Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 34

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

The USDNOK short from Week 32 was decent. Squared it up at a profit at 10.33 ahead of FOMC (as outlined / planned last week). CIBC stock is ripping higher on the strong Canadian data and China reopening optimism but I am skeptical this China bullishness will continue. I think it’s a positioning unwind story in China for now, not a new macro event.

Nosce te ipsum

Nosce te ipsum is Latin for “know yourself.”

The Ancient Greek aphorism "know thyself" is one of the three Delphic maxims. The other two maxims are "nothing to excess" and "certainty brings insanity." It’s easy to connect all three of these aphorisms to trading and while today’s piece focuses on know thyself, here’s how the other two connect to trading psychology.

“Nothing to excess” means two things to me in trading and markets:

Don’t obsess about trading. Turn your phone off before you go to bed and turn it on in the morning. Don’t install a Bloomberg terminal in the can. Those stories of guys with trading screens in the bathroom are neat but do you really want your life dictated by S&P futures? Reminiscences of a Stock Operator is an awesome book, but Jesse Livermore’s excess in his trading and personal lives led to his eventual suicide. Trading is what you do, not who you are.

Trends don’t last forever. There is a point where excessive attention and excessive price moves become destructive for a trend. The best cure for high prices is high prices because when a commodity or stock price runs too far, it triggers changes in supply and demand that eventually lead to mean reversion. 2021 is a classic example of excessive liquidity and excessive animal spirits where excess eventually leads to ruin. Oil prices after the war shock, same deal.

.

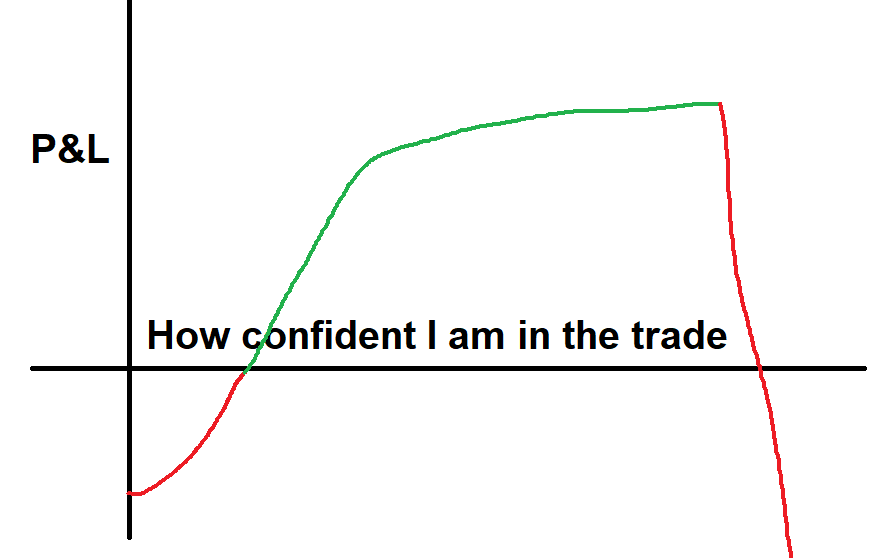

“Certainty brings insanity” is a perfect aphorism for markets because you should always be thinking in probabilistic, not deterministic terms. Most people have a confidence vs. outcome curve in trading that looks something like this:

Overconfidence is kryptonite in trading and humility is a superpower. If you are cheering your positions because you “nailed it!” or you are doing the trading equivalent of the football team pictured below, that’s not good.

San Francisco celebrates prematurely in the 3rd quarter of the Super Bowl; their overconfidence soon leads to ruin

Confidence is critical but overconfidence is deadly.

If you think all your trades are 5-star home run/amazeballs ideas, your ability to determine the expected value of those trades is likely to be hampered by this overly rose-colored view of the trade’s prospects. Overconfidence leads to overtrading, poor assessments of probability, and rigid, closed-minded assessments. Overconfident traders are also less likely to explore alternative hypotheses and will embrace confirmatory information much more openly than contradictory information.

