Week 20: Don't get squozen

How to structure equity shorts for max profit and min risk of ruin.

Hi. Welcome back to Fifty Trades in Fifty Weeks!

This is Week 20: Don’t get squozen

50in50 uses the case study method to go through one real-time trade in detail, about once per week. This Substack is targeted at traders with 0 to 5 years of experience, but I hope that pros will find it valuable too. For a full description of what this is (and who I am), see here.

If you want to learn about global macro in real time … subscribe to my daily: am/FX

Listen to this as a podcast on the web … or Spotify … or Apple.

Update on previous trades

There is a lesson on variance in the recent LLY trade so I just want to point this out. The short LLY trade from week 17 was within 1 cent of the take profit! 283.11 was the low and my take profit was 283.10! Unreal. In real life, it is very unlikely that I would let a trade touch within one cent of a TP and then sit there and watch it take out my stop loss, but in this exercise, I’m not doing any real-time adjustments for logistical reasons. Check out the chart:

And here are the results of the trades so far (table below). I also included the stats for what would have happened if the LLY trade hit the TP instead of the SL so that you can see that even in a sample of 19 trades, the results can be sensitive to a single outcome.

I show this differential because it’s important not to judge your own trading performance over a small sample. If you have been trading for five years with a 50% daily hit rate and you lose money six days in a row, that’s probably variance. A bad week or even a bad month can be variance, not lack of skill. For a full discussion of the difference between variance and bad trading, see Chapter 11 of my book Alpha Trader.

The 50in50 results so far are not amazing, nor are they catastrophic. I am venturing into all kinds of trades where I have no particular edge just to show methods and tactics and ideas of how to look at the market. The idea is to apply solid strategies, tactics, and risk management in a market where you have an edge, as I do in short-term macro and FX. I will do another detailed update like this in Week 30.

Now let’s talk about shorts.

Don’t get squozen

The decimation of short-sellers in 2021 is one of many factors that set the table for the bear market of 2022. The capitulation of short sellers can be an important signpost at the peak.

Whenever a fund blows up, or shuts down, it’s worth considering whether it marks an extreme for that fund’s style. The Russell Clark example is epic timing as was the closure of Julian Robertson’s Tiger Global at the exact peak of the 2000 tech bubble.

Short is not just the opposite of long

Shorting stocks presents unique risk management and trade structuring challenges and in today's 50in50 I will present a few simple structures and strategies you can use to short a stock while avoiding risk of ruin.

Shorting is hard

Three factors increase the degree of difficulty for shorts.

You can only make 1X your money when you short, but you can lose much more. When you are long you can make any multiple: 3X, 5X, 10X, etc. The mathematics work against you when you short a stock. You can never lose more than 100% on a long, but on a short, you can! If you short a stock at $5 and cut your losses at $100, you were risking 95 to make 5. That sounds extreme, but that’s roughly what Melvin Capital did in GME.

You will pay a borrow fee plus any dividends the stock pays out while you are short. You get paid to own stock and you must pay to short it. When you pay to hold a trade, that’s called negative carry. Cost of carry is meaningless on short-term trades but can add up fast over time.

Stocks generally go up. Since 1946, stocks go up on 53.4% of all days, 60% of all months, and 71.6% of all years.

.

Not only are you peeing into the wind when you short a stock, you are paying a fee to do so! As such, the bar to short any stock must be high.

Defense first

Let’s assume you have a company you want to short. Before you can pick a trade structure, you need to answer a bunch of questions about the microstructure of the stock you want to short. This allows you to play defense and protect against disaster.

Is the stock liquid or illiquid? Check daily volume, bid/offer, volatility, and volatility of volatility.

Does the stock have a history of gaps? Download OHLC data for the stock into Excel and create a formula for “today’s open minus yesterday’s close.” What are the five largest gaps? This will give you a sense of your gap risk, though remember it’s backward-looking and you should apply logic and common sense to consider whether a large gap is more likely in future.

Is the stock a takeover candidate? If yes, don’t short it. It’s not worth the risk, no matter how bad you think the company is. Peloton would be a good example here. Sure, it’s been an incredible short, but since it crossed $50 or so, the risk of a buyout was too high. Yes, you missed a big short by avoiding it, but that’s life. If you want to be a good risk manager, sometimes you need to pass up positive EV opportunities in order to avoid tail risk.

Are there any binary outcomes (like a drug approval for a biotech) that could rip your face off? If yes, do not short.

