Here’s how the Hang Seng responded:

Hang Seng Index, 1995 to 2000

While conspiracy theorists love to ruminate over the existence of a US Plunge Protection Team, no proof has yet emerged that this group actually intervened in US stock markets at some point. Personally, I would not be surprised, but whatever.

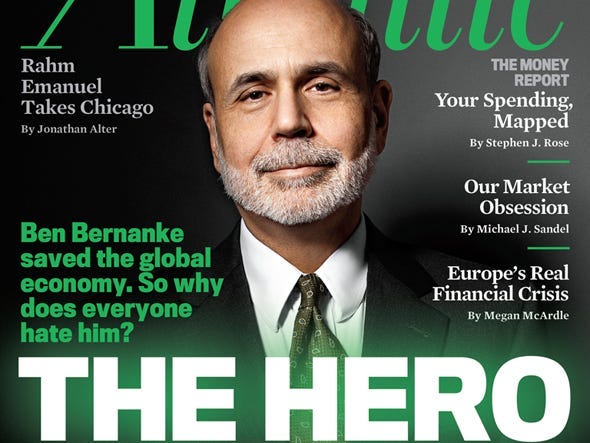

Fed Chairman Ben Bernanke pretty much announced the Fed added a third mandate: “make stocks go up” with this WaPo editorial in November 2010. That editorial ratified Tepper’s view that the Fed was all that mattered. By the way, the June 29, 2010 headline from the NYT (featured above) was the exact low in the SPX (1030) and stocks doubled by the end of 2014.

Over and over, the lesson has been: Governments have more money than you do. Be careful trading from the short side when the government says: No mas. In some cases like Japan 1993, the government eventually let stocks fall again as the risks to financial stability eased, but in most cases, an important low is put in when the government intervenes. Either way, there is always a trade.

So where are we now? The US government could not care less about stocks. They want inflation down and they don’t care what the cost. There is no Fed put… If anything, there is a Fed call as the higher stocks go, the more Fed hikes the market will price, and the more the Fed will hike in response. There have only been two US presidents that wanted higher interest rates: Jimmy Carter and Joe Biden.

Trade 10: Long ASHR

On the other side of the world, we got this headline from China today:

China Securities Regulator Says Supports Social Security Fund, Pension Funds, Trust, Insurance, and Wealth Management Institutions to Allocate More Funds to Equity Assets and Increase Capital Market Investment - Reuters

This is after the mid-March announcements from China that they vowed to support the economy and financial market stability. Those two announcements in tandem are about as close as you can get to China announcing PKOs without announcing PKOs.

While many people trade FXI as a US-listed China proxy, ASHR has a much higher correlation to the CSI 300 (75% vs. 46%). Both FXI and ASHR had absolutely gargantuan volume spikes in mid-March and that sets up a good tradable low for ASHR. The old highs are all around $31 as well so this sets up a great pivot.

ASHR (US tracking ETF for China CSI300), 2017 to now

There is no such thing as free money. It’s possible that the Chinese intervention is not as aggressive as it needs to be and it’s also possible that they just put a floor under Chinese stocks, but supply remains heavy and the bounces are minimal. You need to risk manage every trade.

In this case, you can get really nice risk/reward by putting the stop loss at $29.89 (below the pivot with a bit of room for an overshoot—I always like having my stops on the right side of the large round numbers, too. You can read more about round number bias here.) A rally back to $35 seems like the chip shot target and $40 is the more hopeful objective. In mid-February, there was a series of tops around 36.50 and so I think a TP at 36.44 makes sense.

As you know if you read my daily (am/FX) or my crypto notes, I have been bearish risky assets and bullish USD since April 4. I think the path of least resistance into the May 4th FOMC is: lower risky assets and a higher dollar. As such, you could pair this long China idea against short SPX and be market neutral. For the sake of simplicity, I’m just going to run this as one trade but I acknowledge that ASHR has some beta to US equity direction. I could double my NQ short or whatever, but the point of 50in50 is not to create an optimal portfolio, it’s to isolate where ideas come from and how to structure them.

A QUICK MARKETING BLURB

You should sign up for am/FX. That’s the daily global macro note I have been writing since 2004. In there, I explain all my live trade ideas (lotta FX, but also other asset classes) and give you all the global macro in an easily-digestible two or three-page note.

If you like what you are reading in 50in50 so far, you will love am/FX. It also includes a spicy nonsequitur each day to stimulate your brain jelly. Thanks.

END OF MARKETING BLURB

The right framework and the right game

The real lesson today is that the most important tool for any trader is the right framework.

If someone has been bearish equities since 2010 based on valuation or comparisons of US household net worth to stock market capitalization… They have the wrong framework.

If someone was playing for Fed hikes in 2013 and 2014 because they thought the Fed was crazy to keep rates at zero… They had the wrong framework.

If people are shorting USDJPY right now because equities are going down. They have the wrong framework. USDJPY is a rates trade, not an equities trade.

In late 2021 and through 2022, people screaming “too much is priced in for the Fed!” have had the wrong framework. When the Fed is following market pricing instead of leading it, pricing can go almost anywhere. The market gave the Fed 25 in March and they took it. Now the market is giving them 50 in May and they’ll take it. Playing the “too much is priced” game is not very fun when the Fed and the US government both want higher rates.

What is the right game?

Another way to think about this is to ponder: What is the right game to be playing here? A famous hedge fund manager stuck a Post-It note to his monitor in 2009 after the Fed and Treasury changed all the mark-to-market and stock shorting rules. It said “Long or flat.” He knew the game had changed and now it was time to profit from the coming bull market as governments had declared an end to the financial calamity of 2008. Sometimes just avoiding the hard trade is half the battle.

Separate your philosophy on free markets from this reality: The US is a mixed economy that has both capitalist and socialist characteristics. The government plays an important role in every global economy. Canada, Europe, and other “free market” economies too. There is no pure free market. To wish otherwise can be expensive.

Recognize the moments when the government is intervening in markets, and have a healthy respect for it, even if you find it morally repugnant.

Right now, in the USA, the government wants lower inflation at almost any cost. They don’t care what AAPL stock or GME or TSLA do. They care what CPI does.

At the other end of the planned vs. free market spectrum, China has just signaled they want higher stock prices. While they may or may not get their wish in the long run, I think it sets up an excellent risk/reward trade over the next few months.

The alternate hypothesis

I could write 2000 words about the alternate (bearish China) hypothesis here. China’s economy is dumping, the stock market there is nearly uninvestable, Russia is making them look bad, real estate is collapsing, and so on. All true! This trade is a pure play on government intervention being more important than all those economic fundamentals in China (for the short-term).

If ASHR makes a new low and I get stopped out, my idea is wrong, and life goes on.

That’s it for today!

50in50 goes long ASHR at 32.18 with a stop loss at 29.84 and take profit at 36.44

Risking 2.34 to make 4.26. Full trader framework is here. Given the high frequency of these trades and the fact I’m going outside of my main asset class (FX)… My conviction level has been about the same on all the trades. Risking 2% of capital every time. Same thing this time.

As always, I will monitor the performance and offer detailed updates as we progress. I will also do a detailed recap of the P&L after every 10 trades. That is, next week!

Thanks for reading.

Trade at your own risk. Be smart. Have fun. Call your mom.

If you liked this 50in50, please do me a quick favor and hit the like button.

My global macro daily is here

My crypto substack is here

And this is my Twitter

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

Thank you Brent! I've learned so much from 50 trades in 50 weeks and look forward to each new email (probably the only email I look forward to)

Great read