This is Week 44

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real-time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

Week 37: XOM put spread is doing nada.

Week 38: Sell vol in MSTR has been good so far.

Week 39: Sell 2-month USDJPY and buy 6-month USDJPY. This has been a good idea so far. USDJPY is tiny higher vs. entry point, which is fine.

Week 42: Ford is about unchanged but you had to stomach a huge rally to 14.60.

Week 43: Short TSLA is perilously close to the stop loss.

Back on the horse

One of the great contradictions of trading is that in order to succeed you must have incredible grit and staying power. You must subscribe to the Japanese proverb: “Nana korobi, ya oki” which means “Fall down seven times, stand up eight.” You must never give up!

But then again, good traders give up all the time. Super fast. On losing trades. You need to be able to ruthlessly cut your losers without much thought or remorse. This is kind of the opposite of grit or determination or any of those great human characteristics. How can a single person embody grit and tenacity at the same time they are willing to cut losing trades without a second thought?

This is one of the many contradictions that make it very hard to nail down the archetypal trader characteristics. You need to love risk, but be super disciplined. You need to have high confidence in yourself, but show humility to the markets. You need to hold onto risky trades when you are feeling incredibly uncomfortable, but simultaneously cut your losers early. Paradox City.

This piece is in response to three questions I am very often asked by younger traders: “Is it OK to get back into a position after you have been stopped out? Is it OK to add to a losing position? Is it OK to move your stop loss on a losing position?” My answer to all three is mostly “NO!” But there are times when these three normally-destructive behaviors can be appropriate.

If you do any of these things frequently, you will not succeed as a trader.

If you do them once in a while because the situation rationally calls for it, you’ll be fine.

Self-awareness is the key to everything

The best antidote to almost every psychological problem in trading is self-awareness. I know I have bad discipline. I know when I’m trading for fun and not for profit. I know when I am bullish and short at the same time (and yes, this happens once in a while!) You can’t stop every dumb monkey brain action before it happens, but you can at a minimum step outside yourself and catch yourself doing dumb stuff and course-correct afterward.

This is relevant to today’s questions because if you are going to re-enter a trade after being stopped out, or move your stop, or add to a loser, you need to be self-aware. Here are my three rules for these situations.