What is the current short interest? If you go to a page like this one, you can see the most shorted stocks. There is a conundrum here because generally the most-shorted stocks are most-shorted for a reason. They are crappy companies! But the most-shorted stocks are the most dangerous shorts because short interest is gasoline for a big explosion. My view is generally that it’s not worth it to short the heavily-shorted stocks. Again, the trades are positive EV with a big tail risk. Not worth it!

Is the stock trading below 10 bucks? Low-priced stocks have more topside convexity because retail likes them better.

Are there options on the stock? If there are options to trade, you have more ways to play the downside.

.

Those are practical questions that will determine your ability to rigorously manage your risk with a high level of certainty around your max downside. No matter how juicy a short looks, my philosophy is that if you’re not sure if you can effectively manage your P&L risk, just pass. There are thousands of trading opportunities. Let someone else sell the tails. That’s not the way to play the long game.

Structuring the trade

The best way to trade a bearish stock view depends on various factors, specifically your ability to identify the timing of a possible move, and your estimate of the size of the move.

Note: While what I am writing here today is about stocks, many of the trade structuring concepts apply to all asset classes. In particular, the question: “how far and how fast?” is the key input to the decision on whether to trade delta one (cash), or via an options structure (derivatives). For more on the question of whether to use cash or options, please read 50in50 Week 6

The two big questions are:

How much do you expect the stock to fall?

Do you have a specific time frame or catalyst in mind?

.

In other words: How far and how fast?

Very roughly speaking, there is an appropriate strategy for each speed and size of the expected drop. To take the most extreme example: if you expect a stock to drop to zero tomorrow, options will give you much more leverage and you don't have to worry much about timing or time decay (theta). And you want the farthest possible strike because that will give you the most leverage.

In contrast, if you expect a stock to do nothing for a while and eventually drop 20 percent or so at some unknown time... Options are not going to look as good and low-delta strikes are certainly no bueno.

This article is not a deep-in-the-weeds options lesson, it assumes you know the basics. But let me just give a quick definition of delta here because it’s a critical term that you need to fully understand. There are two main ways I think about delta:

Delta is the market-implied odds that the option will finish in the money. So a 25 delta put has a 25% chance of finishing in the money. A 50 delta option is at the money and has a 50/50 shot of finishing in the money. There are nuances around skew and so on but for our purposes, this is a good, simple way to think about delta.

Delta tells you how much your P&L will change as the stock moves. For example, if you have 1 contract (representing 100 shares) of a 20 delta put option… Your delta is short 20 shares. Your P&L here will go up and down like you’re short 20 shares of the stock. If the stock goes up $1 intraday, you will lose roughly $20. This is not exactly true because your delta changes as the stock moves. And volatility can change. But it’s a good way to estimate how much exposure an option will give you when you buy it. For example, if you buy a 30-delta put option on 1000 shares of AMZN, your P&L risk today is similar to your P&L risk if you were short 300 shares.

.

The main factors that determine an options delta are: 1) the distance from market level to the strike, 2) how much time is left on the option, and 3) the stock’s volatility.

Four paths

Let's go through the four main ways a stock can go down and discuss the best structure for each. There is no correct answer, but this will give you a good starting point for how to think about trade structuring around single-name equity shorts.

There are four paths to consider:

Big drop, soon

Small or medium drop, soon

Big drop, eventually

Small or medium drop, eventually

.

Let’s imagine we want to short Tesla. We think it’s an overvalued stock that has not repriced like the other 2021 retail bubble favorites like PLTR, SQ, ZM, GME, AMC, SHOP, ARKK, PTON, bitcoin, etc.

TSLA trades at 12X sales compared to AMZN at 4X sales, UBER at 2X sales, and most automakers under 1X sales. ***I’m really just using TSLA as an example here and this lesson is about structuring a short when you’re already bearish*** That said, I do believe that reversion to a lower valuation is a reasonable thesis as TSLA lays off employees and their CEO forecasts recession, sending a signal that massive YoY sales growth is set to slow even as June was a great month for production numbers. Rapidly growing companies aren’t usually laying off workforce or forecasting recession. And companies trading at 12X sales need to grow fast or disappoint.

For the sake of this lesson, it doesn’t matter if you are bullish or bearish TSLA. The point is to think about the pros and cons of the different ways to play a bear view on a stock. TSLA is just a useful example.

Say I want to risk $20,000 on my bearish TSLA view (this is not the normal $ at risk for 50in50, but it’s easier to use a larger number to explain these options examples). To give you an idea of how different strategies will pay off, I made two P&L graphs so you can see how different speed and size of moves in the stock will determine the right strategy.