Overconfident traders:

take too much risk

trade too frequently

behave recklessly

make poor assessments of probability

do not keep an open mind

overweight evidence that confirms their idea and ignore evidence that does not

fail to consider alternative hypotheses

refuse to admit when they are wrong

.

Most wise aphorisms and self-helpy truisms apply directly to trading. The Three Ancient Greek aphorisms are no exception.

Now, let’s get back to Ancient Greek aphorism number one.

Know thyself

The most exciting, crushing, fun, and also soul-destroying aspect of trading is the way it forces you along a journey of self-discovery. This is big juicy stuff, and it’s easy to be cynical about phrases like “journey of self-discovery”. Cynicism on this topic isn’t warranted or useful. Whether you want to admit it or not, the pursuit of trading as a profession is a journey of self-discovery. No trader or human being is fully formed when they start trading. Trading forces you to learn about yourself—mostly the hard way.

If you are going to pursue a career in trading, you can’t keep making the same mistakes over and over. While you can quickly learn to fix procedural and process errors, the mental errors of poor discipline, irrational behavior, persistent bias, and emotional interference are not easily fixed with a few tweaks of a spreadsheet or systematic automation of a process.

I wrote last week about the two sources of edge in trading and how they are both necessary for success. You need alpha (tactics or strategy that take money out of the market) and you need a rigorous set of mental and functional processes.

Journaling and writing can be a big part of developing good processes and that’s why I spent Week 33 on the importance of writing things down. This week, let’s talk about a trickier part of process: the ongoing effort to know yourself, build on strengths, and eliminate leaks.

Not all traits can be modified but humans can change significantly over time. Your starting point should be that all traits are malleable and you can improve almost any part of yourself over time with enough effort. On the other hand, there is value to admitting the things you cannot change about yourself because those weaknesses need to be addressed not by “I’m gonna get better” but by introducing systems that acknowledge the weakness and buffer or eliminate its negative impact.

But always start with a growth mindset. Start by assuming that your flaws can be fixed.

The Growth Mindset

If you have kids, you may be familiar with the idea of the growth mindset because it is a perennial trendy topic in education. The idea was popularized by American psychologist Carol Dweck. Here is how she defines it in a 2012 interview:

In a fixed mindset, students believe their basic abilities, their intelligence, their talents, are just fixed traits. They have a certain amount and that's that, and then their goal becomes to look smart all the time and never look dumb. In a growth mindset, students understand that their talents and abilities can be developed through effort, good teaching and persistence. They don't necessarily think everyone's the same or anyone can be Einstein, but they believe everyone can get smarter if they work at it.

When you reflect on particular negative traits you possess and think “that’s just who I am” or “that’s just me”, you cannot grow. Instead, embrace the surprising plasticity of the human brain and keep learning, evolving, and improving.

This concept is similar to the Japanese concept of Kaizen or “good change” which was a key ingredient in the superior quality and productivity of the Japanese automakers as they eclipsed North American car makers in the 1980s. With Kaizen or Growth Mindset (aka, continuous improvement), you always look to make incremental positive changes and continue to grow.

Without a growth mindset, you will wrongly believe that many of the traits, strengths, and weaknesses you possess are fixed or too difficult to change. That’s not the right attitude. Pick a weakness, and work on it. You will notice improvement over time.

When someone says, “I’m not a people person” or “I’m not very good at math”, that’s a fixed mindset. Clearly, people are built a certain way by genetics and personality, and this is augmented by environment. That is your starting hand. A growth mindset says that you can overcome your starting hand by playing well, and thereby outperform your baseline or starting point.

Here’s a quick summary of how the two mindsets contrast:

Even if you were the most disorganized kid in high school, all over the place in university, and live like a pig now, you can still become an organized person. You have to drop the idea that you are a certain way and embrace positive change. You don’t need to take radical action; make continuous small changes. Start small and keep improving every day.

Here is conscientiousness by age:

Conscientiousness by age (average of males and female score)

Remember though, this is an average. Averages camouflage the substantial variance within a sample. Conscientiousness evolves differently in specific individuals over time. Some people will massively increase their conscientiousness as they grow. Some will flatline their entire life or even become less conscientious. This is in contrast to other facets of personality like extraversion, which tends to remain steady over a person’s adult lifetime (on average).