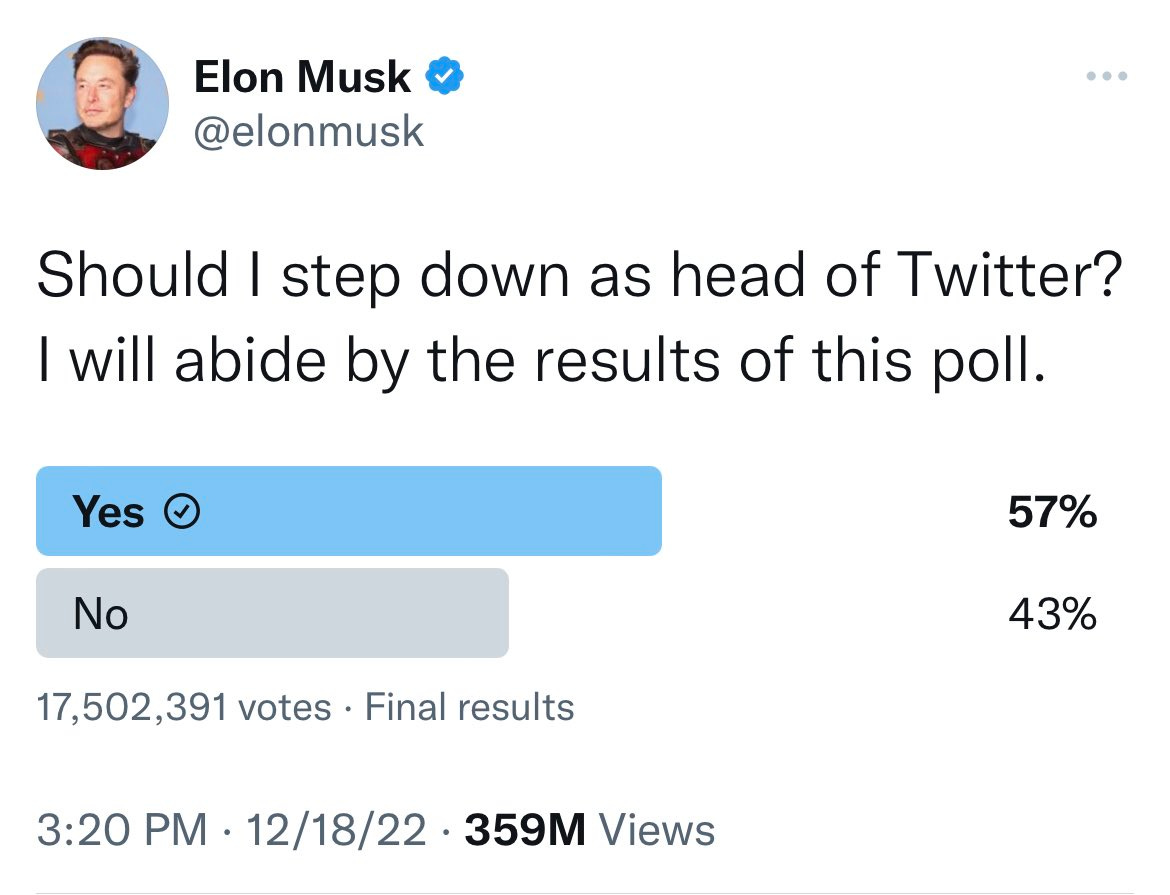

1: Check your mood meter

Has enough time elapsed that you are no longer emotionally impacted by the stop-out? Is there any emotional valence to the trade at all?

If you walk in at 7 am and see that you got stopped out of your long TY futures at the exact low while you were asleep and now TY is trading 24 ticks higher and you are screaming at your broker and just smashed a handset over the desk and your assistant is picking up black pieces of broken plastic all around your feet… Don’t get back into the trade.

Emotions have a half-life. This is an extremely important idea in trading, and outside trading. I wish someone had taught me this when I was in my 20s. However angry you are about something right now, you will be less angry in two hours. You will be much less angry in 24 hours. This is empirically true.

This is why common sense says never to send an angry email right away. Wait until tomorrow and see if you are still angry. Then send it.

Studies show this consistently and if you think about your own life, you will probably realize that very few emotions stay around very long.

Here’s the result of one study, to give you the gist. Don’t worry about the exact numbers. The point is that we are in a permanent state of emotional flux. Emotions come in; emotions go out.

This article takes it to an extreme with this explanation:

“Feelings are like ocean waves,” says psychologist Alyson Stone, “they rise, crest and recede, all day long.” We can all relate. But according to brain scientist Dr. Jill Bolte Taylor, these waves last just 90 seconds. After that, we’re simply re-stimulating our internal circuitry.

Explains Taylor: “When a person has a reaction to something in their environment, there’s a 90-second chemical process that happens in the body; after that, any remaining emotional response is just the person choosing to stay in that emotional loop.”

Again, whether an emotion affects you for 90 seconds or 4 hours isn’t the point here. The point is that emotions come in and go out like waves. You don’t want to make trading decisions when you have just been hit by a wave and you are spinning around underwater and you just scraped your forehead on the hard ocean bottom sand.

So the first rule of putting back on a position after getting stopped out, moving your stop loss, or adding to a losing position is: Wait until you are unemotional about it.

For me, that cooling-off period is usually one day. When I was in my 20s, I might get stopped out at the lows in EURUSD, then it would bounce 20 pips and I’m like: “Dammit! That was the low! Get me back in!” See all those exclamation points? Those are bad. Those mean I was all emotional about the situation. Guess what happened every time? Stopped out again, rebuy, stopped out again, etc.