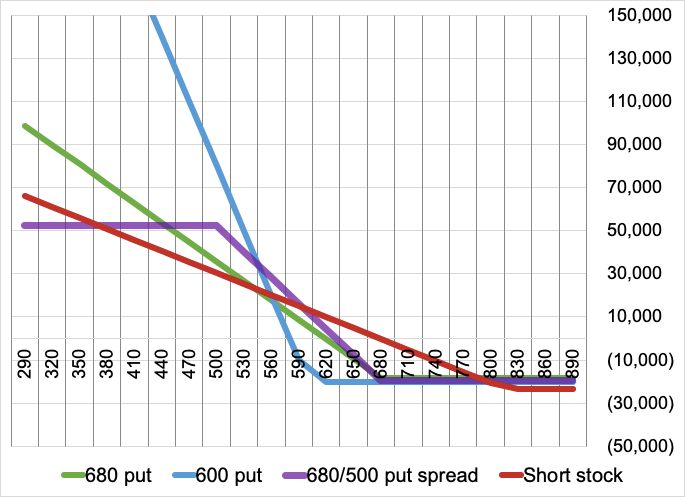

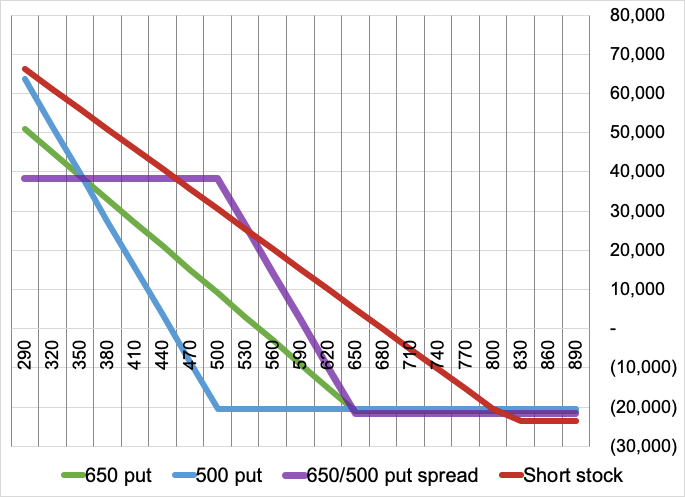

In each chart, I compare shorting the stock (with a stop loss at $820) to an at-the-money put, a lower delta put, and a put spread. A put spread is a strategy where you buy a put, and sell a put with a lower strike to cheapen things up. In a put spread, your P&L is capped once you hit the bottom strike (see purple lines in the charts).

1-month time horizon

6-month time horizon

Takeaways:

You get much more leverage on the one-month option trade vs. the six-month trade. Check out the y-axis on each chart. You will always get paid much, much more if you can nail the timing, but if it was easy, it would not have such a huge payoff!

There is a point at which the put on its own massively outperforms the put spread. This is when the cyan line breaks above the purple.

If you nail the move on the 1-month option, it pays way better than the short stock position, but on the 6-month trade, it takes a huge move before the option is worthwhile. This makes sense.

Note how the red line is above the other lines in most cases in the 6-month time horizon. The longer the option, the more the payoff just looks like a cash position, where you are paying a premium so you don’t have to worry about getting stopped out. This staying power has value. If TSLA goes from here, to $850, to $400 in the next six months, the option is gold and the cash short is a loser because it got stopped out at $820. This is an important takeaway: Short-dated options for leverage, long-dated options for staying power. It’s a spectrum, of course, and you could look at the 3-month option here as a compromise, for example.

.

There are, of course, many other options strategies. I’m covering the big ones here and to be honest, I question whether many other strategies are necessary. If you know how to short a stock, buy ATM puts, buy low-delta puts, and buy put spreads, you are pretty well set. Selling naked calls, for example, is a recipe for disaster and not a good bearish strategy for any trader who cares about risk of ruin.

Every time you are deciding how to structure a trade, you should build a payoff diagram like this. Then, think about the possible paths you think your stock could follow and which path is most likely. Then, match the payoffs on the chart to the path or paths you see as most likely, and choose your structure.

Note: Catalysts are generally priced in by the options market. You are going to pay a ton more for a short-dated option through earnings than you would pay for a short-dated option when nothing is going on. The dream scenario is when you find a catalyst that the market isn’t pricing in correctly. This could be a major chart breakout, a poorly-understood catalyst (for example, a scheduled product announcement from a competitor that could hurt your stock, a court ruling that isn’t well-known, etc.) Not every catalyst is well-understood and priced in by the market.

There are plenty of ways to be correct on your bearish stock view and still lose money, for example:

Your cash position gets stopped out before the stock goes down.

