Week 32: Correlations flip!

Correlations are not stable or static

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 32

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

I had the correct lean on USD and risky asset positioning into CPI, but the release was too strong and AUDUSD ended up unchanged after one of the most insane equity sessions I can remember in recent years. The trade was a loser, despite a pretty good thesis.

I will put that trade in the “good decision / bad outcome” bucket. While a loser is still a loser, I feel completely different about a trade where my process was solid and I lost money, vs. a trade where I made a fundamental mistake or followed a flawed process. In this case, I had a good read on positioning, but the variance around the number itself was too high and that wrecked the idea. If CPI had come in anywhere close to expectations (or below), the trade would have been explosive. It was a positive EV trade that did not work out due to variance.

Also: It is with some sadness that I see the RBLX / CVNA spread (from Week 15) at more than +$20 after I squared that thing up in Week 29. But whatever, that’s life. Sometimes you’re gonna square up good trades before they have time to hatch. Try not to look at, or feel emotion toward, trades in the rearview mirror.

Correlations flip!

The number one question I get from new traders is: “Where do you get your trade ideas?” and it’s not a simple question to answer. First of all, I would say that if you work to become an expert in your particular market, you will find more and more that the good trade ideas come to you. They appear organically out of the hard work and research you put in.

Much of good trading is just making yourself available to the market and waiting for good ideas to materialize. The best traders don’t ‘scour for ideas’ – they pay attention to the constant flow of information on their screens and act only when something seems dislocated or poorly recognized. It’s an attentiveness game that relies on endurance – not a chart-scrolling game that relies on volume. In other words, trading is mostly a passive process. It is mostly not about trading. It’s about remaining patient while actively digesting information, not actively looking for trades.

Sometimes I look at new traders and I see them the same way I see aspiring YouTubers (like my son used to be!). So many kids want to be video game streamers or YouTube stars. And that’s wonderful. But I also think in a lot of cases it’s dishonest. Because the real question is: do you truly have a passion for sitting in front of a camera and entertaining an audience? Is that actually what you want to do, for years?

In most cases, the answer is no – what they actually want is easy fame and to play video games all day. And for aspiring traders, the question is: are you truly passionate about markets? Do you actually want to spend your whole week paying attention to markets and correlations and commodities and monetary policy? If you do, awesome. If you don’t, then you might be fooling yourself about why you’re actually doing this.

And that’s not meant to be discouraging – it’s meant to help you assess yourself realistically so you don’t waste money or spend your time on something that doesn’t actually fulfill you.

The more you understand your market, its microstructure, the factors, stories, and narratives that drive it, and the correlated markets swirling around it… The more often you will see a bunch of information and market activity come together in a clear picture, the way a fuzzy view comes into focus through binoculars, or the way a jigsaw image reveals itself as you put together the pieces.

One of the most complicated, but useful ways to generate trade ideas is to study prices and inputs of markets and economic variables that are correlated to your market and find signals that help you predict future direction. As with everything in markets, correlation trading is probabilistic. You don’t say “Gold is higher, so gold mining stocks are definitely gonna rally!” You think: “The rally in gold suggests short-term risk/reward in gold mining stocks is positive.”

Where to look for correlations

There are so many ways to use correlation to your advantage. The world has evolved significantly since I started trading and there is much less edge in correlation trading than there used to be. But still, it’s a great tool.

Here are some examples of correlations that can help you trade and forecast markets.

Single name vs. index

When I was day trading in the late 1990s, most of my edge came from listening to the S&P pit squawk and getting ahead of single-name moves thanks to my better real-time understanding of where S&P futures were trading, and where they were headed.

This is one of the simplest examples of a correlation: Equity index vs. single-name equity. Naturally, these correlations are arbitraged away by algorithms now, especially when the single stock is a member of the index. Still, you can watch the relationship between single stocks and equity indexes and sometimes extract information and make predictions from relative performance.