Or I would see USDJPY ripping and move my stop and move it again and then move it again to the point where the risk/reward on half my trades was worse than 1:1.

Re-entering a position right after stopping out, then setting a new, lower sell stop is the equivalent of moving your stop down. Actually, it’s worse, because you probably incurred some extra slippage in all that frustrated buying and selling.

Moving your stop repeatedly or stopping out and re-entering intraday are kryptonite. Same thing with adding to losers. You will never succeed in trading if you do any of this with any regularity.

So to simply state the rule.

RULE 1: If stopped out of trade today, do not touch again until tomorrow. Do not enter a trade and then move the stop or add when it’s losing money on the same day you got in.

I am always checking my mood meter. Am I pissed and bursting with FOMO? Or just calmly reassessing the probabilities? Remember, of course, these are rules for me. Your rules should relate to your trading style, time horizon, personality, strengths, and weaknesses.

2: Don’t get married to a view

You can’t keep going back to the same idea over and over again, no matter how much you believe in it. Even if you’re calm about it. This will eventually lead to a terrible psychological state where you are paralyzed by the fear of missing the trade when it finally happens.

When I was trading in 2007, my boss (who is one of the best people I have ever known on or off Wall Street) was convinced that AUDJPY was going to collapse. This was a logical thesis! The carry trade was a mania by that point and huge hedge funds were long billions of AUDJPY and USDJPY and selling JPY puts at the same time to extract even more carry from the trade.

Here is a chart of AUDJPY.

AUDJPY weekly, mid-2005 to late 2007

Every time it dipped, my boss thought the big one was coming and added to his shorts at the lows. By mid-2007, as you might guess, his P&L was not very good. Trading FX on a bank desk, you are expected to be flexible and able to make money in various regimes. You can’t sit there positioned the same way all the time, waiting for the big one.

Sadly, he lost his job at the end of 2007. He is one of the nicest people in the market and he’s an excellent trader, he just got dialed into a particular view and couldn’t shake it.

Wanna guess what that chart looks like if we jump forward one year?

AUDJPY weekly, 2006 to end of 2008

Look at the y-axis! AUDJPY dropped more than 40% in less than a year. Mind-boggling moves, but my boss was not there to participate because the move took too long to happen. The problem with short-term traders who get addicted to a single view is that it very often doesn’t matter whether the view is right or wrong. After enough tries and failures, those traders become terrified of missing the big one and so they trade the view in a highly suboptimal way.

The best way to trade is always to have the flexibility to trade a market from the long or the short side. Even if you are super bearish bigger picture, you should be able to recognize times when you are wrong on the relevant (shorter) time frame and go long because you know the asset is going to go up, not down for a while. You can’t just keep going short the same asset over and over and hope the timing works out. It rarely does.

If you are so locked into a view that you cannot shake it… Stop trading that asset and find something else to trade where you can maintain an open mind. Rigid views are rife with confirmation bias and FOMO and don’t allow a rational interpretation of new inbound information.

RULE 2: Don’t try the same trade more than three times.

Again, this rule is for me. If you have a different style or time horizon, it might not be right for you. Feel free to stick with the same view over and over if it’s making you money. But the whole point of a stop loss and risk management system is to acknowledge the fact that no matter how confident you are, you will still be wrong.

Treat your market views like short-term relationships, not marriage. You do your best while you are in the view but you stay open to the idea that it might not work out. Stopping out of a marriage is way too hard. You have too much emotional investment. You do not want to be emotionally invested in any trade. You want to see it through rational eyes. You want to monetize it or cut it, and move on.

If you get stopped out two or three times, put that market in the penalty box for a few months and find something else to trade.

3: Consider options

For trades where you believe strongly in the idea but fear you might keep getting jiggled or stopped out… Or you’re not sure where to put your stop. Use options. I have written a fair bit in 50in50 about the choice between cash and options. It is a critical choice in some cases because options give you staying power and noise-resistance. But you pay a price for that. You still need good timing, and if the thing doesn’t move at all, you lose money in options when you would have broken even in cash.