If you’d like to see where you score on the Big Five personality traits (openness, conscientiousness, extraversion, agreeableness, and neuroticism), check out this link. It’s useful to do these types of personality evaluations because while they will mostly reveal what you already know, they will also bring up subtleties and information about you that you may not have realized.

You can learn much more about how the Big Five relate to trading success in my book Alpha Trader.

In that book, I include a personality questionnaire that relates directly to trading as it looks at all the key traits that make a successful trader. I humbly request that you please fill out this 5-minute survey before continuing with this piece.

You can learn how to interpret the results in Alpha Trader, but most of it is pretty self-explanatory. Note that there are not that many “must have” traits to become a successful trader. The key isn’t having specific traits or qualities, it’s knowing where you’re strong and where you’re weak and making the right adjustments.

For example, risk-averse traders can succeed just as well as risk-seeking traders. They just have to think and behave differently. For every successful trader that tends to err on the side of too little risk, there is one like me who tends to err on the side of too much.

After working on various trading floors for many years and studying the research on trader success and failure, here are my best estimates for the ideal characteristics of the Alpha Trader:

Remember, this is just me throwing subjective darts. This is not science or math. Reasonable people could easily disagree on my choices of where to put the X’s. It’s just a starting point for you to assess yourself.

Once you have completed the questionnaire, compare it to that grid and see where you are substantially different.

There is not enough room to discuss the importance of each trait in this note, of course. One of the main objectives of Alpha Trader is to help you identify your strengths and weaknesses and figure out how to level them up. This piece is about starting the process of understanding yourself and the questionnaire is one step in that direction. Consider this the self-evaluation phase.

The self-improvement phase is in your hands.

Now, pick one trait (a strength, or a weakness) from the survey you completed, and ponder how you will level it up.

One goal

I am a big believer in working on just one or two measurable and achievable goals at a time. Let me explain.

When I was a senior manager at a bank, we used a formal corporate goal-setting system, and it usually allowed for somewhere between five and fifteen goals to be entered. I found that was just way too many goals for me to supervise or coach as a leader and way too many goals for an employee to manage as an individual.

I eventually instituted my own “One Goal” system. I told the people that worked for me that all those goals in the corporate system were great, but all I cared about was their one most important goal. I asked them to e-mail me that goal and explain why it was important and how they planned to achieve it. This was effective. I saw much more impact from this One Goal system than I ever saw from more formalized, multi-goal systems.

This is consistent with Jocko Willink’s approach in the book “Extreme Ownership.” Prioritize and execute. If you pick seven things you want to work on, guess what? None of them will receive the necessary attention. If you say: “I’m going to work on my intellectual flexibility this month because my permabear bias is hampering my short-term trading.” You’ll benefit. If you say “I’m going to work on these six traits this year to become a better trader.” You’ll flounder. Pick one thing and work on it.

Here are some examples of how to level up… Just to get you started. These are excerpted from Alpha Trader and are just the tip of the iceberg to wet your whistle.

Level up your self-discipline

If you have poor self-discipline, admit it. Then create systems to deal with it. Too many people just hope they will be stronger and more disciplined next time instead of creating friction to prevent unwanted actions, and automating desirable habits.

Outsource discipline as much as possible. For example, every time you put on a trade, load up an automated stop loss right away. If you have a team that works for you, keep your hands off the buttons and let them get you in and out of trades according to parameters you set in advance. Remember that once you put a trade on, the bias kicks in. You often start to overthink, overreact, and overanalyze. Stick with the parameters you selected when you entered, automate or outsource the stop loss, and take profit so that you do not overtrade.

Create a clear set of risk management rules and keep them as simple as possible. If you have a daily stop loss of $100,000, it’s easy to know when you are done for the day. On the other hand, if you use a very complex set of rules governing your risk management and have no clear eject button, you are more likely to crash. Always have either a daily, weekly, or monthly stop loss (or all three) to manage risk of ruin.

Meditate or do yoga. A mind in a state of agitation has less self-control and less willpower. Learn about mindfulness. Check out dailystoic.com.