You buy a put and the stock falls after the option expires.

You buy a put and the stock ends up at your strike price (but not below) at expiry. This is called pinning the strike. It’s one of the most frustrating outcomes because if you bought a 25-delta put and then pinned it, you correctly forecast a large move lower and yet you lost your entire option premium.

You short the stock, but it takes forever to fall and you pay more to borrow the stock and cover dividends than you make on the short position.

Choosing a strategy

The thesis for this lesson is pretty basic: We want to short TSLA on still-high valuation, catch up to peers, and a bearish chart formation. When we play the valuation game, we are looking for a large drop on an unknown time horizon, so there is no logic to buying a short-dated option.

Then again, looking at the chart of TSLA, it’s been in a steady trend lower since mid-April and it looks to be consolidating in a nice bear pennant:

In theory, we might say that the narrowing triangle helps us with timing as breakout odds rise as the triangle narrows. This is reasonable, but I’d still be worried about two or three more weeks of rangebound consolidation like we saw in February 2022 and again in June. Therefore, the best structure here is to simply short the stock.

If we’re going to short a stock, we first need to go through the checklist of no go’s from the “defense first” section earlier in this note. Here is how it looks for TSLA: The stock is extremely liquid and high-priced, topside gaps do not suggest risk of ruin (the three biggest topside gaps in TSLA over the past 12 months are 10%, 9% and 6%). Risk of ruin is close to nil. It’s not a takeover candidate, there are no binary outcomes of note, and short interest is tiny, just 3% of the float. So we’re good. What about the risk of getting stopped out before the thing collapses?

The biggest disadvantage of shorting a stock instead of buying puts is that you might get stopped out before the stock drops. My view is that if we go back above $800, the idea is probably wrong anyway because that will take the price back up and out of the triangle. Therefore, in this case, the staying power offered by a put option is probably not worth much. That is, this is the kind of setup where TSLA should just keep going lower as it breaks down out of the triangle. Otherwise, the idea is probably wrong. I would rather take the risk of getting stopped out at $820 than take the risk that TSLA range trades for another month before it dumps and I have spent a load of cash on a worthless option. There are always tradeoffs when choosing a structure.

Choose your weapon

Once you decide you are bearish a particular stock, you need to choose a structure. It’s all about the tradeoffs between timing, leverage, and the probability of getting stopped out on cash shorts. To summarize this note, here are the pros and cons of the four main ways to structure a single name equity short:

Conclusion

We aren’t clear on the timing of the TSLA short, so we don’t want to touch options. We go short the stock on the Monday open ($680 approx) with a stop loss at $820 and a take profit at $437 (TSLA gapped higher through that level as it commenced its voyage moonward in late 2020 so it’s a nice round trip target). Risking $140 to make $243 on a position of 14 shares (~$2,000 at risk).

Short TSLA is a bit of a hedge for the ARKK long from 50in50: Week 12. I don’t have a strong view on broad market direction right now so partially-hedged feels reasonable. It’s incredible how badly ARKK has performed when we consider that Cathie Wood’s biggest holding and loudest rah-rah in 2021 was TSLA. Craziness. Maybe it’s time for “TSLA down / ARKK up” mean reversion as most of Wood’s holdings are thoroughly bombed out at this point. Something to consider.

That’s it for today. Thanks for reading!

If you liked this episode, please click the LIKE button. Thanks!

Thanks for another excellent week. I'm not looking forward to getting to the end. But despite being a complete idiot, I am wondering about a couple points you make.

1. "You can only make 100%". Two part question:

1a. I don't understand this oft repeated bit of wisdom. When a long position goes your way, your position size grows, but when a short goes your way, the position size shrinks. For a fair comparison, shouldn't you add to your short as it falls? Even if you just top up to your original position size and don't grow it a la a long, you can make far more than 100%. I know the dark side has its own special risks and you may not think this is a great idea, but I still suggest saying you can only make 100% is misleading.

1b. Say I short TSLA at $200 and cover at $100. What is my percentage gain? I didn't actually put up any capital (I have plenty of unused margin) so my denominator is zero and I made infinite percent - let's see you do that with a long! Joking of course, but what is my denominator? If my stop is set at $250, could my denominator be $50? If so, I just made 200%.

2. You state shorts are negative carry, sounding like it is some great truth engraved in a burial chamber in an Egyptian pyramid. But in my short trading career, that is not my experience. Today if I short TSLA, I pay a 0.25% borrow, pay no dividends in lieu, and receive 4.58% in interest from my broker on the proceeds of my short. So a TSLA short is actually a positive carry to the tune of 4.28%.