Single-name sympathy plays

When Nike makes a negative earnings announcement, the market will assume this is bad news for the entire sports apparel industry. Therefore, when Nike drops, stocks like Lululemon (LULU) and Under Armour (UAA) will probably drop, too. Markets are very, but not 100% efficient in pricing in sympathy plays. For example, you might notice that LULU reacts almost instantly to bad news from NKE but a stock like Dick’s Sporting Goods (DKS) might react with a short lag.

Nike (black), Lululemon (cyan), and Under Armour (orange)

If you know your sector and know your stocks, you can jump on sympathy plays if you are quick. When I was day trading in the late 1990s, this was a major source of P&L for me, and I still trade sympathy trades now.

You can also trade sympathy in other markets, for example: If good news comes out on UK gilts (the UK 10-year bond)… US bonds will normally rally in sympathy. If the Bank of Canada hikes rates unexpectedly, AUDUSD will usually rally as the market sees a read-through from Canadian to Aussie monetary policy.

Commodities and yields vs. currencies

I remember sitting on the trading floor at Lehman Brothers in 2005/2006 and more than half the FX traders didn’t even have a live feed for gold, copper, or oil. My co-workers would ask me “What’s oil doing?” or “Where’s gold?” which seemed completely ludicrous to me (because it WAS ludicrous!). How could people trade FX without knowing where other markets are trading?

This all changed in 2007/2008. Correlations between FX and other asset classes jumped toward 1.0 and FX traders suddenly understood how important it was to watch other markets. Now there are armies of algorithms that trade FX correlation in real time. There is a phalanx of hedge funds analyzing fair value of currencies using complex quantitative cross-market analysis models. There are fintech startups that will tell you what is driving currencies right now according to their multivariate Granger causality or AI regression or machine learning models. Even with infinitely more competition, though, intermarket correlation is still a great source of understanding and edge for discretionary human FX traders.

Relationships such as the US 10-year yield vs. USDJPY worked well in 2006, and still work well now. Here’s the overlay over the past two years:

USDJPY (black) vs. US 10-year yield (blue)

Market variable vs. economic data

Many economic releases are highly correlated to market variables. For example, consumer confidence in the United States is highly correlated to gasoline prices. More recently, one might suspect that German business confidence would be related to European energy prices.

If you had no other information, and you looked at this next chart, you might reasonably guess that the next German PMI figure (which comes out October 24), is likely to be higher, not lower than last month. The huge drop in gas prices should restore some European business confidence.

Germany PMI (black) vs. Dutch Natural Gas prices (inverted, left y-axis)

While economists should in theory forecast economic data using these high-frequency, predictive variables… Economists don’t update their forecasts very often and not all economists use these variables in their models. This is especially true here because energy prices in Europe were not nearly as important for German sentiment pre-2022 and thus most models would not incorporate them.

Questions to ask as you consider correlations

As the title of this piece suggests, correlations are not stable and they are not static. What worked yesterday is not guaranteed to work tomorrow.

Whenever you see or read about a correlation in financial markets, you need to ask yourself:

Does the correlation make any econometric/logical sense? This is the most important question of all. I don’t care if the r2 is 99.9%… If the relationship has no underlying logic, either forget about it or search for a reasonable explanation. Otherwise, it is likely a spurious correlation. Spurious correlation is when people infer a cause / effect relationship between two variables when there is no logical or actual connection between them.

Is the correlation likely to continue into the future? Correlations are inherently unstable. You need to make a logical assessment of whether or not a given correlation will continue into the future. This comes mostly from experience. Correlations like interest rates vs. currencies have existed pretty much forever and will tend to be reliable most of the time whereas the correlation between, say, natural gas and CAD might work at times and be completely useless most others.

Are there periods of both rising and falling prices in the sample? It is more likely a correlation is spurious if it is simply two prices going straight up or straight down. You can easily find a bunch of price charts that have been rallying steadily for a given time period and then overlay them to imply some relationship. If prices go up and down together, it’s more likely that you haven’t simply found two smooth trends that happened at the same time by coincidence.