Read books about willpower and self-control. It is a trait that is innate to some extent but can also be built. Willpower: Rediscovering the Greatest Human Strength by Roy Baumeister and John Tierney is excellent, as are The Science of Self-Discipline by Peter Hollins and The Disciplined Trader by Mark Douglas.

When you are done reading these books, create a short list of takeaways: two or three actions you plan to take to improve your process and become more disciplined. Keep things as simple as possible.

Get a coach. There are many levels of coaching available for traders. When I worked at a hedge fund, we had a coach that came in once a month and I found the process useful. I found I did most of the talking and the coach prompted me and helped me find my way. There are online trading coaches available too, but do your homework before hiring someone.

.

Level up your willpower

Don’t say things like: “I’m just like that” or “I’m really disorganized” or “That’s just who I am” when it comes to conscientiousness. Being organized or on time or proactive is a choice. Think of your mind as plastic, not fixed.

Read the book: “Willpower: Rediscovering the Greatest Human Strength”, by Roy Baumeister and John Tierney. It is packed with research and anecdotes about how to improve not just your willpower, but your organizational skills and your metacognition. I learned a ton of immediately applicable information from that book, including how to keep my inbox empty. It also taught me how we have a finite supply of willpower each day and thus willpower often runs low, especially at night. And the book taught me the importance of Zeigarnik Loops.

Acknowledge your willpower is not perfect and create systems to protect yourself from this weakness. Create friction in places where you engage in activities you should not. An example of friction is when people turn off their phone while at dinner to avoid checking it. By making it a hassle, you are less likely to perform the habitual or addictive behavior. On the other hand, reduce friction to reinforce desirable habits.

For example, if you want to get in shape, don’t make yourself decide whether to work out or not each day. Work out every day. And go to bed in your workout gear so you have one less step to take in the morning before working out. When the decision is already made, there is less friction. In trading this means you need to build systems and install processes that protect you from unwanted behaviors like overtrading while working to automate desirable behaviors. Delete the trading app from your phone if you overtrade on it. Institute an unbreakable rule that every position must be matched with an automated stop loss in a system.

.

Level up your quantitative skills

Learn about expected value (EV) and decision trees. These are especially useful when trading economic or market events with discrete outcomes.

Learn Python. This is rapidly becoming the standard for data analysis in finance. Excel is fine but not as good as Python. Not even close.

Take a course in statistics, probability, or data visualization.

Read academic research papers about the assets you trade. Freely available academic research is a hugely underutilized resource. Most research can be found and read online. Go to Google Scholar and type in a topic you find interesting (e.g., stock market inefficiencies, trading psychology, currency valuation or high-frequency trading). If you find a good paper, go to the bibliography and read some of the papers cited.

Learn about Bayes Theorem and Bayesian updating. There are many, many good websites on the topic (e.g., towardsdatascience.com). The basic idea of Bayesian updating is that good forecasters start with a prior probability and then update it as new information comes in. This is in contrast to people that form an opinion and then ignore new information. Good thinking and good forecasting are not possible without Bayesian updating.

Read Superforecasting by Phil Tetlock and Dan Gardner. This is one of the best books on statistics and forecasting, and it has tons of applications both in the real world and in trading. The book also does an excellent job of explaining Bayes so you kill two bullet points with one stone if you read it. I would say Superforecasting is one of the books that has most influenced my quantitative thinking style (along with Fooled by Randomness by Nassim Taleb, Risk by Dan Gardner, and Thinking in Bets by Annie Duke).

Backtest your ideas. If you notice that stocks tend to fall every Monday and rally every Tuesday, backtest it. If it feels like oil rallies every day from 2 PM to 3 PM, check it out. Is it true or false? Whenever a hypothesis appears in your head, dig in and figure out if it’s true. Playing with ideas and data like this can inspire new ideas and a better understanding of the inner workings of the markets you trade. If you don’t know how to backtest, just open Excel and start messing around. This is the kind of thing you can teach yourself with a bit of effort.

.