RULE 3: If you are worried about noise and repeated stop outs, use options.

Cash vs. options is a huge and important topic but I am not going to get into it here. But if I love a trade and get stopped out and still love it, my first thought will usually be to consider putting on the trade in options to avoid the chop. You can read more about cash vs. options in 50in50 Week 6: Options or Cash? If you are new here, I recommend that post, it was one of the most educational.

TSLA is a Tubthumper

Tesla gets knocked down, but it gets up again.

In Week 43, 50in50 went short TSLA at 171 with a stop at 221. While the trade has not been stopped out yet, it has moved 43/50ths of the way from entry to the stop loss. I actually like the idea more than I did when I first put it on, and the rally has been dramatic.

In this case, I am not re-entering a position after being stopped out. I am re-evaluating my parameters because I like the trade more than ever and my stop is within a random blip of getting done. So I plan to increase my position and move the stop at the same time.

I want to reiterate here: This is an extremely dangerous habit! Do it rarely or never. And only do it if you believe in your own self-awareness and ability to think rationally in the face of escalating losses. Part of me thinks I shouldn’t have even written this piece because I’m giving a green light to do something that often ends up catastrophic when repeated.

But I think it’s important to explain that constant reassessment of the probabilities through the prism of a rational mind can bring clarity that can sometimes extricate you from a badly timed, but good idea. You don’t want to do this often, but you want to have it in your playbook for the rare times it’s appropriate.

In this case, I am going to calmly and rationally move my stop loss and double my risk because I think the trade has high expected value despite my initial entry being mistimed.

There are four main reasons:

First, NASDAQ seasonality turns bearish today. Seasonals are never the be-all end-all but they are a useful tool in a holistic trader’s toolkit. There are myriad reasons for persistent seasonality in equities and we are about to enter a period where bullish bonus inflows and new year 401k allocations run out but before bullish mid-March tax refunds start rolling in. The chart looks like this:

NASDAQ average seasonality since 1998

TSLA seasonality looks similar but I have not included it because the sample size is much smaller (TSLA stock has only been around for 12 years).

Second, 2023 has been characterized by aggressive buying focused on the most injured stocks from 2022. This is a combination of a seller’s strike (end of 2022 was all about tech fund redemptions and tax loss selling and that selling stopped 31DEC22) and rebound in everything most hated from 2022.

This chart from Macro Alf captures it perfectly:

2023 has mostly been about unwinding the extreme panic selling from late 2022.

Third, US yields have risen dramatically of late, and once again long duration assets like TSLA are slow to react. Here is a chart of the US 10-year yield (inverted) against Tesla.

US 10-year yield (inverted, blue) vs. TSLA

Notice how every time yields go up, TSLA hangs around for a while, or even rallies? Then, eventually, there is the “oh sh*t” moment and TSLA craps out. I eagerly await that moment!