What third variables might be influencing the movement in your two variables? You will hear over and over that correlation does not imply causation. That is true–but it certainly provides a clue! For example, the Canadian dollar and Canadian interest rates are both driven by expectations for Canadian growth (the third variable) and as such it makes sense that Canadian yields and the Canadian currency would move somewhat in tandem.

.

To read much more about how correlation impacts markets and what causes cross-market correlation, please read 50in50, Week 2.

Correlations flip!

In question 2 above, I ask: “Is the correlation likely to continue into the future?”

That’s an important question!

2022 has served up some incredible correlation breaks. For example, the relationship between interest rates and the value of the UK pound flipped.

GBPUSD (blue) vs. UK 10-year yield (black)

Normally, when UK rates go up, it reflects good news about the UK economy and stronger growth and inflation. Today, when UK rates go up, it reflects fear of insane fiscal policy in the UK and a possible sudden stop of capital flows into Britain. This flip in correlation was an important negative event in global capital markets.

The relationship between energy prices and many currencies has also completely flipped. Here’s crude and EURUSD:

NYMEX crude oil (black) vs. EURUSD (purple)

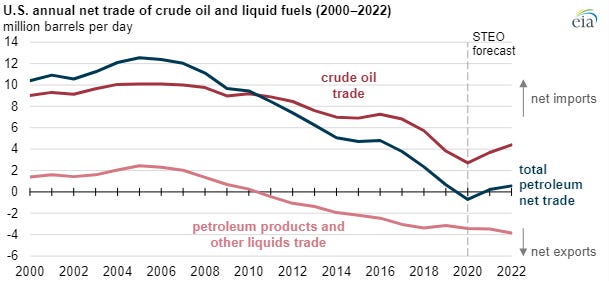

From 2000 to 2020, moves up and down in oil generally reflected ups and downs in global demand. The US dollar tends to rally when global demand is weak because it’s a safe haven in global recession. The dollar used to sell off when oil rallied because of the implications for global growth, and also because the US was a net importer of crude.

Higher oil meant lower USD for most of the past 20 years. But here’s how the US oil import/export balance has evolved over time.

The US used to be a net importer of crude; now it’s a net exporter. Meanwhile, with the war in Ukraine, the EU is having trouble finding a reliable source of energy. Instead of buying cheap energy from Russia, using euros, Germany needs USD to buy expensive energy from other nations such as Qatar, or Canada. Here’s Germany’s Trade Balance:

Germany Trade Balance, 1971 to now

Oops. All gone.

But it’s not quite that simple

Based on the discussion above, one might expect that oil exporters like Canada and Norway would see their currencies ripping higher the way the USD is exploding to the moon. But they are not. The correlation story is always hypercomplex and depends on many details.

The most important detail is often the specific nature and direction of the cashflows. If Canada is selling crude at higher prices, but all that revenue is going to foreign shareholders… And Canadian energy companies are not investing in new projects… The benefit to CAD will be minimal. That is exactly the case right now.

The incredible changes in the flow of energy around the world have led to some major changes in FX and other market correlations. The USD used to be highly-connected to the price of oil. Higher oil meant a weaker USD for most of the period from 2000 to 2020.

But shale has made the US much more energy independent and the war in Ukraine destroyed Europe’s manufacturing business model. They relied on cheap Russian gas and as the gas is cut off, their terms of trade has collapsed. As such, the relationship between the dollar, the euro, and energy prices has flipped. This type of shift in correlation happens regularly, though mostly on a much smaller scale than the massive flip in energy correlations over the past 12-18 months.

Sell USDNOK as equities rally

The market has been obsessed with energy prices since the war started in Ukraine in late February 2022. An “obvious” trade into the war was to buy the Norwegian krone because Norway is a massive exporter of energy with a massive current account surplus and very little geopolitical risk. The next chart shows how that played out.

The chart shows NOK in black and oil in green. You can see that in 2015, oil and NOK sold off in tandem. Same thing in 2020, then they both rallied back in 2021. But then, in 2022, there was a massive decoupling.