Level up your creativity and curiosity

Study other asset markets or businesses with linkages to your market. The more you understand the iron ore market, the better you can trade the Australian dollar. The more you understand American Airlines, the better you can trade the airline ETF: XAL. Drill into the principal factors that drive your market and learn about them in detail.

Read about random and varied topics. It seems so obvious but I never really understood this until recently. If you read voraciously, you load new information into your mind and that information can then cross-pollinate with old information and spark new ideas. Most ideas come from combining two forms of disparate knowledge. If you read about art, or outer space or fractals or whatever… Cool finance-related ideas may pop into your head from time to time thanks to the stimulation.

Go for a walk. Sitting at your desk staring at numbers going up and down will drop you into a rut at some point. Get up and go outside for a few minutes. I have had many moments of clarity on the way to the bathroom or on my way to pick up Panera for lunch.

Talk to people in your network. New ideas come from contact with new streams of thought. Don’t be a taker, though. Offer ideas to your network. Don’t be the guy that just emails ten people saying, “What you thinking?” To form a strong network, you need to both offer and receive information and ideas.

Be curious and develop interests outside finance. Learn some history. Listen to British rap music. Exercise your brain like it’s a muscle.

.

The trade

As I have learned more about myself over the years, one thing I have come to learn is that if I want to hold a trade for longer than a week, I have to do it in options. I am impatient, I am biased to overtrade, and I get bored easily. I have worked on my discipline and it has improved at the margin, but it’s still pretty bad. I am addicted to excitement and change.

I change jobs every three years. I am always knee-deep in some new project. I like shiny intellectual objects. That’s who I am. So it’s not fair to expect myself to patiently sit on a delta one position for say, four months.

When I worked at a hedge fund, the guy next to me and I used to exchange thoughts all the time. More than once, it went down something like this:

BRENT: Wow, GBPCHF is a great setup. Bullish chart, fundamentals, positioning, etc. etc. I’m buying here.

GUY NEXT TO ME: OK, I’ll check it out.

— TWO DAYS LATER —

Brent takes profit, up 1.9% on the trade.

— A MONTH LATER —

GUY NEXT TO ME: Wow, great idea on the GBPCHF! I’m taking profit here, it looks overdone.”

Brent checks GBPCHF and sees he would have been up 7.4% if he held it.

I’m not good at holding cash positions for more than a week, especially because I hate weekend risk. I learned this over time by observation, and by journaling and tracking my trades, including what happened afterward.

Bullish Brazil

Recently, I have been getting more and more bullish on Brazil after I visited in early October. The full thesis from early October is here.

Almost a month later, I still think there is an opportunity to own Brazil for a trend trade into 2023. Assets there are cheap, the political situation looks stable, real rates are high, economic policy is somewhat orthodox, and the people I met there are generally proud, friendly, and humble. Not sure that last part matters, but whatever.

EWZ is the Brazil ETF and it tracks the US dollar vs. Brazilian real exchange rate (USDBRL) extremely closely and works as a simple proxy where both perform similarly. If I were to buy EWZ here at 34.10 and hold it for a move to 38.00, I would inevitably get bored at some point and sell at 34.85 or something before an epic move higher.

Therefore, if I think Brazil is going to trend for a few months, I need to know myself. I need to do an option. The election is out of the way, and the entry point is still pretty good in EWZ. There are still positive catalysts possible (Bolsonaro officially concedes, Meirelles named as Finance Minister) and I think the removal of election uncertainty is the big story and now Brazil can trend higher.

To keep it simple, I’ll buy a January 2023 $35 $39 EWZ call spread, spending 2% of capital or $2,000. Entry point is 34.25 in EWZ and around $1.15 in the spread.

Conclusion

Know yourself.

If you have not already done so, please complete the trader questionnaire. Pick one trait you want to improve. Create a simple plan to level up that trait. Get going. And don’t forget to buy the 2023 Trader Handbook and Almanac.

That’s it! Thank you for reading.

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view!

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

Would you consider to write about Statistic programs like Eviews, R etc

thank you Mr. Brent, I read your work and it is informative. I am looking forward for the next post.

I just wanted to ask if maybe you can write something on commodities, how we can find trade ideas, commodity drives and fundamentals. thank you sir.