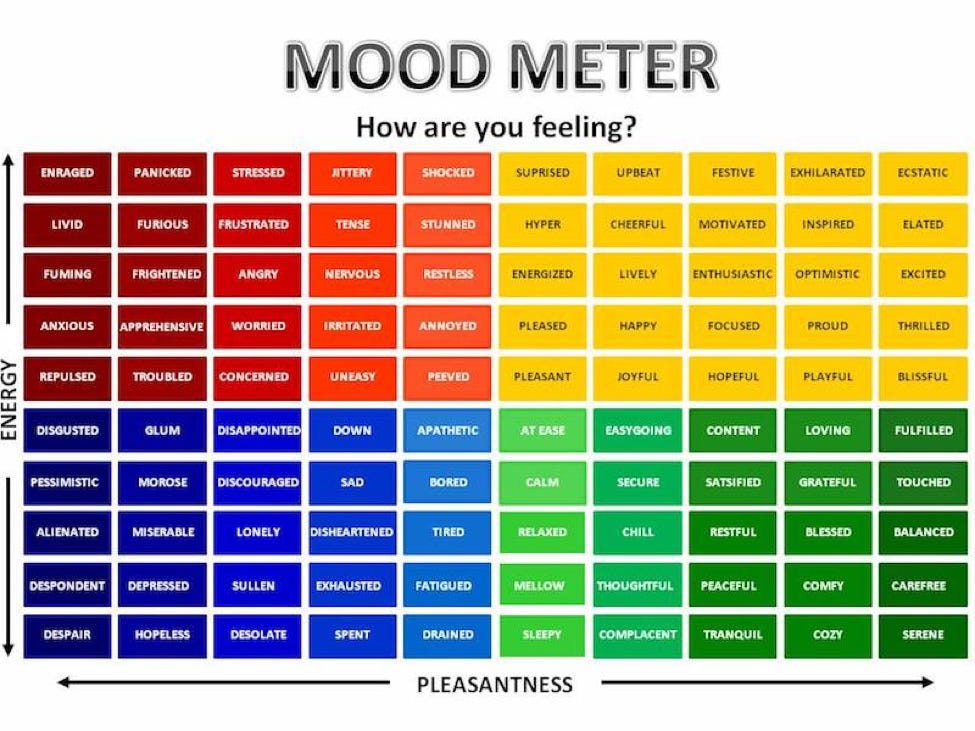

Fourth and finally, one of the TSLA bull narratives has been that Elon Musk might return home to TSLA at some point as he gets bored of spending time in the weeds helping Twitter engineers debug the platform. Now he says he’s going to hang around Twitter until the end of 2023. Sure, much of what Musk says is unserious or outright false, but these headlines don’t inspire a lot of hope for immediate succession plans.

Big resistance is at $237 so I think a stop above $250 offers plenty of room for a bit of noise. If this position gets stopped out, I will not go short Tesla again for at least six months.

Conclusion

A lot has changed, even as TSLA rallied over the past two weeks. Seasonality turns bearish today, the shorts are impaled, US yields are higher, and the CEO change promised by Musk in 2022 might not happen until 2024. So while the backdrop for TSLA has gotten worse, the price has gone up as shorts continue panic covering. That panic covering should be done or close to done.

While adding to losers and moving stop losses is generally what bad traders do all the time, good traders also do it on occasion if they are rational and new information compels them to do so. I have no strong emotions here. I was long TSLA at 114 and I went short at 171. I’m flexible. I am neutral on Elon Musk one way or the other. He’s smart, he’s entertaining and he does a lot of really dumb stuff. So I have no emotional attachment to him, the stock, or this trade.

I looked at options but found them too expensive. So, I am adding a new trade of short TSLA on the open 16FEB23 and I will put the stop loss on the whole double position at $251.11. This means the original position has really bad risk/reward now in hindsight—but that’s life.

Sometimes you have to react to new information.

The original trade was risking $2,000 on a move from 171 to 221 so moving the stop to 251 adds another $1,200 of risk there and we risk $2,000 on this new clip so the total risk on this idea ends up being

$2,000 (original idea) + $1,200 (moved stop) + $2,000 (adding here) = $5,200.

That concludes Week 44. Thank you for reading!

If you liked this week’s 50in50, please click the like button. Thanks.

Trade at your own risk. Be smart. Have fun. Call your mom.

DISCLAIMER: Nothing in “50 Trades in 50 Weeks” is investment advice. Do your own research and consult your personal financial advisor. I’m putting out free thoughts for people who want to learn. This is an educational Substack. Trade your own view! I may be long or short stocks or other securities mentioned in this piece, and those positions could be in the same or opposite direction to the views expressed herein. I am a short-term trader and my views change all the time.

If you are passionate about learning how to trade…

Sign up for my global macro daily, am/FX, right here

Subscribe to 50in50 for free right here.

Great post. Where do you think the best place to get currency options is for retail traders?

Great read, thanks for posting your thoughts.