NOK vs. oil, 2012 to no

The reasons for this decoupling are complicated, but mostly come down to the fact that the Norwegian fund that manages the oil revenues has been a massive holder of foreign equities and it hedges those equities quite actively. If equities fall, Norwegian asset managers need to sell NOK to rebalance their hedges. So while the oil correlation fell, the equity market to NOK correlation looked like this in 2022:

S&P futures (black) vs. NOK (orange) since July 2022

If you wanted to express a view on equities, you could use NOK and get a pretty good synthetic S&P 500 trade!

In Friday’s and today’s am/FX, I outlined why I am bullish risky assets, including stocks, for the next few weeks. But instead of going long S&P or NASDAQ futures, I decided to go short USDNOK (that is, long NOK and short USD).

Here is what I wrote:

When you look at equity correlation to FX markets, CAD and NOK always pop up as two of the most tradable correlations. I don’t love long CAD because I am worried about the mortgage reset problem there and the risk that the Bank of Canada Outlook Survey today could be dour (10:30 am NY time). I don’t think we are far from a BoC pause, despite consistently hawkish words from Macklem, et al.

I am pre-empting the breakdown by going short here, simply because I think the triangle offers close enough resistance that you can get short here (10.55) with a stop at 10.92, targeting 9.8800. A move back towards 9.80 would be a full round trip of the move up that started with the September 13 explosion higher on US CPI. The spike high after last week’s US CPI figure was 10.8600 and that is why I think a stop at 10.9200 makes sense. That is also above the quintuple top at 10.90 (start of October.)

In contrast, there is nothing coming out in Norway until the 20th of October. USDNOK is forming a nice triangle on the hourly chart and 2022 has been marked by a consistent stream of great setups featuring either triangles or horizontal lines. Here’s the chart:

USDNOK hourly

Lower USDNOK is a higher SPX trade (~70% correlation), so if stocks collapse, this idea will not work. Why not just be long S&P futures? The risk/reward looks better to me in USDNOK because you can have a tighter stop and I would argue that NOK got more oversold than S&Ps. The high in the RSI for USDNOK was 80 while the SPX RSI never got much below 30. They are both similar trades, but I like short USDNOK better.

If you want to know more about my bullish stock market view, please subscribe to am/FX. You will get my global macro thoughts, live trade ideas, and some random silliness in your inbox every day… Subscribe here. If you are passionate about markets, learn from an experienced professional. It’s a good investment. Really good.

Conclusion

Correlations are not static and they are not stable. They come and go, and they even completely flip sometimes. A good understanding of macro will get you ahead of the curve on correlations and help you predict changes over time. A good understanding of correlation will help you find good trade ideas and think of interesting ways to structure them.

I am bullish stocks over the next few weeks, but I think the setup is even better for the highly-correlated Norwegian krone. It got more beaten down than stocks, it’s super correlated to stocks, and it’s tracing out a beautiful triangle on the charts. If we can take out the bottom of the triangle and strong support in the 10.35/10.40 area, 9.85 quickly becomes a reasonable target. So 50in50 goes short USDNOK at 10.53. The take profit is 9.88 and the stop loss is 10.92.

Correlation and intermarket trading are huge topics. You can read more in Week 2 of 50in50, in many of my daily am/FX notes, and in my first book, The Art of Currency Trading (Chapter 8 is “Understand Correlation and Intermarket Relationships”).

Trading correlation is challenging, but over time, it gives you a much deeper understanding of your markets, and global capital markets as a whole.

There are macroeconomic reasons for relationships between markets and there are micro reasons for these relationships. The global economy is a complex system of nearly infinite connections. When one asset price moves, the trigger for the move could be something relevant to other assets as well. Similar to chaos theory where a butterfly flaps its wings in the Amazon and triggers a monsoon in Thailand, every action in the global economy can be caused by and can also trigger other complicated actions and reactions.

The more you watch, understand, and trade correlation, the better you will understand the wildly complex, interrelated, and ever-changing systems that make up the global economy and capital markets.

That’s it! Thank you for reading.

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.